We recently reported that home prices are

continuing to rise across most of the nation. This has created concern in some

pundits that a housing bubble, like we saw ten years ago, is forming again. We

want to explain why these concerns are unfounded. The current increase in home

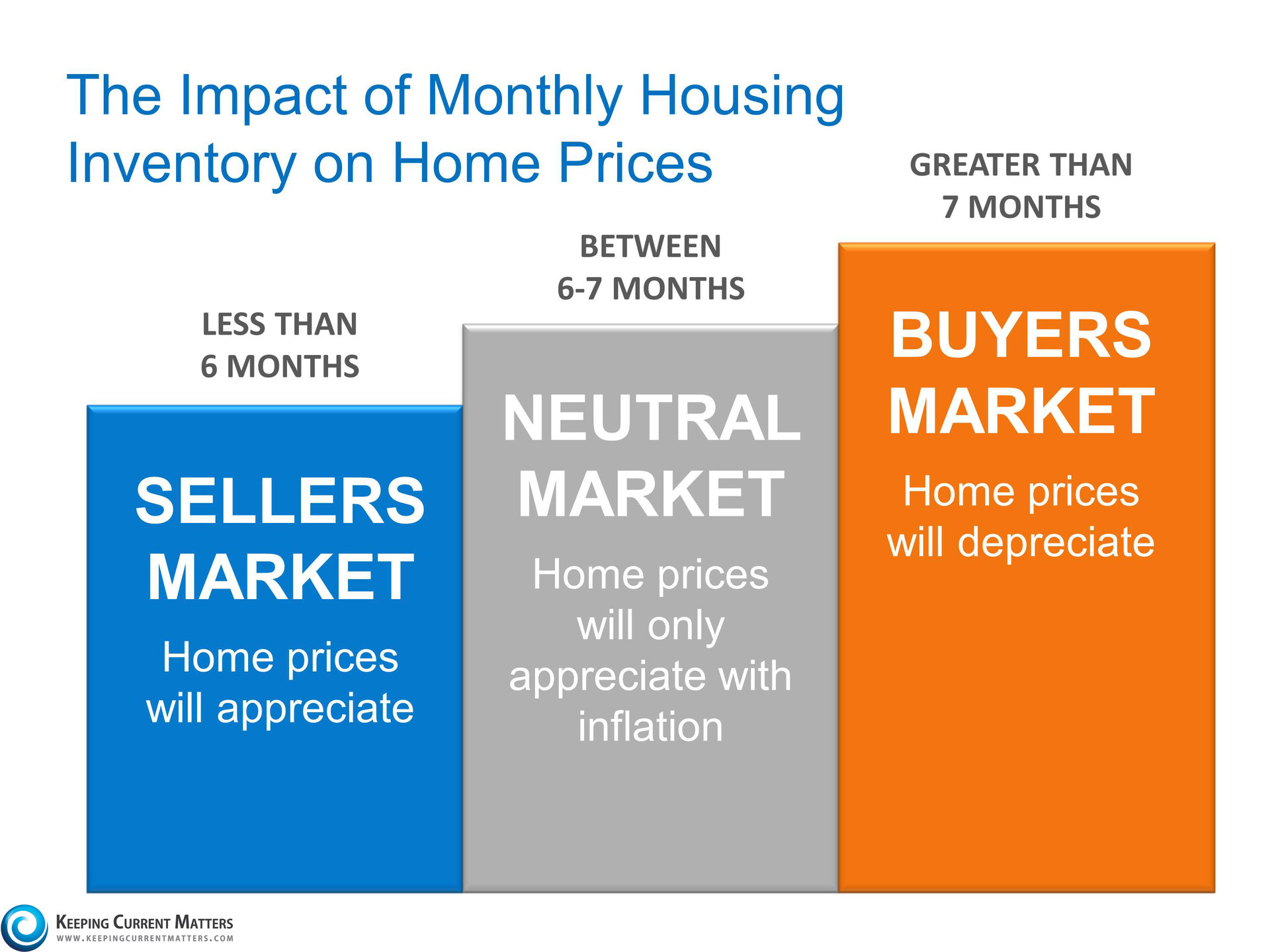

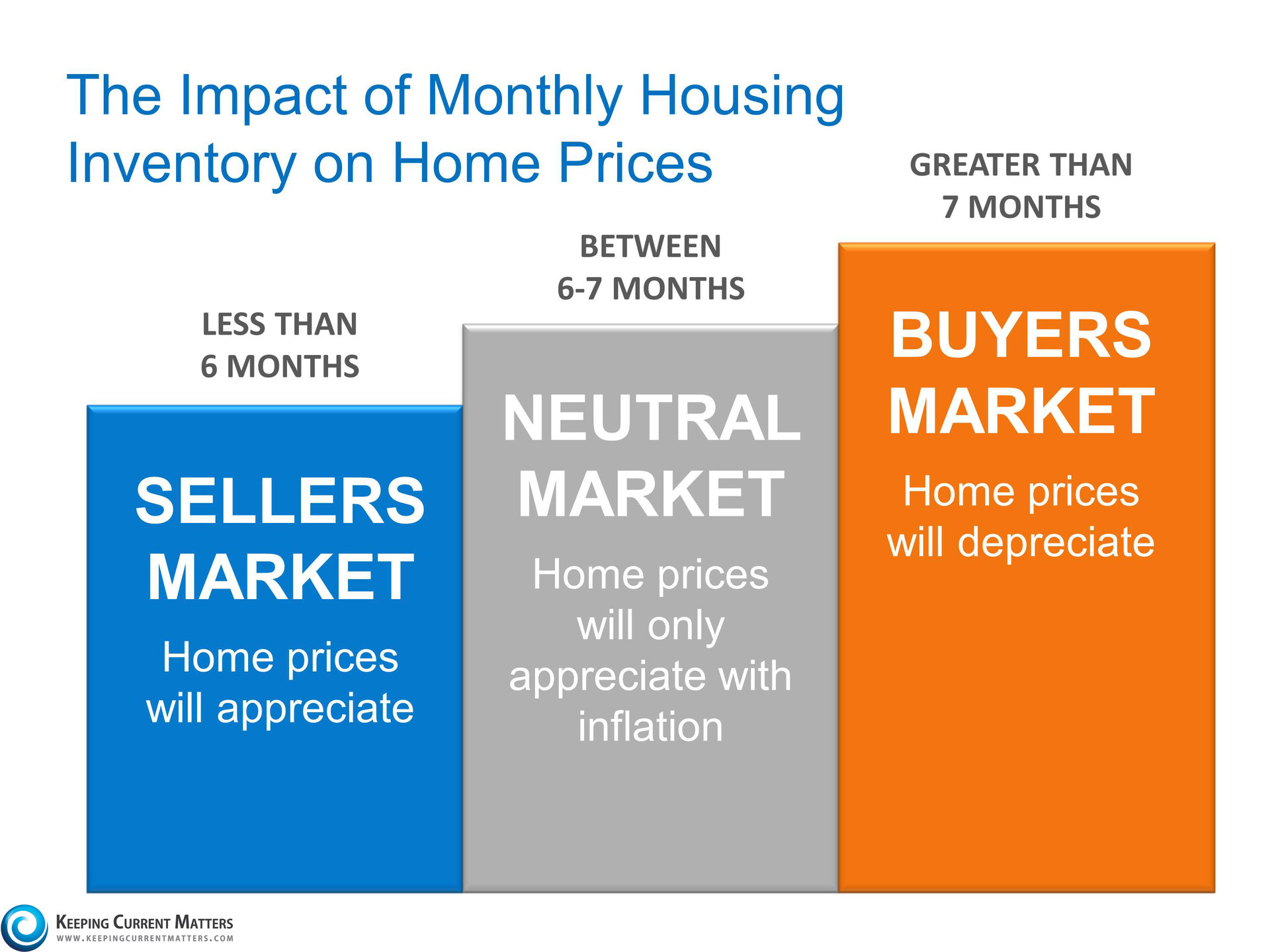

values can be easily explained by the theory of supply and demand. Right now, the number of

families looking to purchase a home is greater than the supply of homes on the

market. Here is a chart that explains how the months’ supply of housing

inventory impacts home values:  According to the latest Existing Home Sales Report

from the National

Association of Realtors, there is currently a four-month supply of

inventory. That puts us in the blue section of the above graphic. Home prices

should be appreciating.

According to the latest Existing Home Sales Report

from the National

Association of Realtors, there is currently a four-month supply of

inventory. That puts us in the blue section of the above graphic. Home prices

should be appreciating.

According to the latest Existing Home Sales Report

from the National

Association of Realtors, there is currently a four-month supply of

inventory. That puts us in the blue section of the above graphic. Home prices

should be appreciating.

According to the latest Existing Home Sales Report

from the National

Association of Realtors, there is currently a four-month supply of

inventory. That puts us in the blue section of the above graphic. Home prices

should be appreciating.

The difference in

2006…

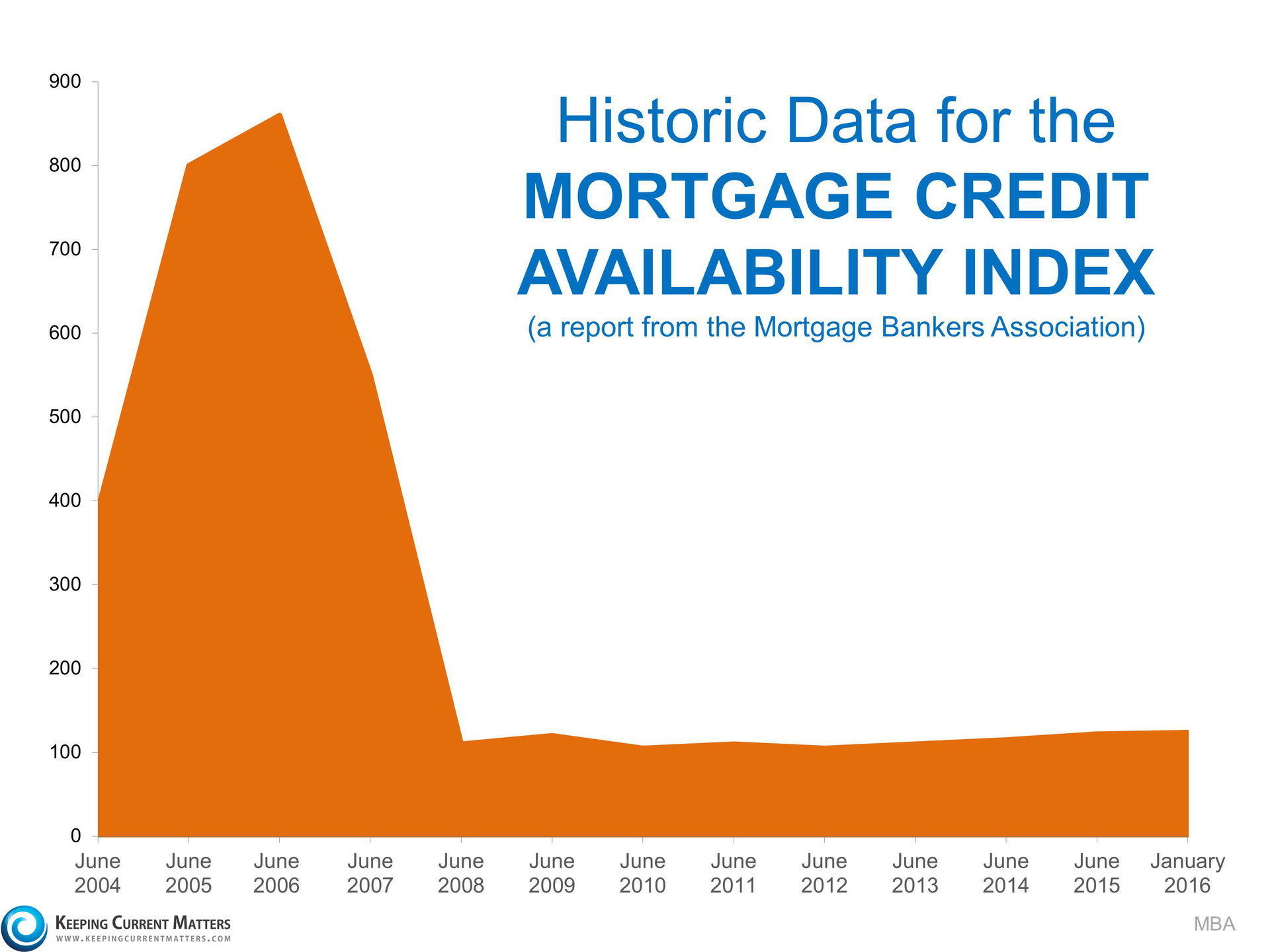

A decade ago, the demand for housing was artificially boosted by

lending standards that were far too lenient. Today, the strength of the demand

for housing is legitimate, as lending standards are nowhere near what they were

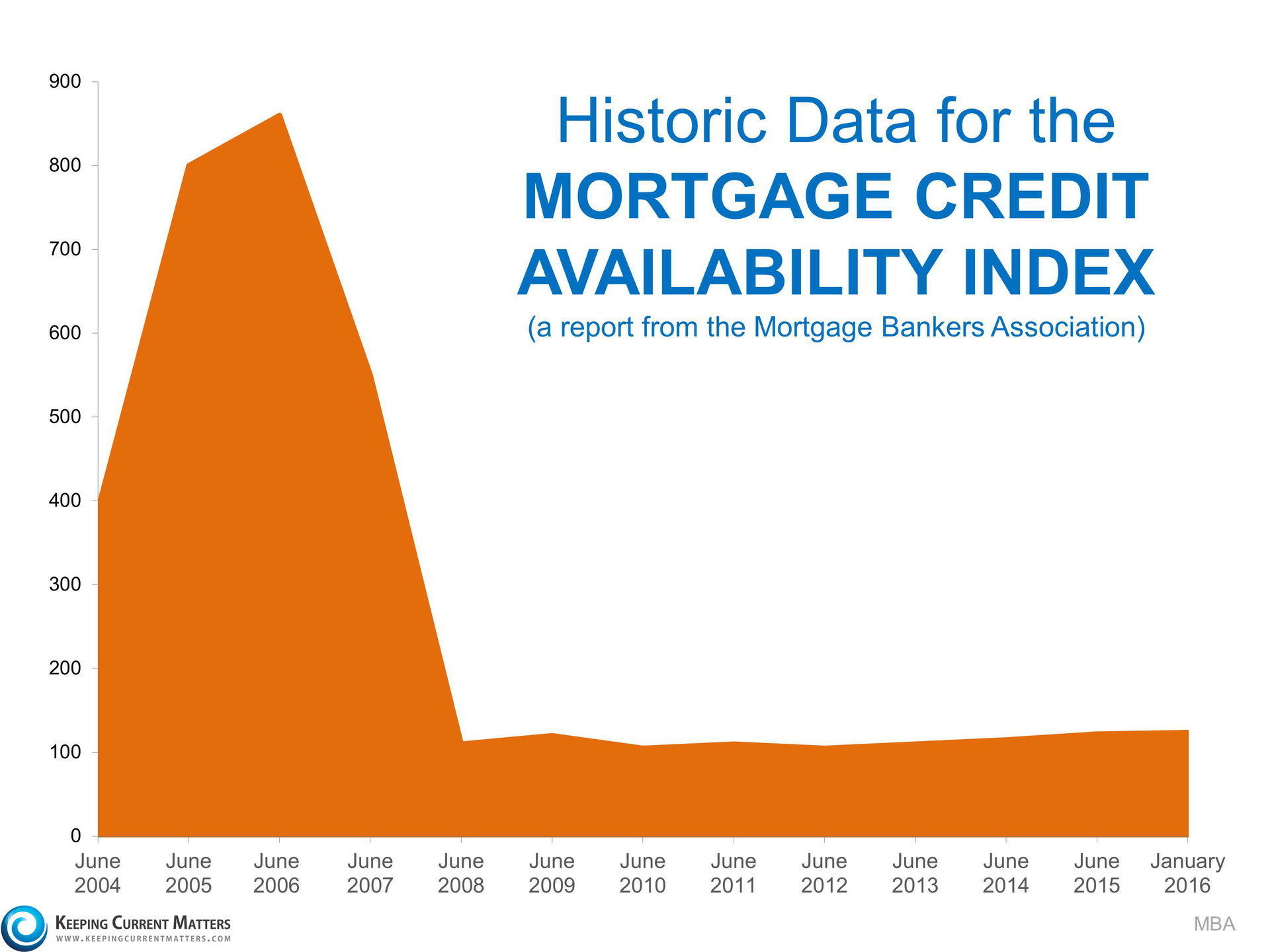

a decade ago. For proof of this, let’s look at a graph of the Mortgage Bankers’ Association’s

Mortgage Credit Availability

Index:  The higher the number, the

easier it was to get a mortgage. We can see that from June 2005 to June 2007,

mortgage standards were much more lenient than they have been over the last

nine years.

The higher the number, the

easier it was to get a mortgage. We can see that from June 2005 to June 2007,

mortgage standards were much more lenient than they have been over the last

nine years.

The higher the number, the

easier it was to get a mortgage. We can see that from June 2005 to June 2007,

mortgage standards were much more lenient than they have been over the last

nine years.

The higher the number, the

easier it was to get a mortgage. We can see that from June 2005 to June 2007,

mortgage standards were much more lenient than they have been over the last

nine years.

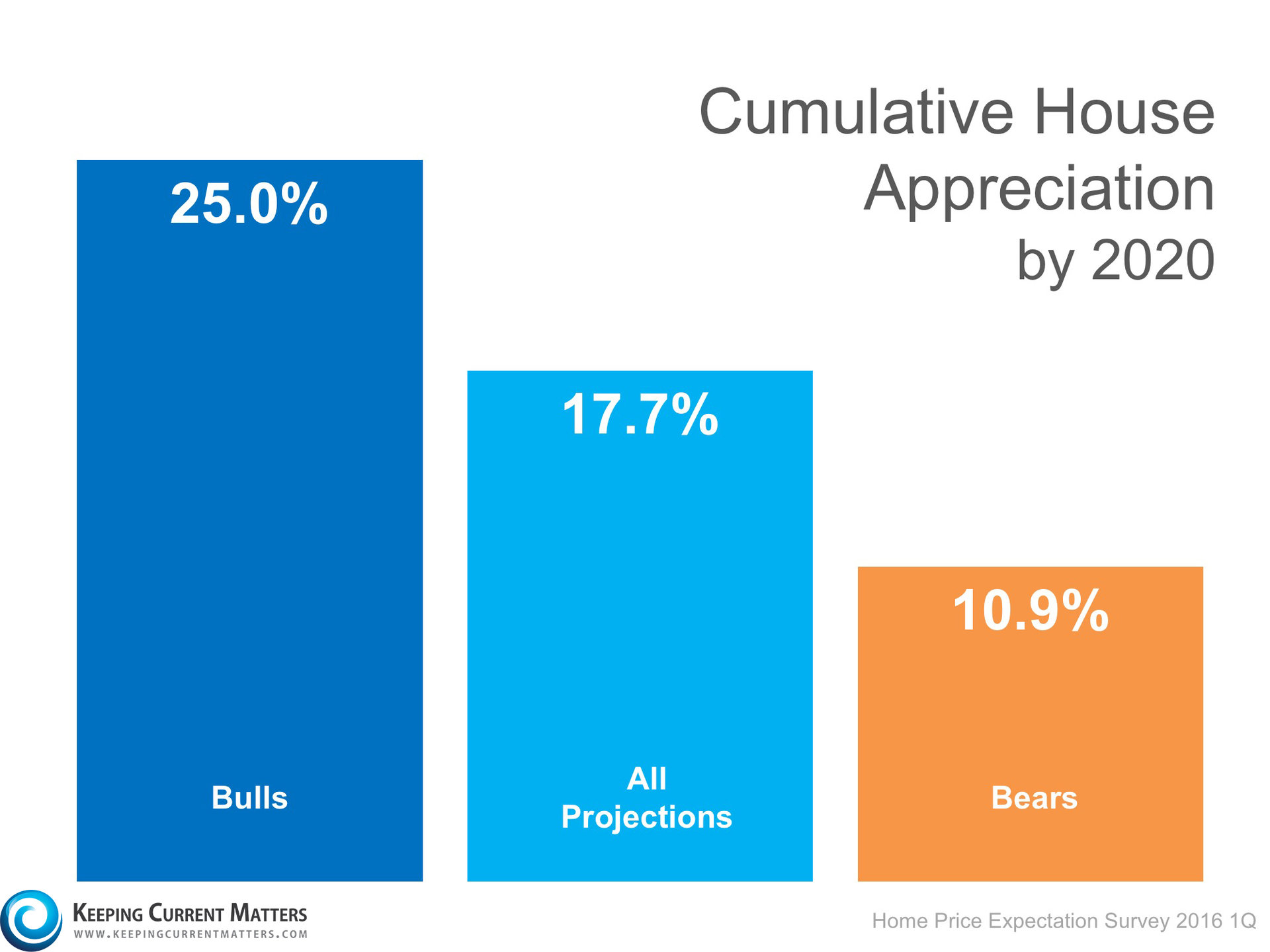

Bottom Line

Today’s price increases, unlike those a decade

ago, are the result of qualified buyer demand exceeding the current inventory

of homes available for sale. Once the supply increases, prices will level out. Looking to Buy, Sell, or Invest? Contact:

David Demangos

858.232.8410

Locally Known, Globally Connected

Luxury Home Marketing Specialist

Global Property Specialist

David@AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

![Exising Home Sales Inch Up In January [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2016/02/EHS-FEB-KCM.jpg)

![Why Do Americans Consider Moving? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2016/01/Why-Americans-Move-KCM.jpg)