Every year the National Association of REALTORS releases their Profile Home Buyers and Sellers, in which they reveal the results of a yearlong survey of buyers and sellers. The latest profile revealed what actual buyers saw as the benefits of using an agent during the home buying process.

Here are the Top 5:

#1: Helped the Buyer Understand the Process

Whether it is your first time purchasing a home, or you’re an experienced buyer, there are over 230 possible actions that need to happen during every successful real estate transaction. Having someone to guide you through the process who can simply explain what is going on at every step of the way was sited as the top benefit by 63% of all buyers (that number jumped to 83% with first time buyers).

#2: Pointed Out Unnoticed Features/Faults with the Property

When you start the process of buying a home, you may be too excited to see each potential home for what it is, good and bad. An experienced professional can help you realize the potential hidden gems or risks before you make an offer. Nearly 60% of all buyers listed this as a major benefit of hiring a professional.

#3: Improved the Buyer’s Knowledge of Search Areas

Whether you are looking to relocate to a new state, or just across town, having someone who knows the neighborhoods in which you are looking can be an invaluable asset.

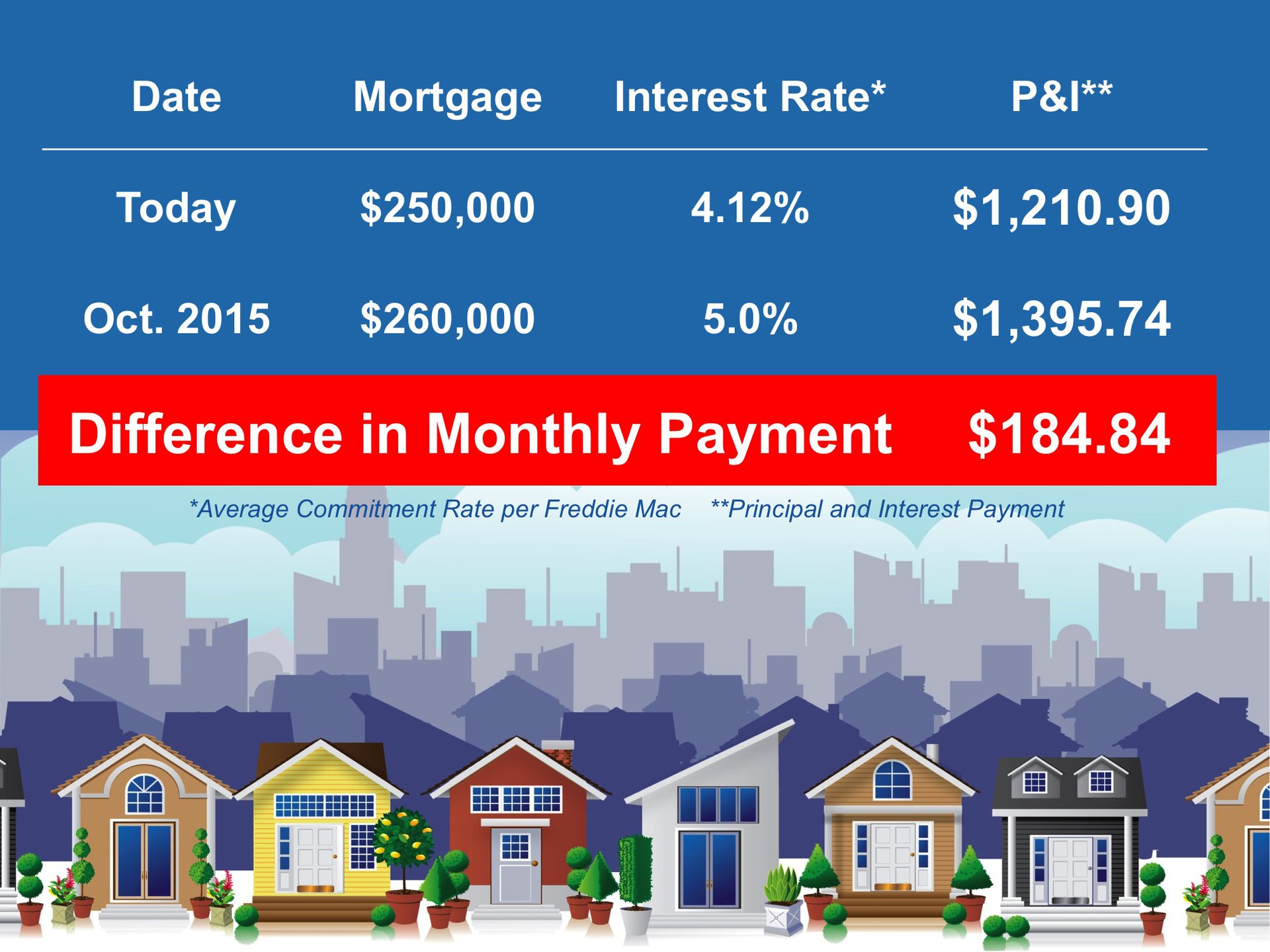

#4: Negotiated Better Sales Contract Terms/Better Price

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

#5: Provided a better list of service providers

A great agent has relationships with mortgage professionals, home inspectors, appraisers and other experts that you will need in securing your dream home.

Bottom Line

If you are considering purchasing a home, whether as a first-time or move up buyer, sit down with a local experienced real estate professional in your area and see what they have to offer.

David Demangos