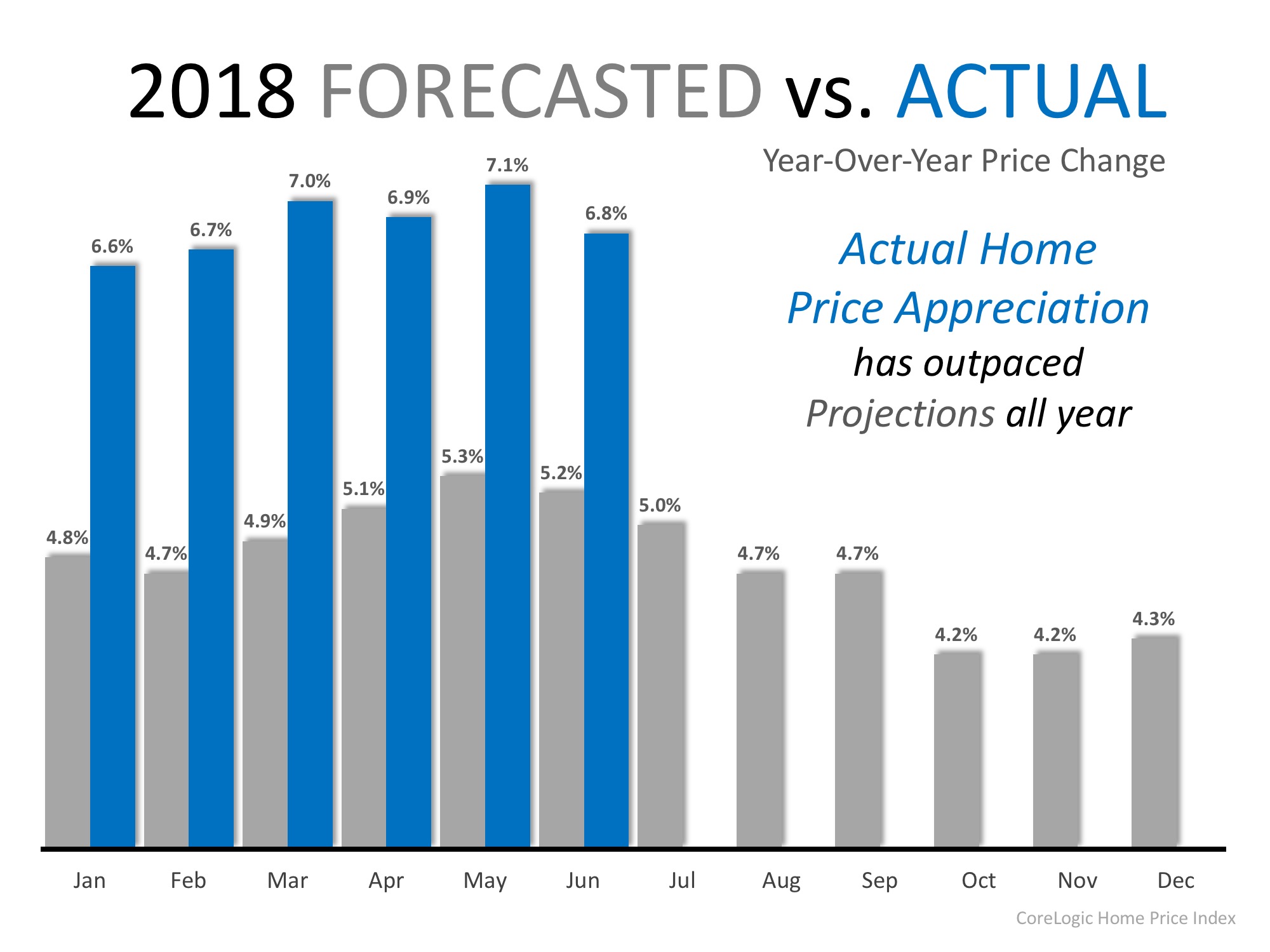

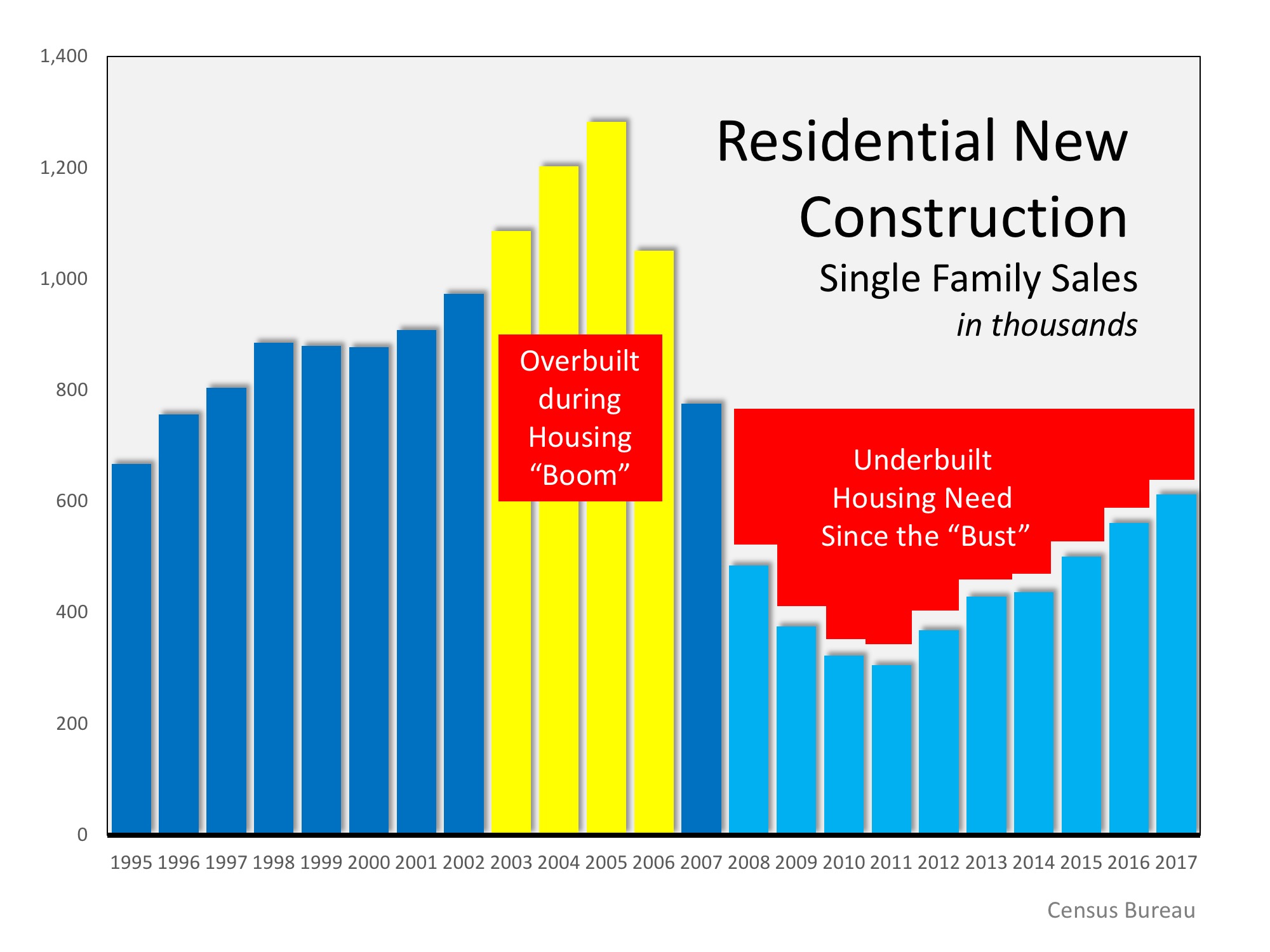

For the last several years, buyer demand has far exceeded the housing supply available for sale. This low supply and high demand have led to home prices appreciating by an average of 6.2% annually since 2012.

With this being said, three of the four major reports used to measure buyer activity have revealed that purchasing demand may be softening. Here are the four indices, how they measure demand (methodology), what their latest reports said, and a quick synopsis of the report.

by the National Association of Realtors

Methodology: Every month SentriLock, LLC provides NAR Research with data on the number of properties shown by a REALTOR®. Lockboxes made by SentriLock, LLC are used in roughly a third of home showings across the nation. Foot traffic has a strong correlation with future contracts and home sales, so it can be viewed as a peek ahead at sales trends two to three months into the future.

Latest Report: “Foot Traffic climbed 3.2 points to 55.8 mid-summer in July. Additionally, the diffusion index is higher than last year by 13.5 points. Despite a healthy economy and labor market, supply and new construction remains unable to keep up with buyer demand.”

Synopsis: Buyer demand remains strong.

by ShowingTime

Methodology: The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.

Latest Report: “Showing activity throughout the country increased by 0.3 percent year over year in July, the third consecutive month that the U.S. ShowingTime Showing Index recorded buyer interest deceleration compared to the previous year. The June 2018 figures revealed a 0.0 percent change in showing traffic from 2017, while May showed a 1.2 percent year-over-year increase. The 12-month average year-over-year increase was 4.6 percent.”

Synopsis: Buyer demand is softening

by the National Association of Realtors

Methodology: The REALTORS Confidence Index is a key indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Practitioners are asked about their expectations for home sales, prices and market conditions.

Latest Report: “REALTORS reported slower homebuying activity in July 2018…The REALTORS® Buyer Traffic Index registered at 62, down from the same month one year ago (69). This is the fifth straight month (since March 2018) that Realtors reported a decline in buyer activity compared to conditions one year ago.”

Synopsis: Buyer demand is softening

in the ‘Z’ Report by Zelman and Associates (subscription needed)

Methodology: Proprietary survey results of real estate executives.

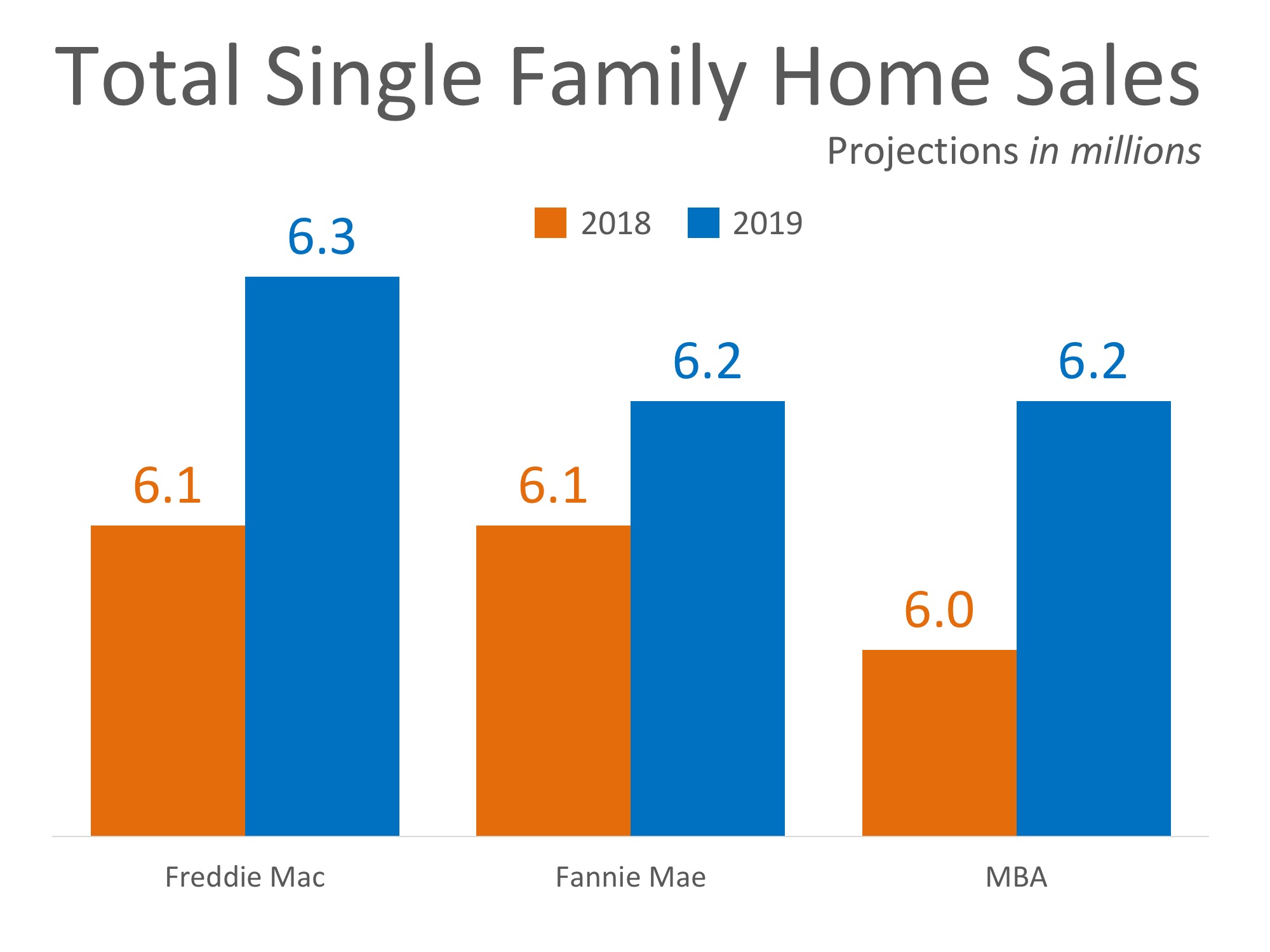

Latest Report: “While we continue to expect a resumption of growth in resale transactions on the back of easing inventory in 2019 and 2020, our real-time view into the market through our Real Estate Broker Survey does suggest that buyers have grown more discerning of late and a level of “pause” has taken hold in many large housing markets. Indicative of this, our broker contacts rated buyer demand at 69 on a 0-100 scale, still above average but down from 74 last year and representing the largest year-over-year decline in the two-year history of our survey.”

Synopsis: Buyer demand is softening

Bottom Line

Again, three of the four most reliable measures of buyer activity are reporting that demand is softening. We had a strong buyers’ market directly after the housing crash which was immediately followed by a strong sellers’ market over the last six years.

If demand continues to soften and supply begins to grow (as is projected to happen), we will return to a more neutral market which will favor neither buyers nor sellers. This “more normal” market will be better for real estate in the long term.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - Keller Williams Realty

Cell: 858.232.8410 | Realtor® BRE# 01905183

www.AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016 & 2017 Recognition of Excellence Award Winner SDAR