That headline might be a little aggressive. However, as the data on the 2015 housing market begins to roll in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME!

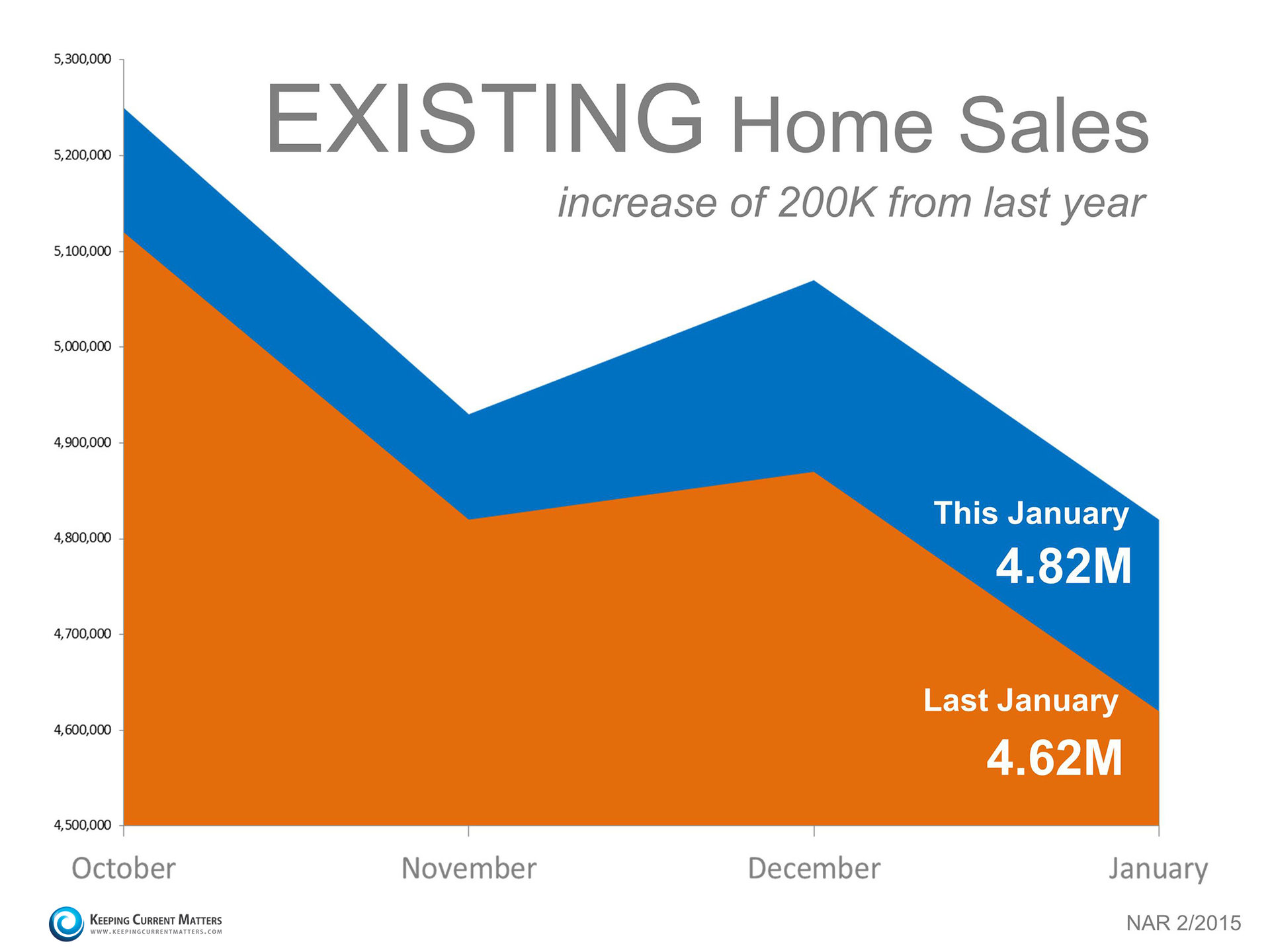

We realize that existing home sales stumbled in January compared to December. But, if we compare the current September-January time period to the same period a year ago, we can see that existing home sales have outpaced last year every month with the January sales numbers 200,000 homes greater than last January:

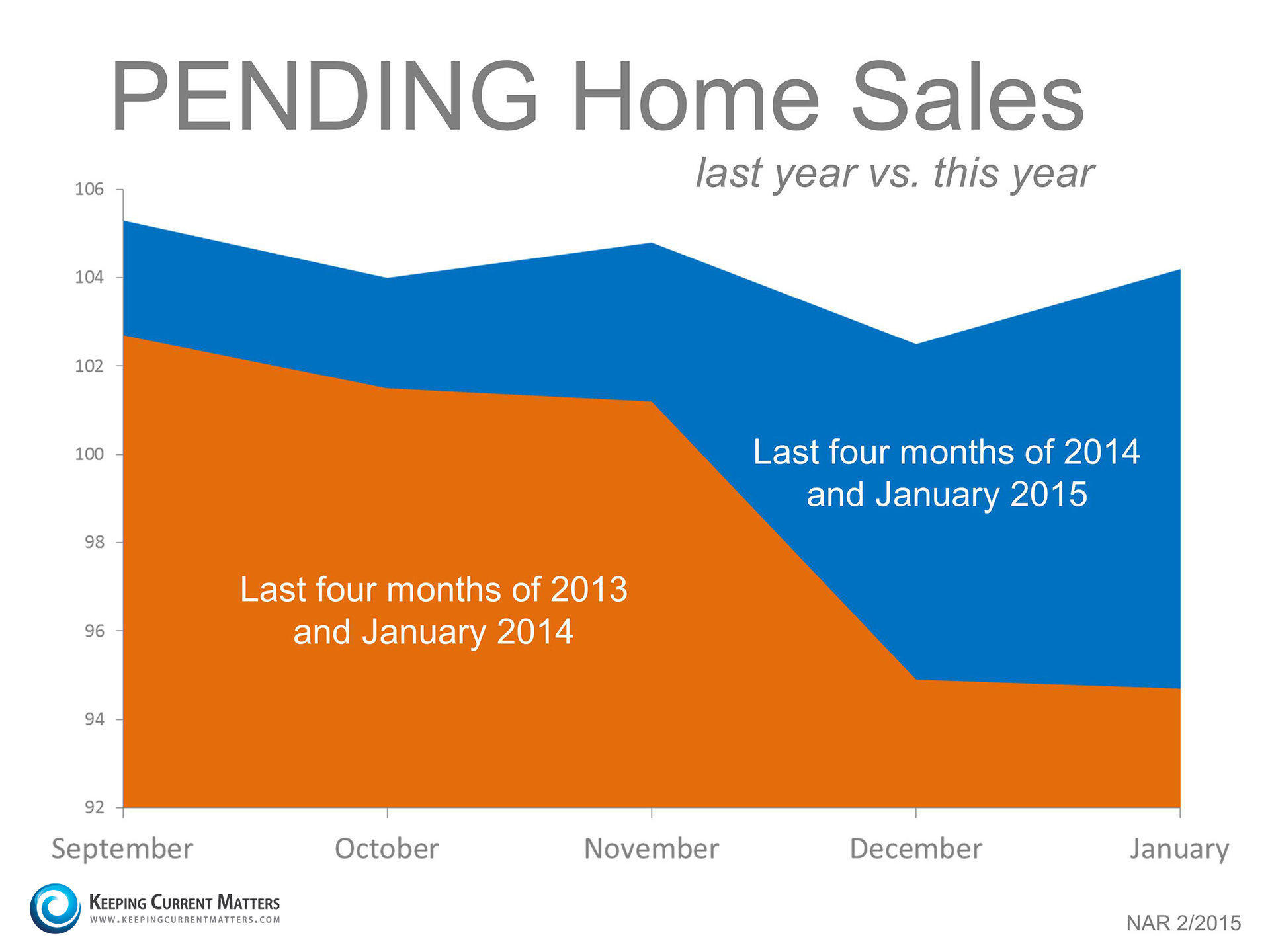

Pending home sales (houses going into a contract) as reported by the National Association of Realtors have also done much better in the last five months compared to a year earlier:

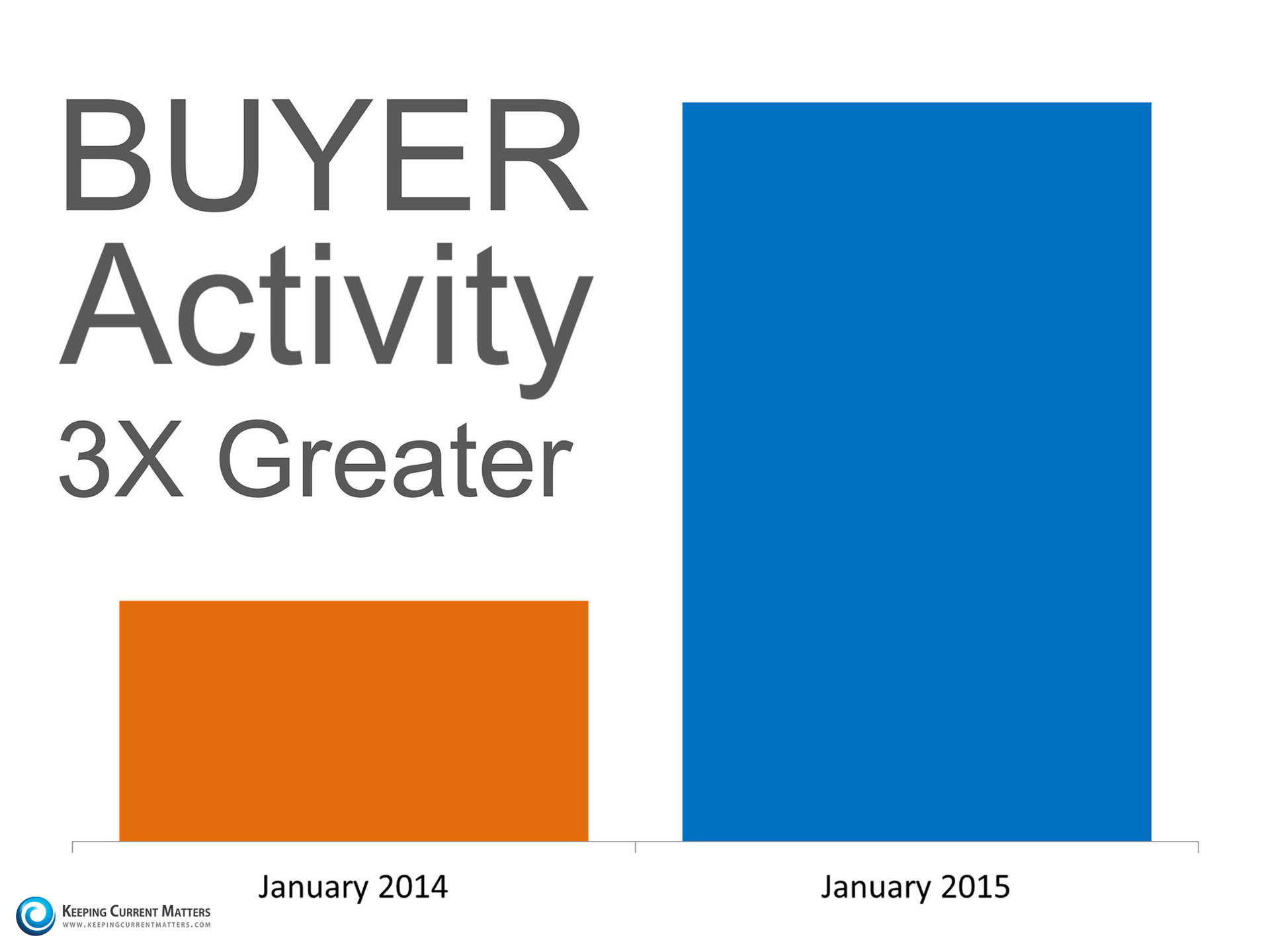

And, buyer demand is continuing to skyrocket:

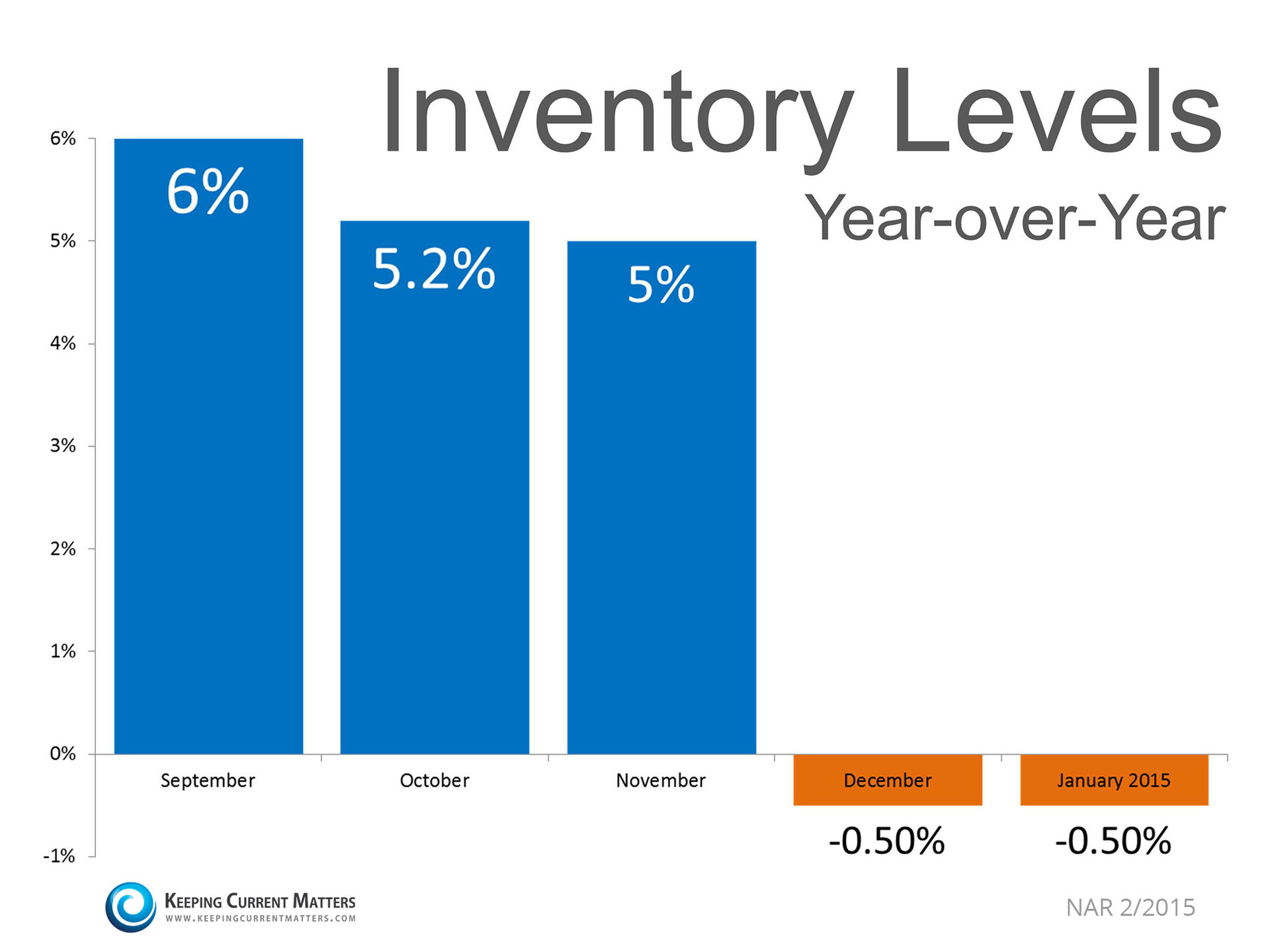

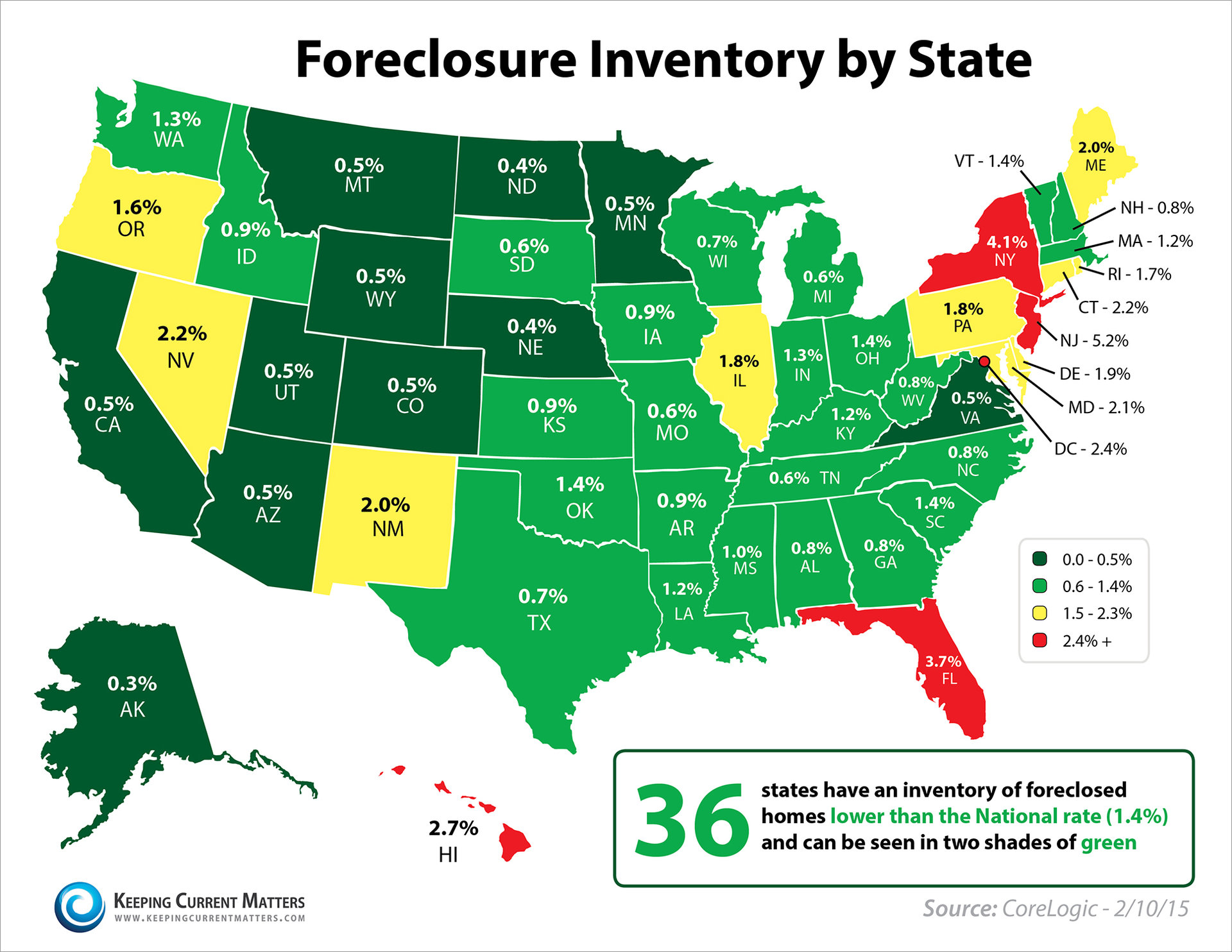

At the same time, the amount of housing inventory coming to the market compared to last year is plummeting:

Bottom Line

With demand increasing and supply dropping, this may be the perfect time to get the best price for your home. Call David Demangos today to see whether that is the case in your neighborhood.

Looking to Buy, Sell, or Invest? Contact:

David Demangos

858.232.8410

Locally Known, Globally Connected

Luxury Home Marketing Specialist

Global Property Specialist

David@AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!