Recently, the National Association of Realtors

(NAR) released their latest Existing Home

Sales Report which covered sales in November. The

report revealed that sales:

“…fell 10.5 percent to a seasonally adjusted

annual rate of 4.76 million in November (lowest since April 2014 at 4.75

million)…”

That revelation gave birth to a series of

industry articles, some of which quoted pundits questioning whether the

housing market was slowing. In actually, there is one rather simple

explanation to much of the falloff in sales last month is likely the

implementation of the “Know

Before You Owe” mortgage rule, commonly known as the TILA-RESPA

Integrated Disclosure (TRID) rule, which went into effect on October 3..

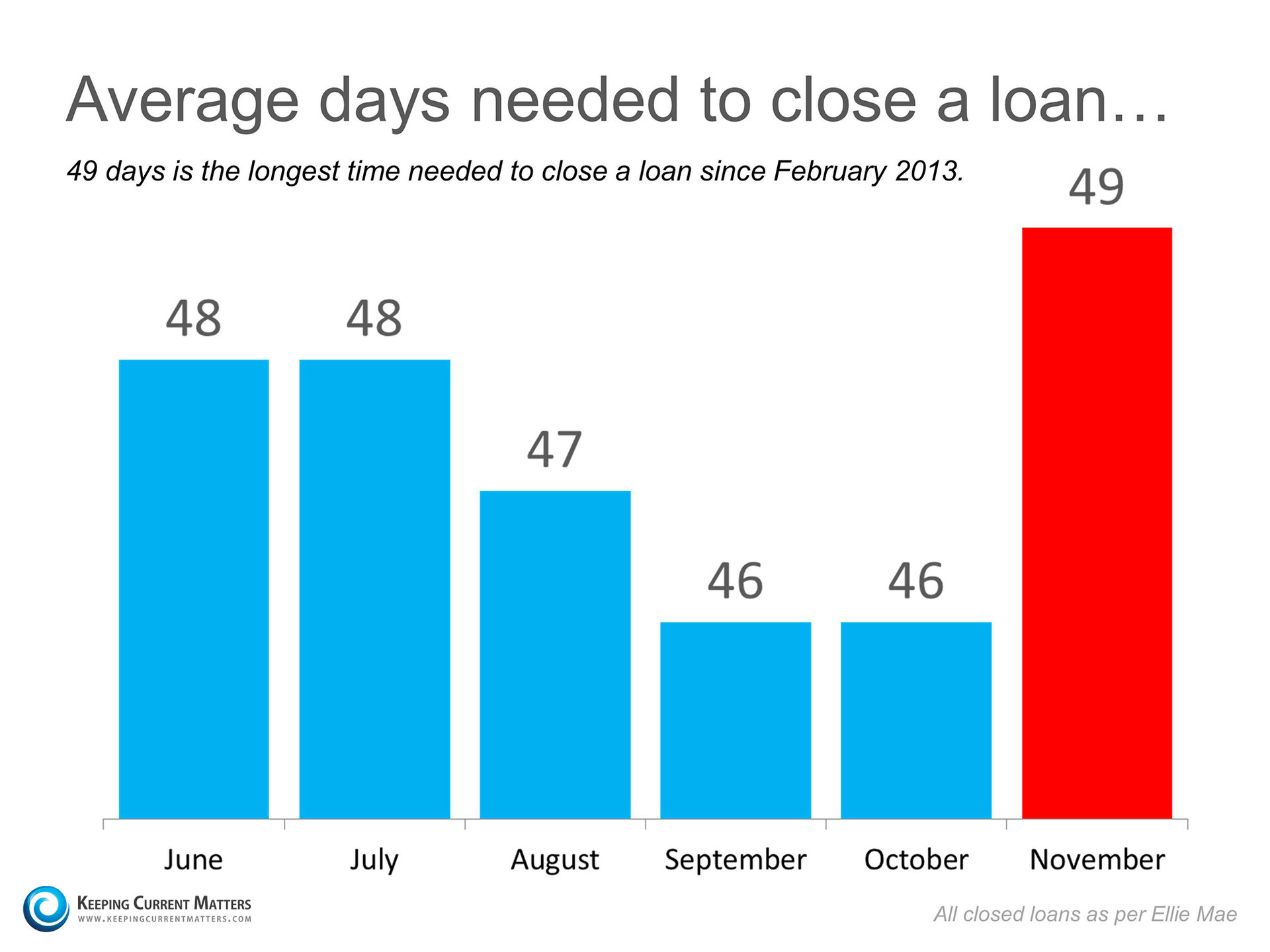

These regulations caused house closings to be delayed by an extra three days

in November as shown in the graph below. That revelation gave birth to a series of

industry articles, some of which quoted pundits questioning whether the

housing market was slowing. In actually, there is one rather simple

explanation to much of the falloff in sales last month is likely the

implementation of the “Know

Before You Owe” mortgage rule, commonly known as the TILA-RESPA

Integrated Disclosure (TRID) rule, which went into effect on October 3..

These regulations caused house closings to be delayed by an extra three days

in November as shown in the graph below.  Three days might sound like a

minimal difference. However, since there are only approximately 20 days in a

month that a closing would normally take place (Mondays through Fridays),

losing three days constitutes well over 10% of all closings. These sales are

not lost. They are just moved into the next month’s numbers. In a DS News article

on the subject yesterday, Auction.com

EVP Rick Sharga explained: Three days might sound like a

minimal difference. However, since there are only approximately 20 days in a

month that a closing would normally take place (Mondays through Fridays),

losing three days constitutes well over 10% of all closings. These sales are

not lost. They are just moved into the next month’s numbers. In a DS News article

on the subject yesterday, Auction.com

EVP Rick Sharga explained:

“The most likely cause for the weak sales

numbers is a delay in processing loans due to the new TRID mortgage

requirements imposed by the CFPB. This is the biggest change in mortgage

document processing in many years, and there have been numerous reports within

the industry of problems implementing the process and the new documentation

that comes with it.”

So how is the

housing market actually doing?

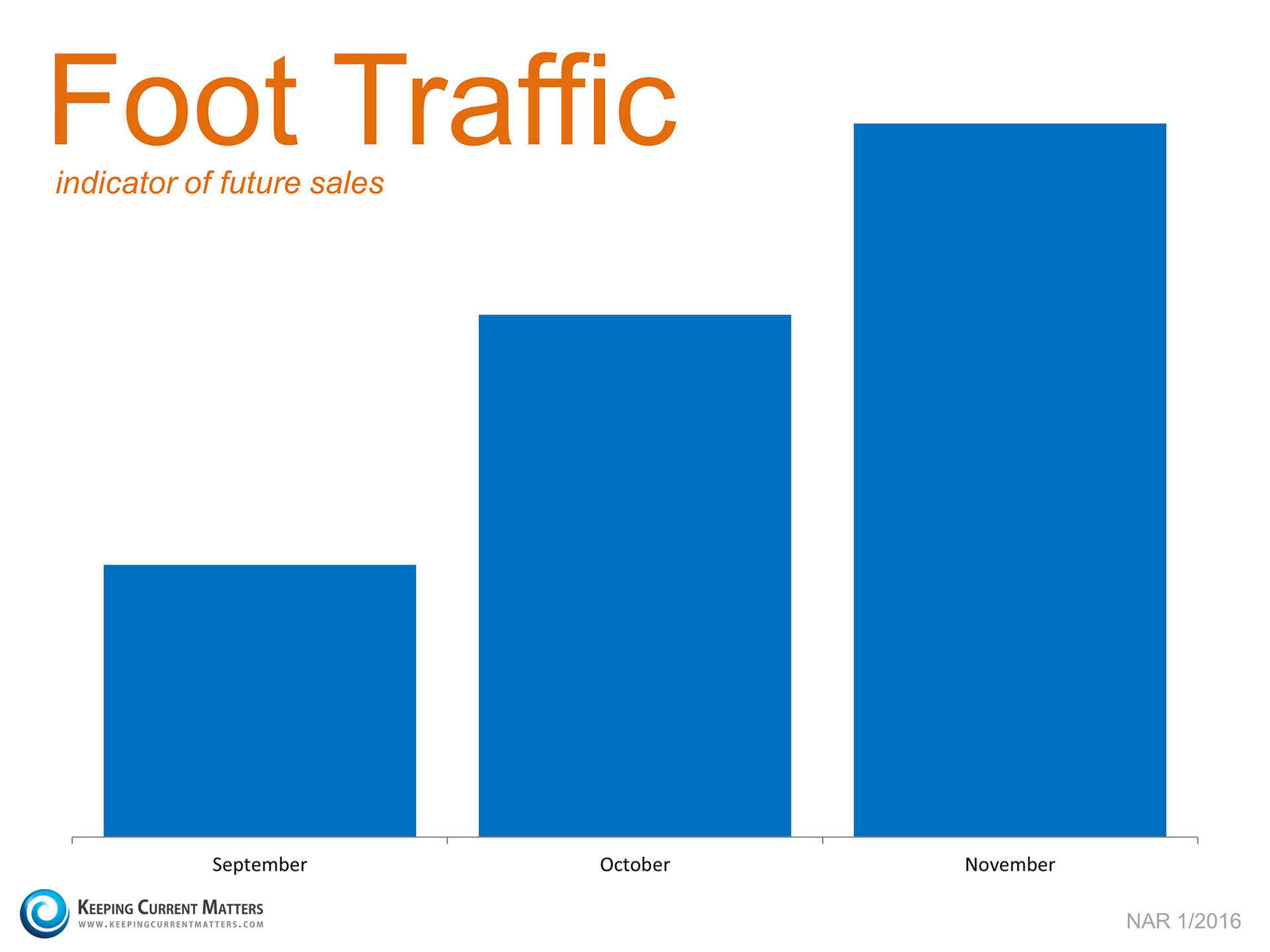

A better way to look at how well the housing

market is doing is to look at the Foot Traffic Report from NAR which

quantifies the number of prospective buyers that are actively looking for a

home at the current time:

We can see immediately that

demand to buy single family homes is increasing over the last few months -

not decreasing. We can see immediately that

demand to buy single family homes is increasing over the last few months -

not decreasing.

Bottom Line

No matter what last month’s sales numbers

show, the housing market is still doing well as demand remains strong.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Tuesday, December 29, 2015

Why Did Home Sales Drop So Dramatically Last Month?

Saturday, December 19, 2015

Millennials: What FICO Score is Needed to Buy a Home?

In a recent article by the Wharton School of Business

at the University of

Pennsylvania, it was revealed that some Millennials are not

looking to purchase a home simply because they don’t believe they

can qualify for a mortgage. The article quoted Jessica Lautz, the National Association of Realtors’

Managing Director of

Survey Research, as saying that there is a significant population

that does not think they will be approved for a mortgage and doesn’t even try.

The article also quoted Fannie

Mae CEO

Tim Mayopoulos :

“I do think that there’s a sense out there

in the marketplace among borrowers that credit may not be available,

especially for people with lower credit scores.”

So what credit score is necessary?

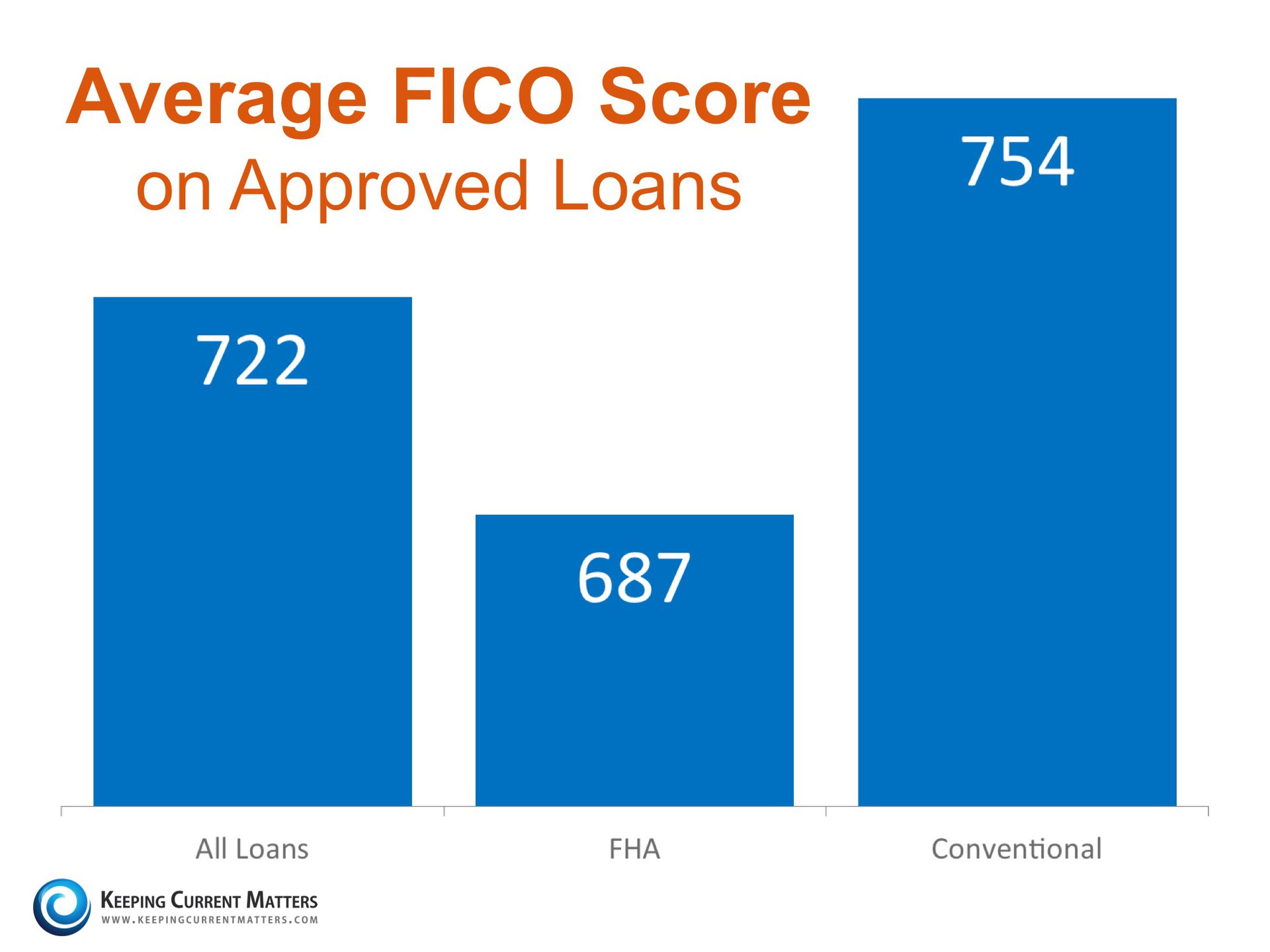

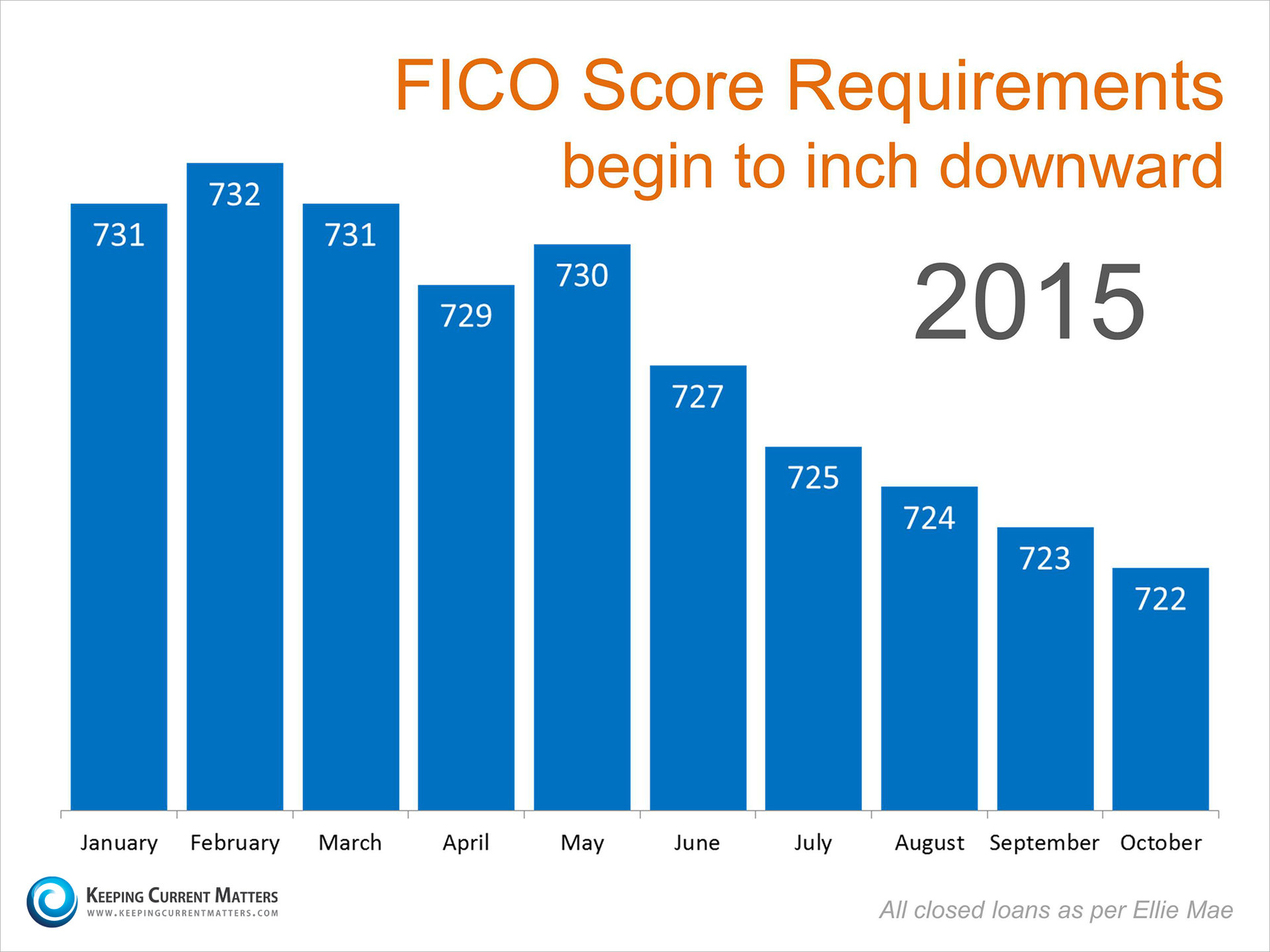

A recent survey reported that two-thirds of

the respondents believe they need a very good credit score to buy a home,

with 45 percent thinking a “good credit score” is over 780. In actually, the

FICO score on closed loans (as reported by Ellie

Mae) is much lower and has been dropping over the last several

months.

Bottom Line

Millennials who are considering a home

purchase should get advice from a local real estate or mortgage professional

now. They may be surprised how much the requirements for a mortgage have

eased.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Sunday, December 13, 2015

The Importance of Home Equity to a Family

There has been much written about how

dramatically home values have increased over the last several years. With the

increase in values, comes an increase in the equity each home owning family

now has. The Joint Center

of Housing Studies at Harvard

University recently reported that, after taking inflation

into account, aggregate home equity has increased 60% since 2010. Home equity

is the major component

of most family’s overall wealth.

|

Saturday, December 12, 2015

NAR Reports Reveal Two Reasons to Sell This Winter

We all realize that the best time

to sell anything is when demand is high and the supply of that item is

limited. The last two major reports issued by the National Association of Realtors (NAR)

revealed information that suggests that now is a great time to sell your

house. Let’s look at the data covered by the latest Pending Home Sales Report and Existing Home Sales Report. We all realize that the best time

to sell anything is when demand is high and the supply of that item is

limited. The last two major reports issued by the National Association of Realtors (NAR)

revealed information that suggests that now is a great time to sell your

house. Let’s look at the data covered by the latest Pending Home Sales Report and Existing Home Sales Report.

THE PENDING HOME

SALES REPORT

The report announced that pending home sales

(homes going into contract) are up 3.9% over last year, and have increased

year-over-year now for 14 consecutive Lawrence Yun, NAR’s Chief Economist, expects

demand to remain stable through the final two months of the year, and “forecasts existing-home sales to

finish 2015 at a pace of 5.30 million – the highest since 2006.”

Takeaway: Demand

for housing will continue throughout the end of 2015 and into 2016. The

seasonal slowdown often felt in the winter months hasn’t started and shows

little signs of being near.

THE EXISTING HOME

SALES REPORT

The most important data point revealed in

the report was not sales but instead the inventory of homes on the market

(supply). The report explained:

- Total housing

inventory decreased 2.3% to 2.14 million homes available for sale

- That represents a

4.8-month supply at the current sales pace

- Unsold inventory is

4.5% lower than a year ago

There were two more interesting comments

made by Yun in the report:

1. "New and existing-home supply has

struggled to improve, leading to few choices for buyers and no easement of

the ongoing affordability concerns still prevalent in some markets."

In real estate, there is a guideline that

often applies. When there is less than 6 months inventory available, we are

in a sellers’ market and we will see appreciation. Between 6-7 months is a

neutral market where prices will increase at the rate of inflation. More than

7 months inventory means we are in a buyers’ market and should expect

depreciation in home values. As Yun notes, we are currently in a sellers’

market (prices still increasing).

2. "Unless sizeable supply gains occur

for new and existing homes, prices and rents will continue to exceed wages

into next year and hamstring a large pool of potential buyers trying to buy a

home.” As

rents and prices increase, potential buyers will not able to save as much for

a down payment and many may become priced out of the market.

Takeaway: Inventory of homes for sale is still well below the 6 months needed for a normal market. Prices will continue to rise if a ‘sizeable’ supply does not enter the market. Take advantage of the ready willing and able buyers that are still out looking for your house. Bottom Line

If you are going to sell, now may be the

time.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Wednesday, December 9, 2015

What You Really Need To Qualify For A Mortgage

A recent survey by Ipsos found that

the American public is still somewhat confused about what is actually

necessary to qualify for a home mortgage loan in today’s housing market. The

study pointed out two major misconceptions that we want to address today.

|

Subscribe to:

Posts (Atom)