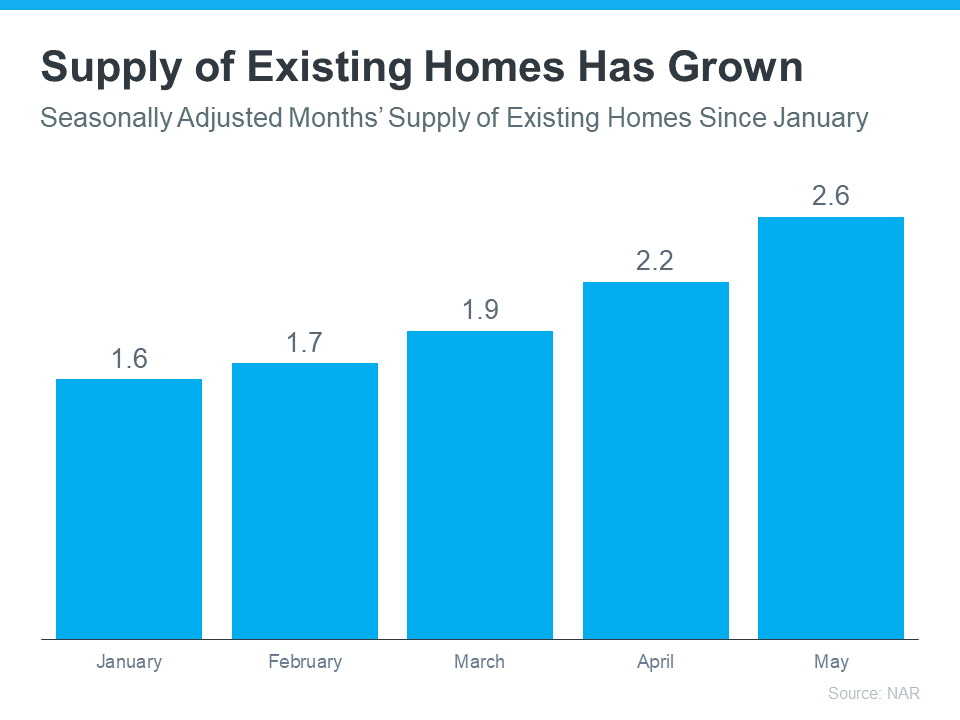

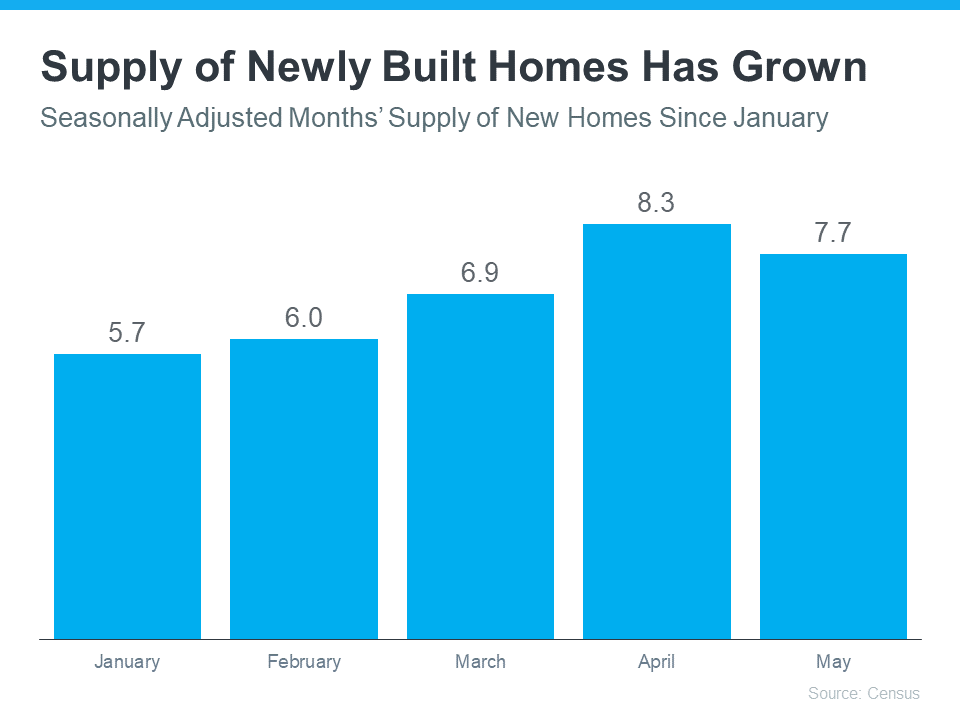

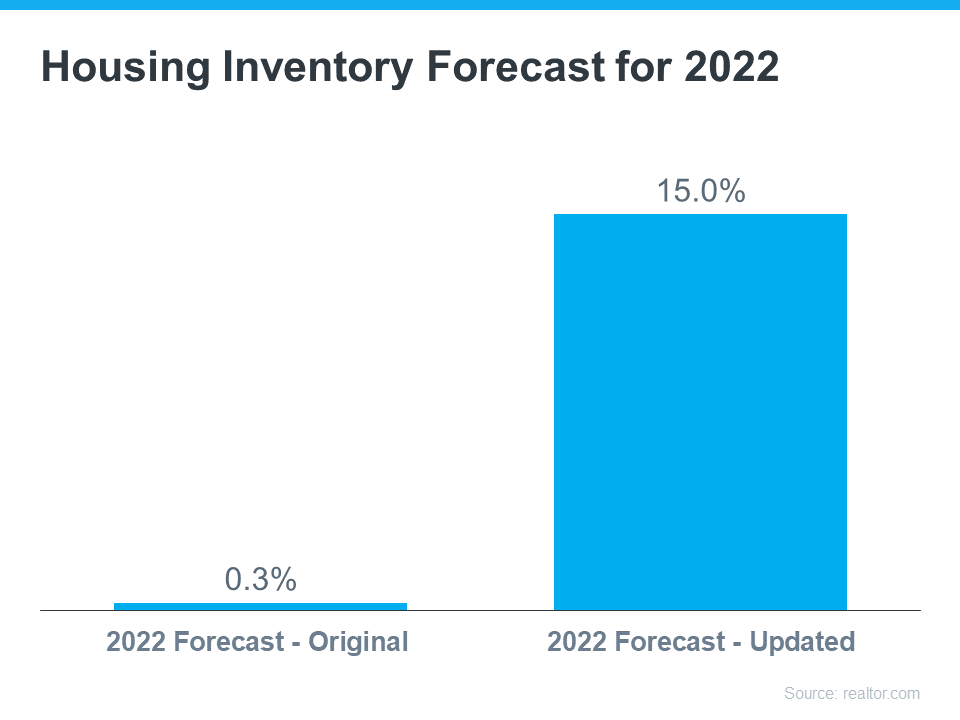

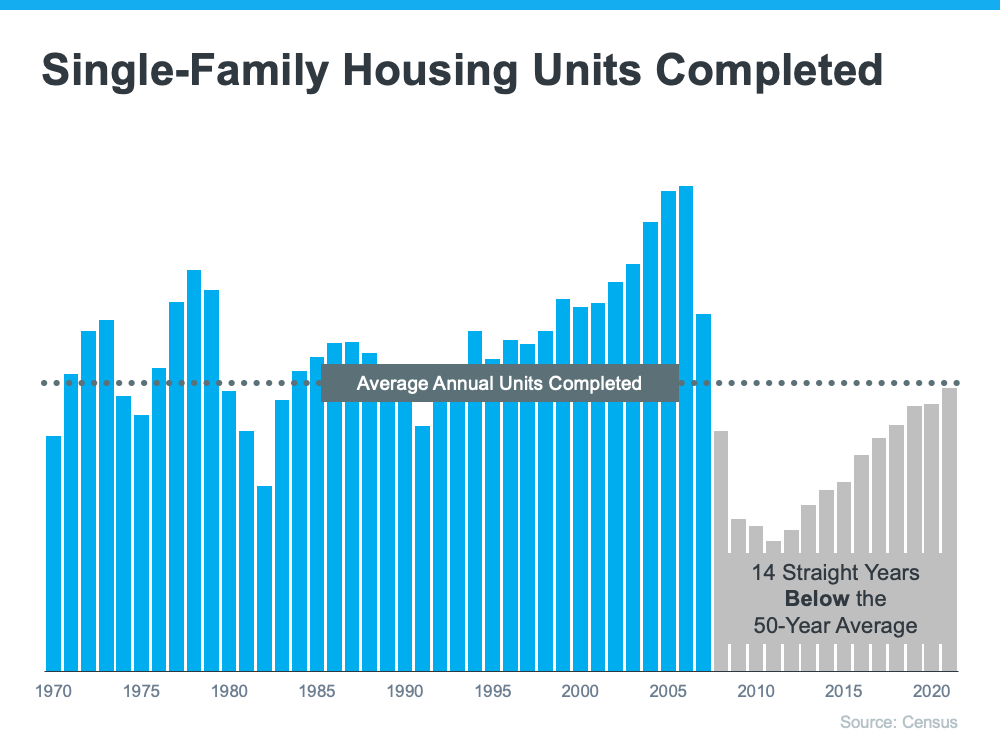

Even though inventory is increasing this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s.

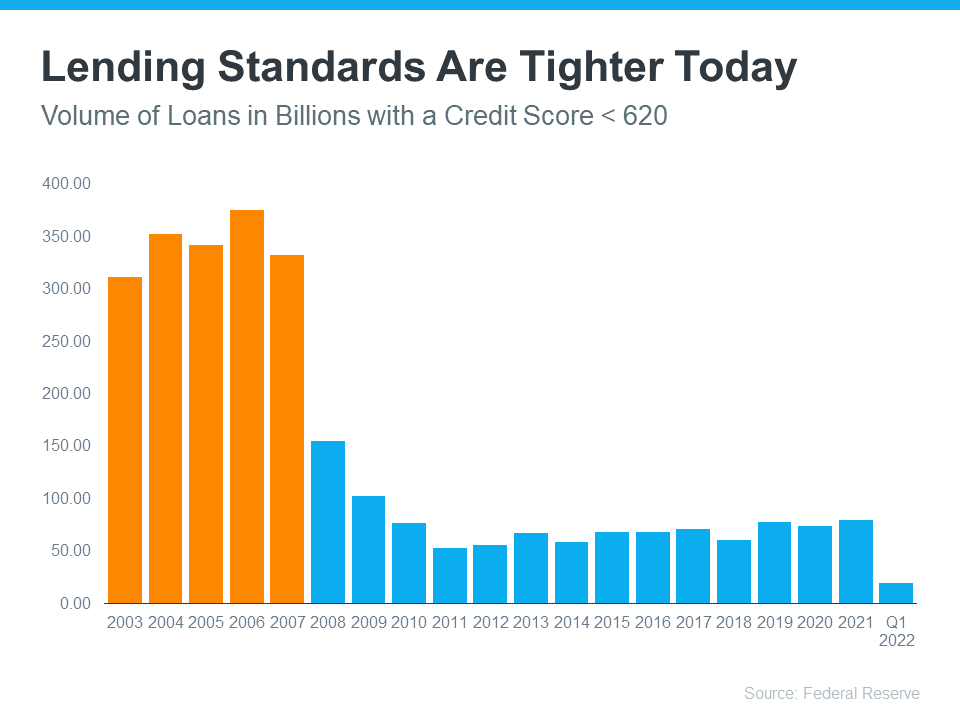

The blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan.

The resulting oversupply of homes for sale led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years.

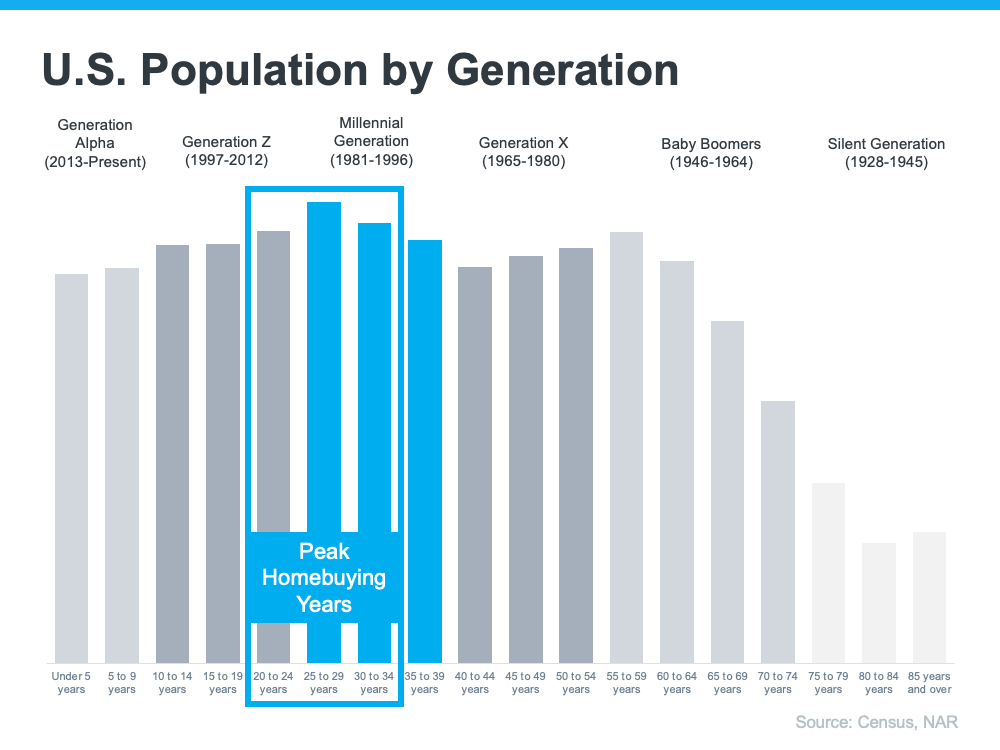

Millennials Will Create Sustained Buyer Demand Moving Forward

The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph below):

Odeta Kushi, Deputy Chief Economist at First American, explains:

“. . . millennials continue to transition to their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.”

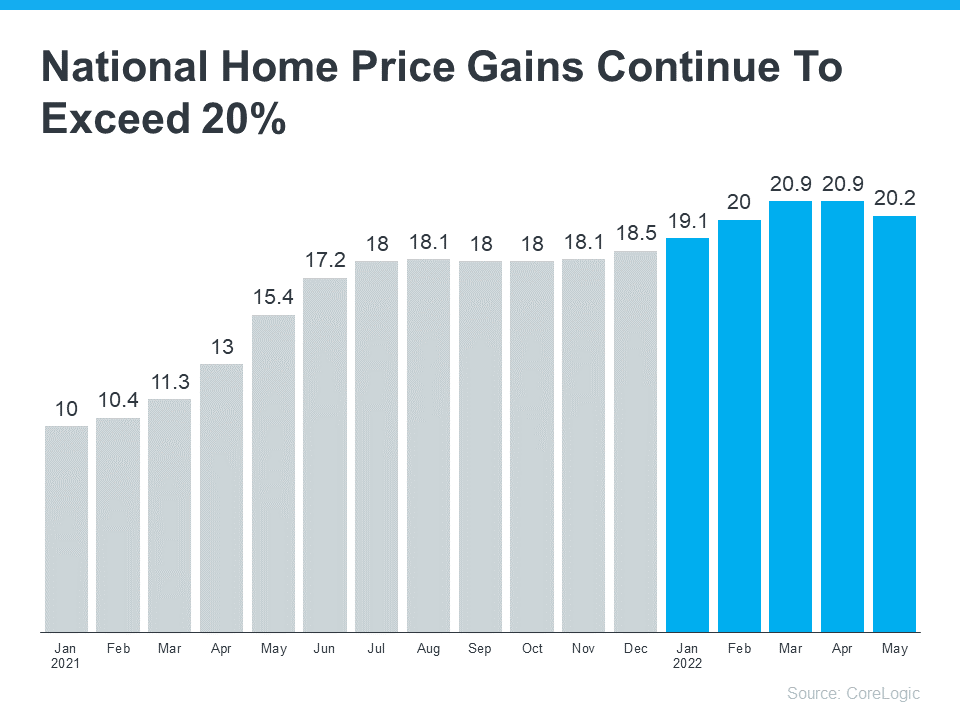

That combination of millennial demand and low housing supply continues to put upward pressure on home prices. As Bankrate says:

“After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.”

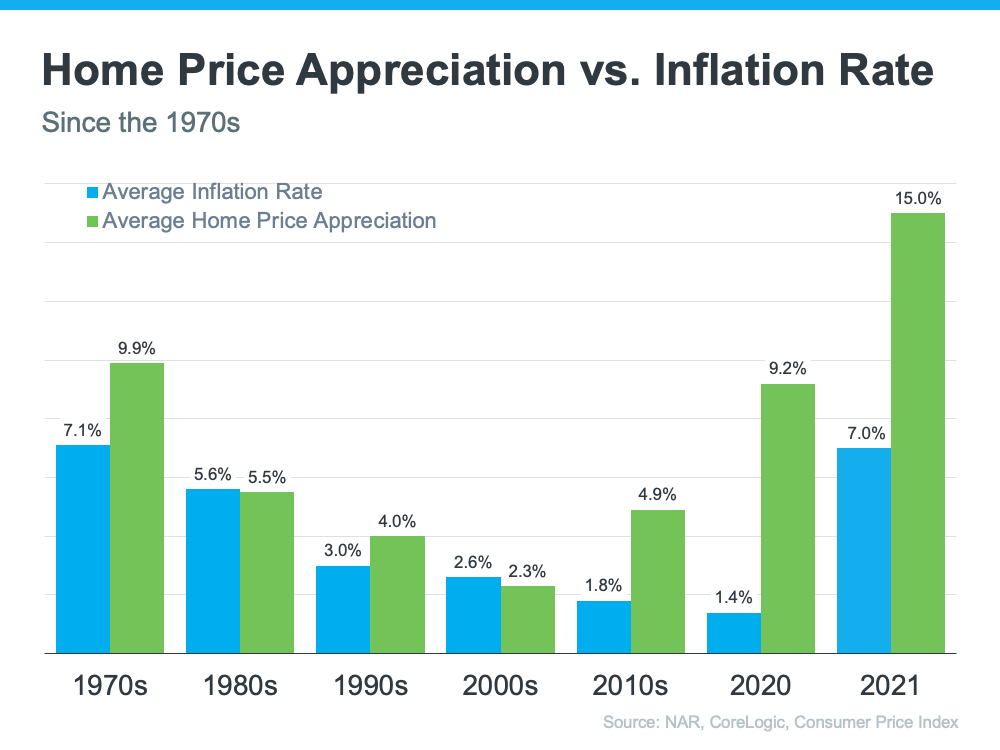

What This Means for Home Prices

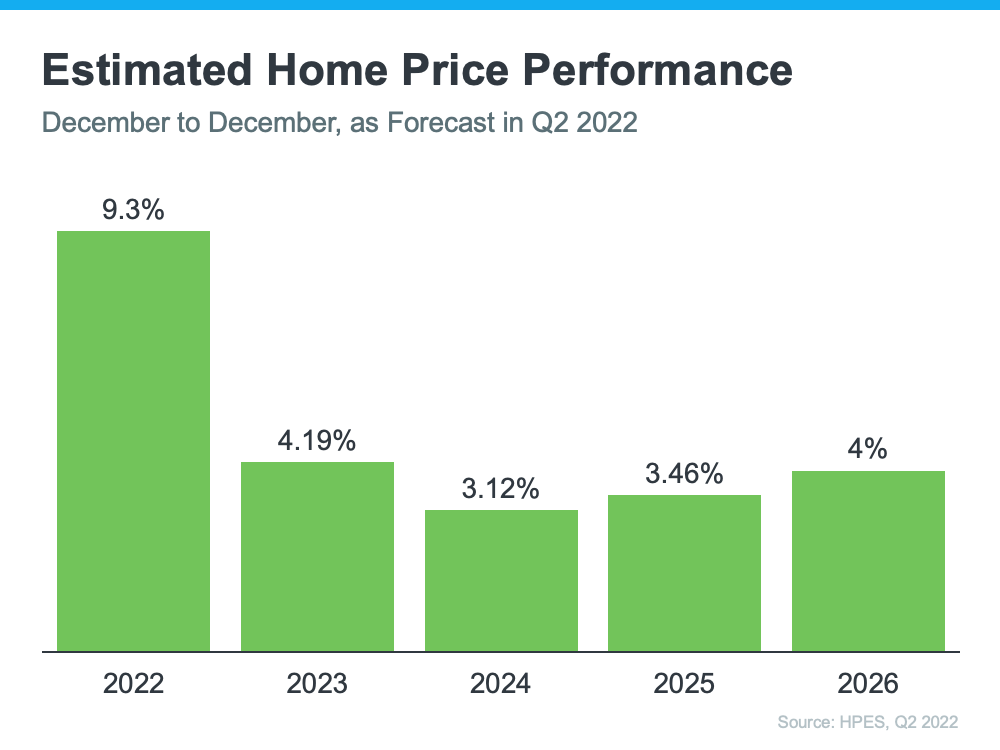

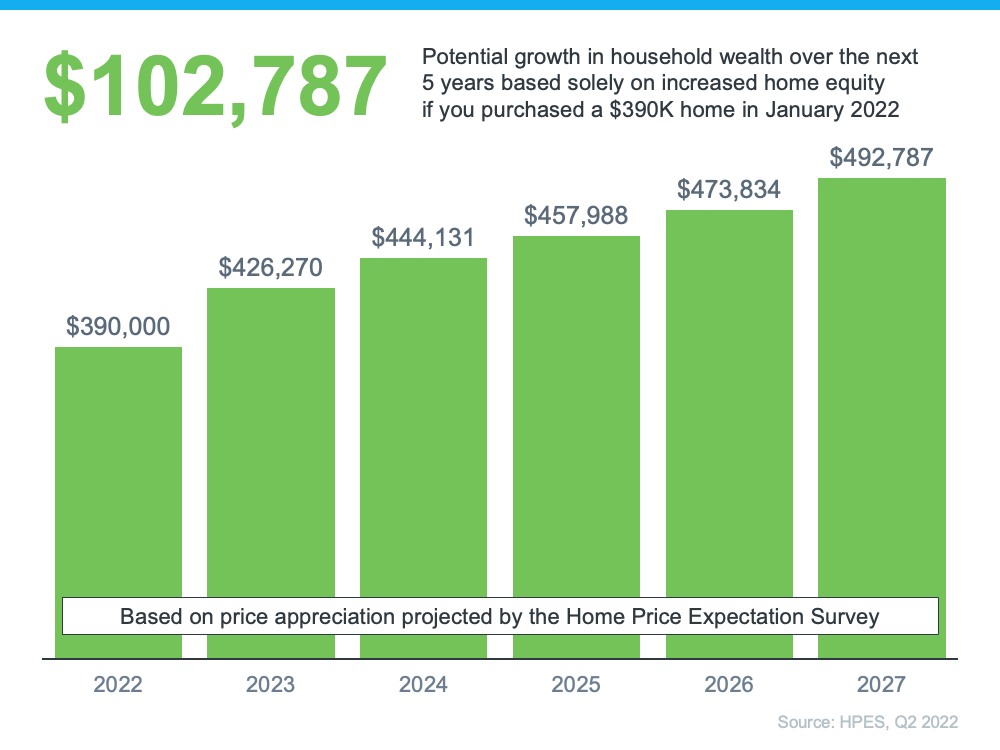

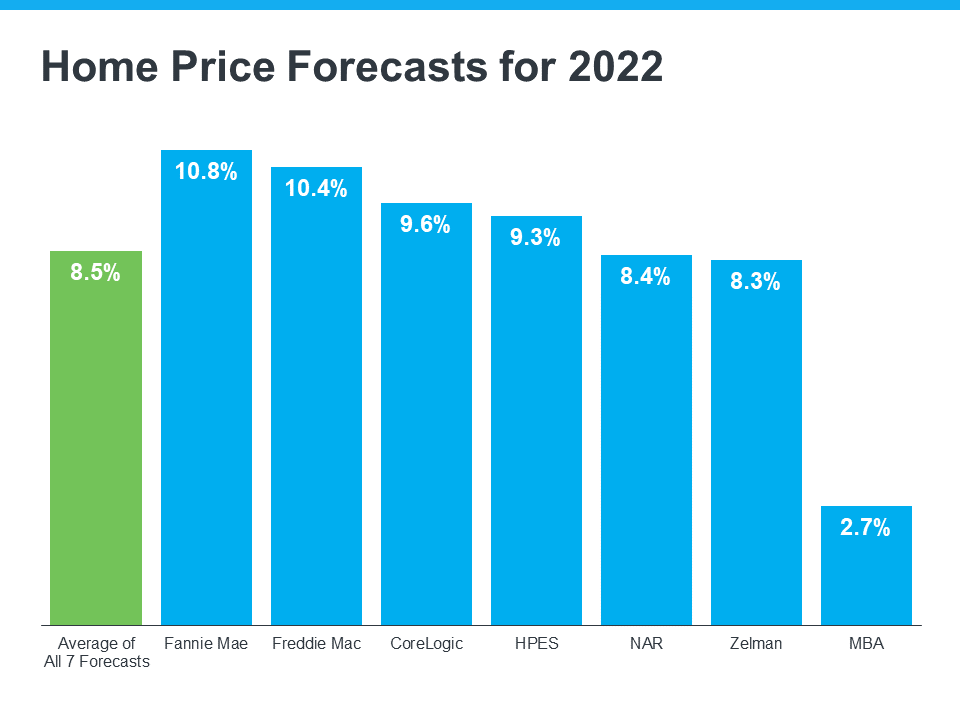

If you’re worried home values will fall, rest assured that experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand. That means home prices won’t decline.

Bottom Line

Based on today’s factors driving supply and demand, experts project home price appreciation will continue. It’ll just happen at a more moderate pace as the housing market continues its shift back toward pre-pandemic levels.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,2019,2020,& 2021 Recognition of Excellence Award Winner SDAR