“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Unfortunately, when information in the media isn’t clear, it can generate a lot of fear and uncertainty in the market. As Jason Lewris, Cofounder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying or selling a home is a big decision, and it should be one you feel confident making. To help you separate fact from fiction and get the answers you need, lean on a local real estate advisor.

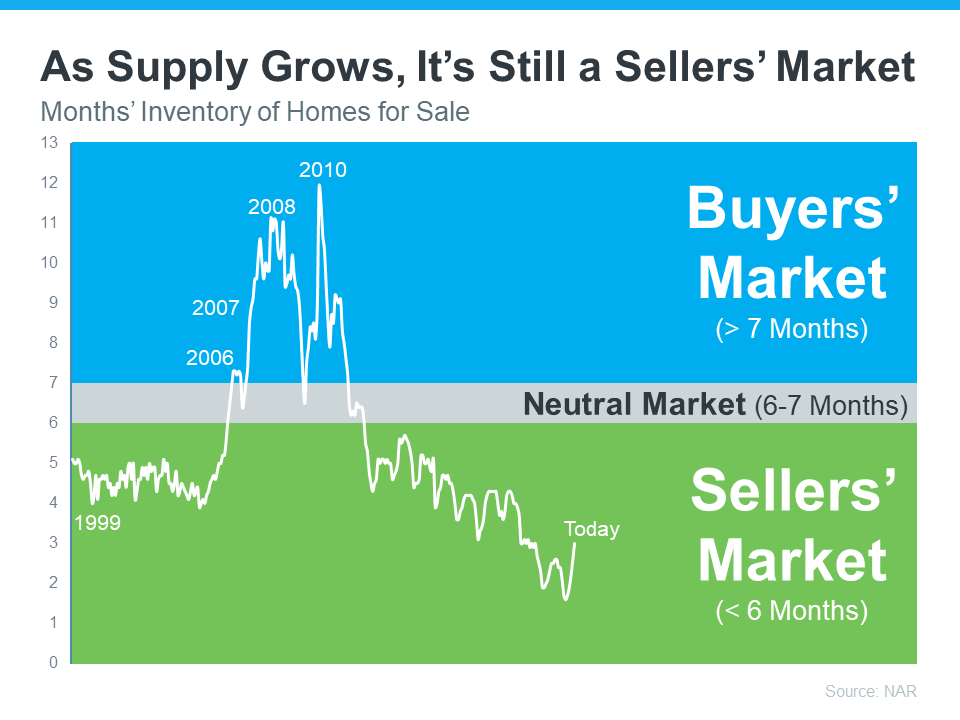

A trusted expert is your best resource to understand what’s happening at the national and local levels. They’ll be able to debunk the headlines using data you can trust. And using their in-depth knowledge of the industry, they’ll provide context so you know how current trends compare to the normal ebbs and flows in the industry, historical data and more.

Then, to make sure you have the full picture, they’ll tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you’ll use all of that information to make the best possible decision for you.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where an agent comes in.

Bottom Line

If you have questions about the headlines or what’s happening in the housing market today, let’s connect so you have expert insights and advice on your side.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,2019,2020,& 2021 Recognition of Excellence Award Winner SDAR