|

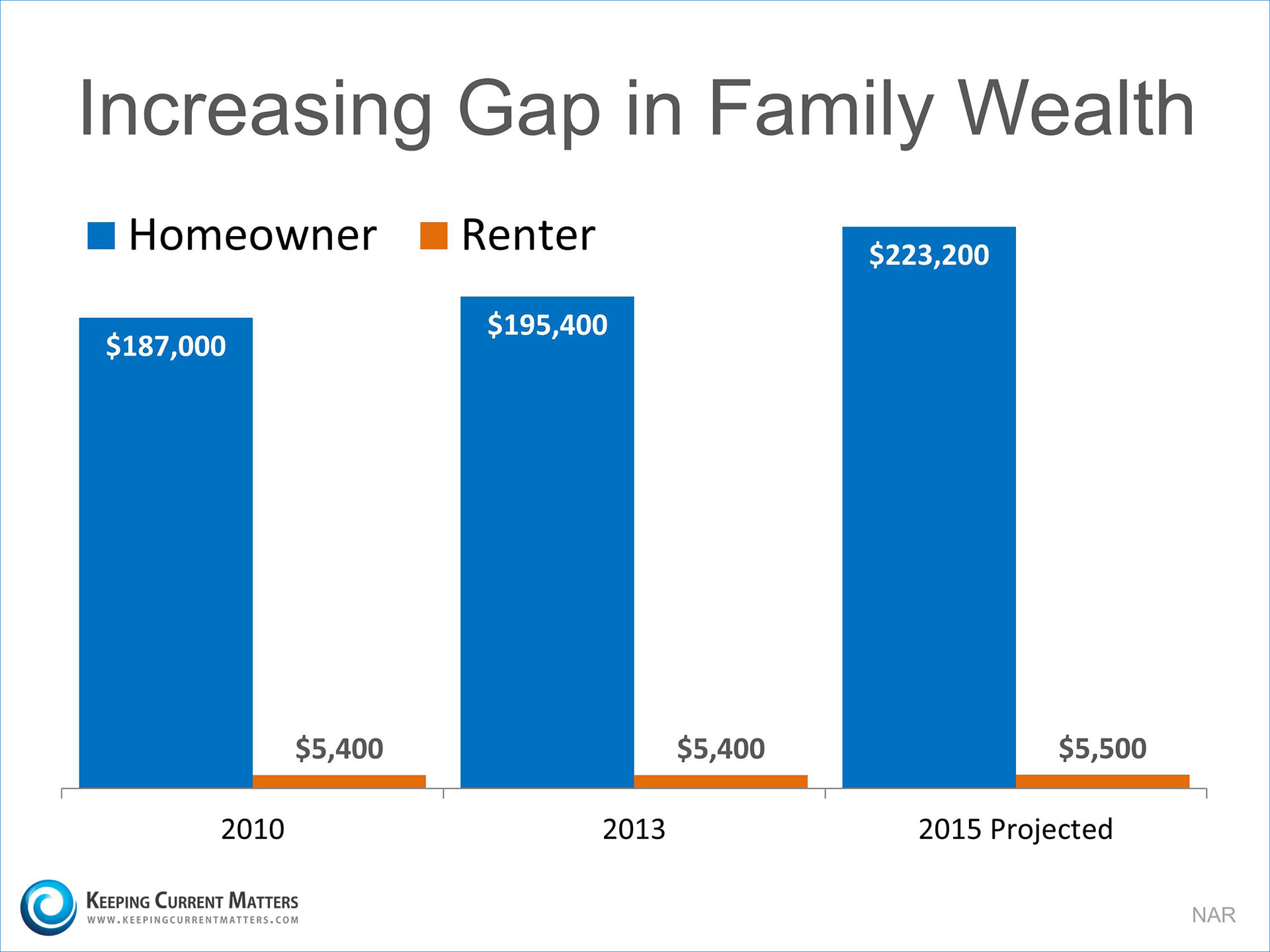

People often ask whether they

should buy a home now or wait. Recently released data suggests that waiting

may not make sense as prices seem to again be on the rise. Let’s take a look

at some of the data and commentary on the subject:

“The current tightness of supply conditions

would normally be consistent with much faster price growth. The continued

steady growth in home sales that we expect this year will only add to this

upward pressure on prices.”

“The S&P/Case-Shiller U.S. National Home

Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual

gain in March 2015 … with a 0.8% increase for the month.”

“All signs are pointing toward continued

price appreciation throughout 2015… Tight

inventories, job growth and the impact of demographics and household

formation are pushing price levels in many states toward record levels.”

“Even without further acceleration, the pace

of price growth remains too high. Strong buyer demand and low inventories

coupled with relatively low new construction are helping to push prices up,

keeping the housing market tipped in favor of sellers.”

"The first quarter saw strong and widespread

home price growth throughout most of the country. Home prices are now, on

average, roughly 20 percent above where they were three years ago. This

run-up has been historically exceptional and is particularly notable in light

of the limited household income growth and modest rate of overall inflation

observed during that same time period."

Bottom Line

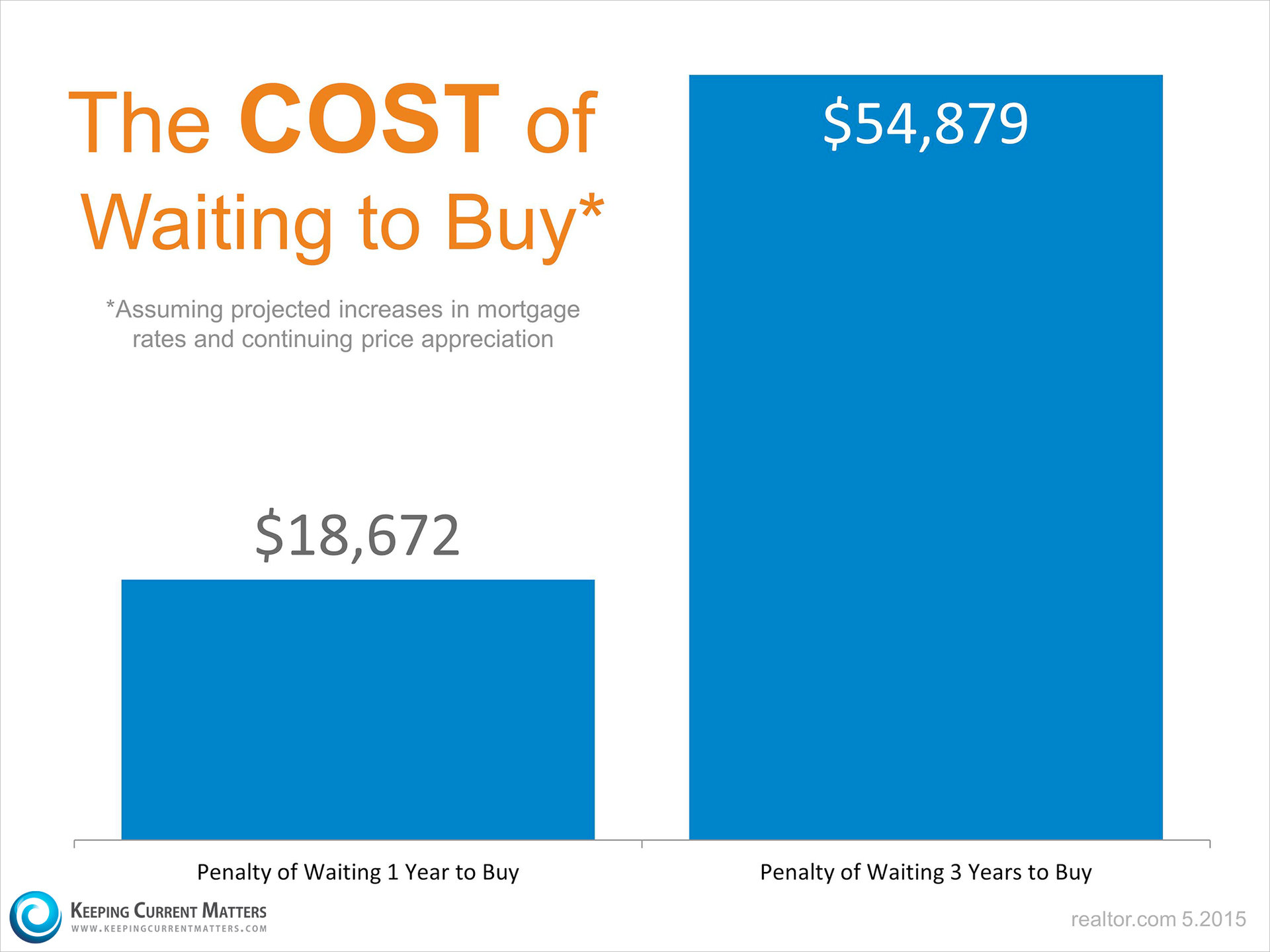

If you are planning on buying a home in the

near future, waiting probably doesn’t make sense from a purely pricing

standpoint.

Looking to Buy, Sell, or Invest? Contact:

|

![Do You Know The Cost of Renting vs. Buying? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/05/Rent-vs.-Buy-KCM.jpg)