1. Know Your Numbers

Having a complete understanding of your budget and how much house you can afford is essential. That’s why you should connect with a lender to get pre-approved for a loan early in the homebuying process. Taking this step shows sellers you’re a serious, qualified buyer and can give you a competitive edge in a bidding war.

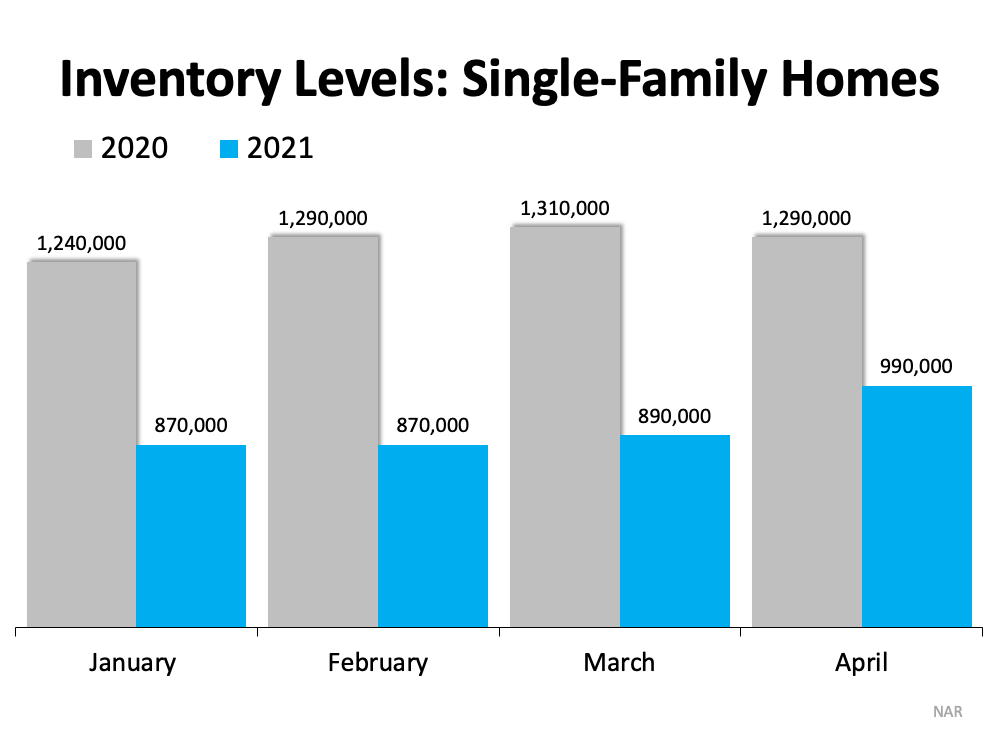

2. Brace for a Fast Pace

Today’s market is dynamic and fast-paced. According to the Realtors Confidence Index from the National Association of Realtors (NAR), the average home is on the market for just 17 days – that means from start to finish, a house for sale in today’s climate is active for roughly 2.5 weeks. A skilled agent will do everything they can to help you stay on top of every possible opportunity. And, as soon as you find the right home for your needs, that agent will help you draft and submit your best offer as quickly as possible.

3. Lean on a Real Estate Professional

While homebuying may seem like a whirlwind process to you, local real estate agents do this every day, and we know what works. That expertise can be used to give you a significant leg up on your competition. An agent can help you consider what levers you can pull that might be enticing to a seller, like:

Offering flexible rent-back options to give the seller more time to move out

Your ability to do a quick close or make an offer that’s not contingent on the sale of your current home

It may seem simple, but catering to what a seller may need can help your offer stand out.

4. Make a Strong, but Fair Offer

Let’s face it – we all love a good deal. In the past, offering at or near the asking price was enough to make your offer appealing to sellers. In today’s market, that’s often not the case. According to Lawrence Yun, Chief Economist at NAR:

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

In such a competitive market, emotions and prices can run high. Use an agent as your trusted advisor to make a strong, but fair offer based on market value, recent sales, and demand.

5. Be a Flexible Negotiator

If you followed tip #3, you drafted the offer with the seller’s needs in mind. That said, the seller may still counter with their own changes. Be prepared to amend your offer to include flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember, there are certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

When it’s time to make an offer, it’s important to consider not just what you need, but what the seller may need too. Let’s connect so you have expert advice on this step in the homebuying process to put your best offer on the table.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,& 2019 Recognition of Excellence Award Winner SDAR