There are some people that have not

purchased a home because they are uncomfortable taking on the obligation of a

mortgage. Everyone should realize that, unless you are living with your

parents rent free, you are paying a mortgage - either your mortgage or your

landlord’s. As The Joint

Center for Housing Studies at Harvard University explains:

“Households must consume housing whether

they own or rent. Not even accounting for more favorable tax treatment of

owning, homeowners pay debt service to pay down their own principal while

households that rent pay down the principal of a landlord plus a rate of

return. That’s yet

another reason owning often does—as Americans intuit—end up making more

financial sense than renting.”

Christina Boyle, a Senior Vice President, Head of

Single-Family Sales & Relationship Management at Freddie Mac, explains

another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll

have the certainty & stability of knowing what your mortgage payment will

be for the next 30 years – unlike rents which will continue to rise over the

next three decades.”

As an owner, your mortgage payment is a form

of ‘forced savings’

that allows you to have equity in your home that you can tap into later in

life. As a renter, you guarantee your landlord is the person with that

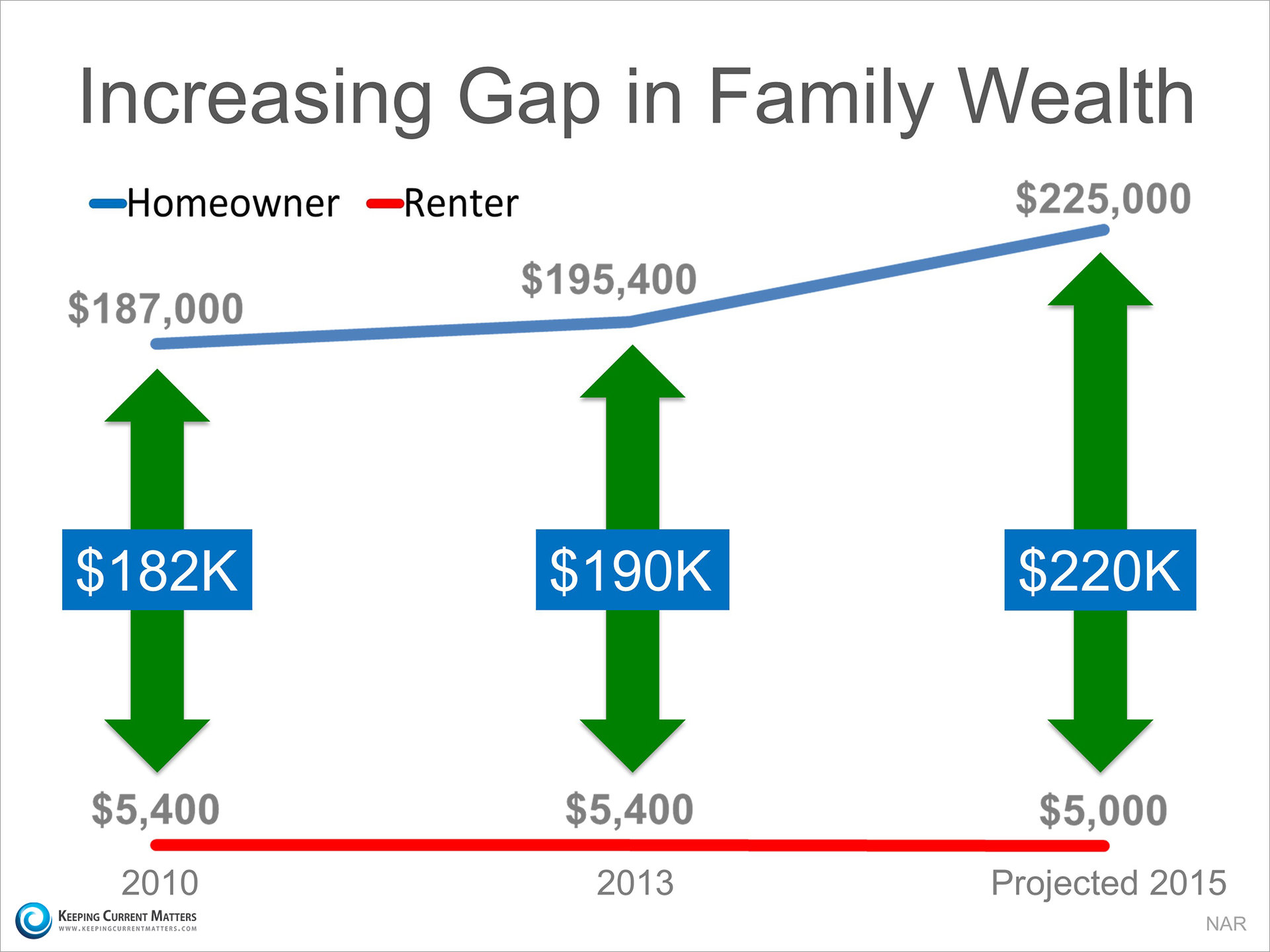

equity. The graph below shows the widening gap in net worth between a

homeowner and a renter:

Bottom Line

Whether you are looking for a primary

residence for the first time or are considering a vacation home on the shore,

owning might make more sense than renting with home values and interest

rates projected to climb.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Monday, November 30, 2015

Rent vs. Buy: Either Way You’re Paying A Mortgage

Sunday, November 22, 2015

Slaying Myths About Buying A Home

Some Highlights:

- Interest Rates are

still below historic numbers.

- 88% of property

managers raised their rent in the last 12 months!

- Credit score

requirements to be approved for a mortgage continue to fall. The 723 average

score is the lowest since Ellie

Mae began reporting on scores in August 2011.

- The average

first-time home buyer down payment was 6% in 2015 according to NAR.

Looking to Buy, Sell, or Invest? Contact:David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Saturday, November 21, 2015

Fannie Mae’s Housing Forecast

Some

Highlights:

§ 30-year fixed

mortgage rates are projected to increase steadily over the next year.

§ Housing Starts will

well surpass 2015 numbers.

§ Home Sales will

reach an annual rate of over 6 million by the fourth quarter of 2016.

Looking to Buy, Sell, or Invest? Contact:David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Wednesday, November 18, 2015

How to Get the Most Money from the Sale of Your House

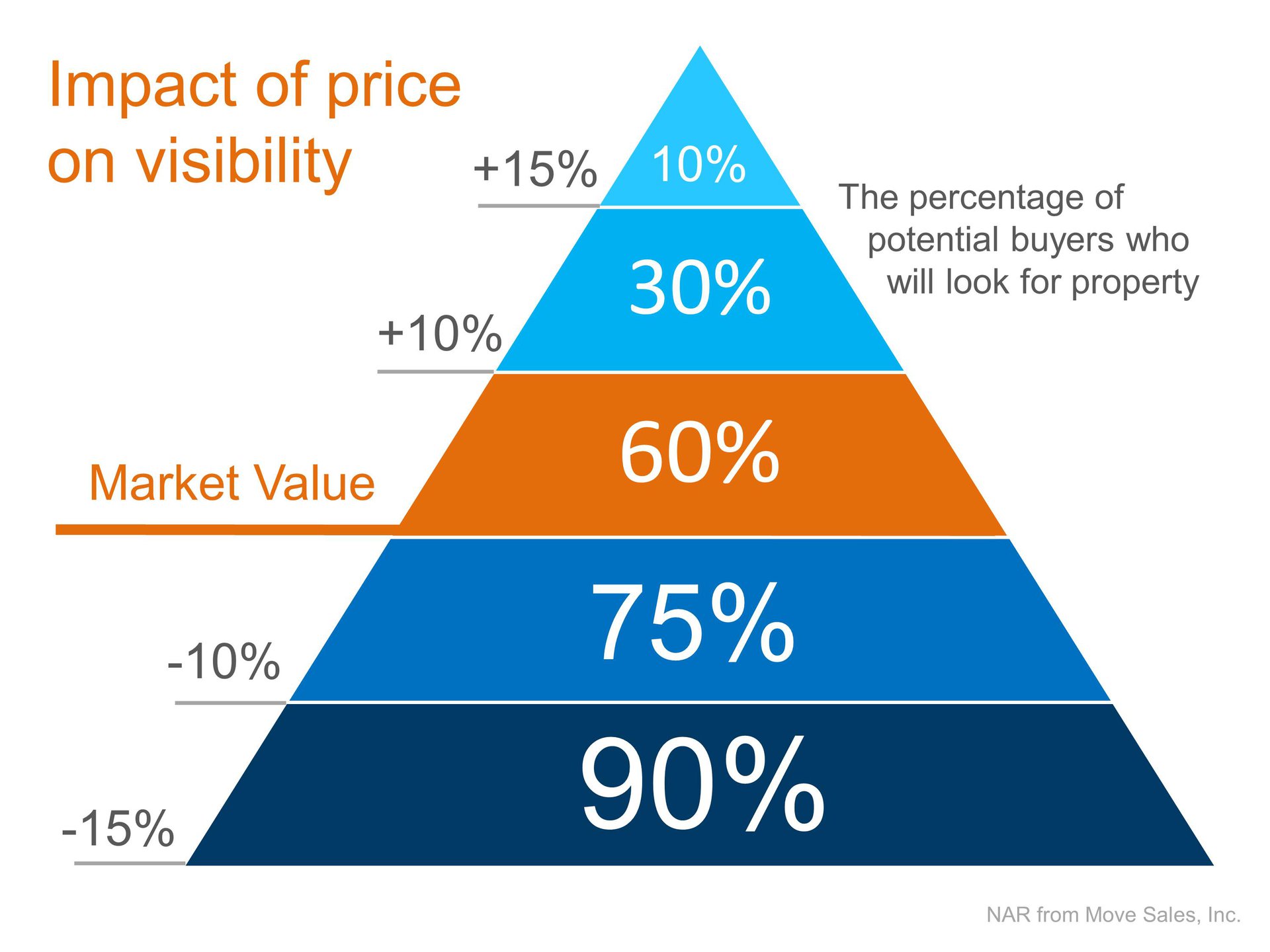

Every homeowner wants to make sure they

maximize the financial reward when selling their home. But, how do you

guarantee that you receive maximum value for your house? Here are two keys to

insuring you get the highest price possible.

|

Sunday, November 15, 2015

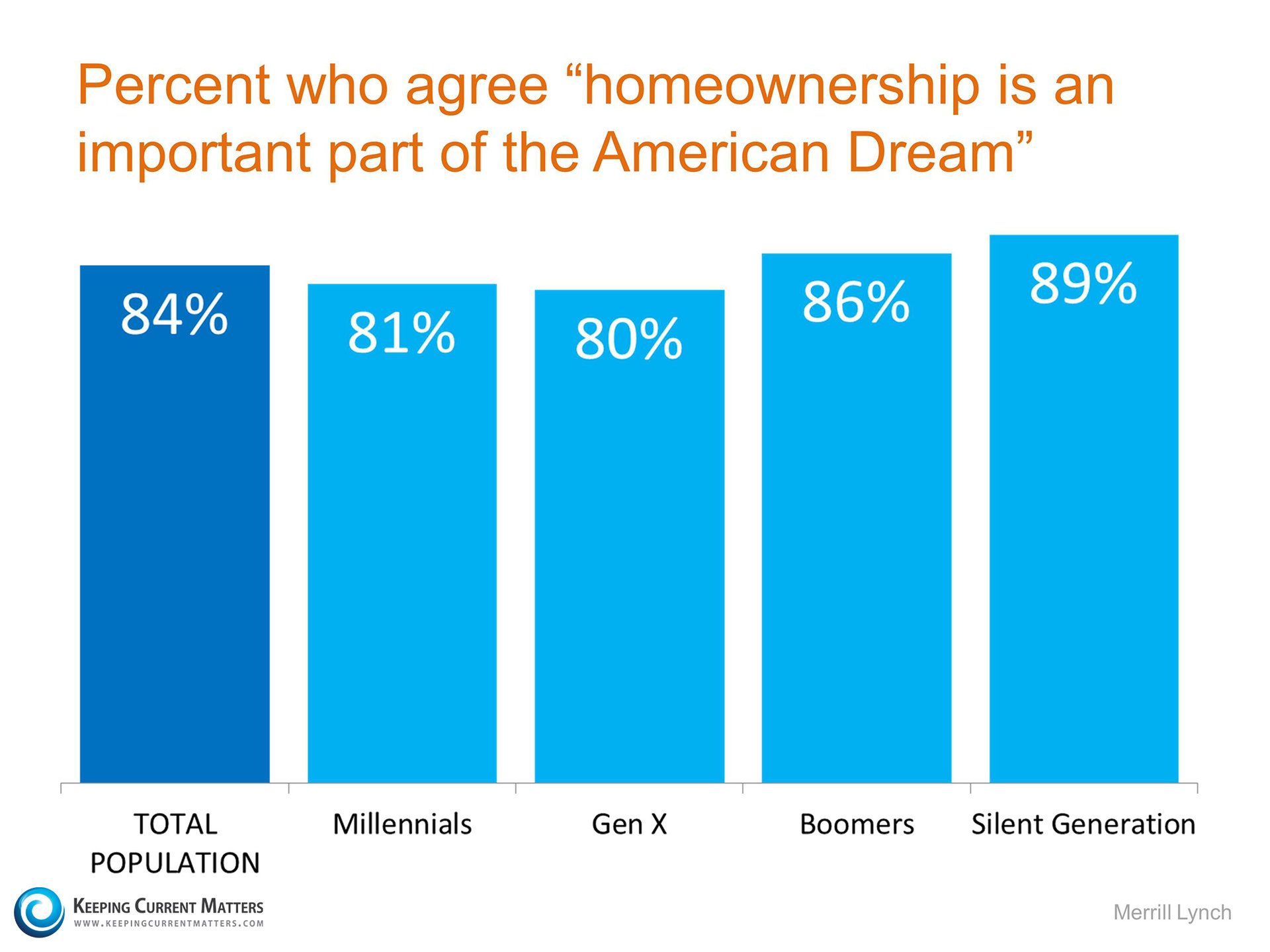

Homeownership is Still a Huge Part of the “American Dream”

There have been some who have

voiced doubt as to whether or not the younger generations still consider

buying a home as being part of the “American Dream”. A study

by Merrill Lynch

puts that doubt to rest. According to their research, every living generation

still believes that owning a home is in fact important. Here are the

numbers:

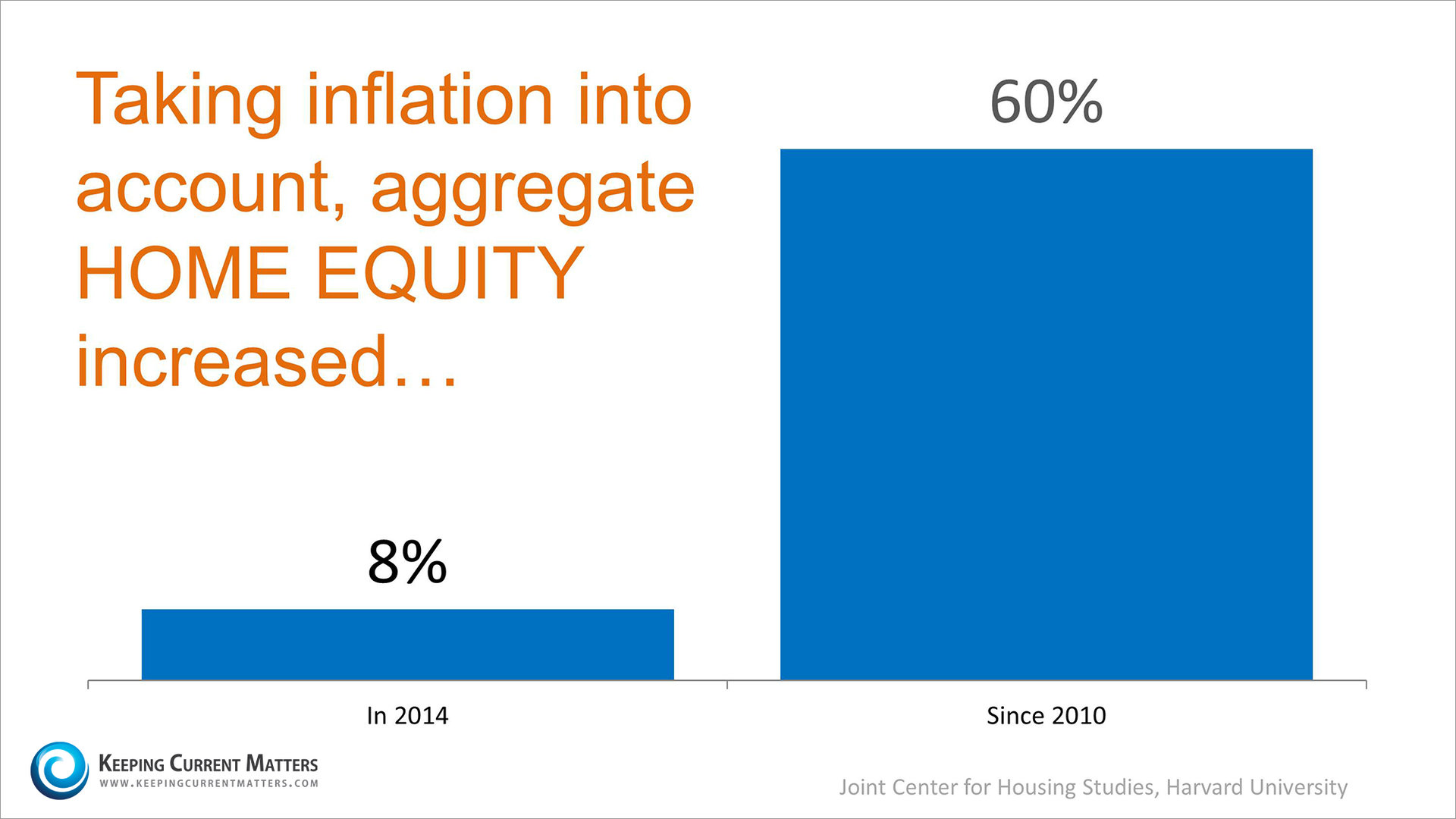

This should not surprise us

as many studies have revealed the benefits enjoyed by the families who own

their own home. One such study

was done by the Joint

Center of Housing Studies at Harvard University that addressed a

major financial benefit to owning your own home: forced savings. The report explains: This should not surprise us

as many studies have revealed the benefits enjoyed by the families who own

their own home. One such study

was done by the Joint

Center of Housing Studies at Harvard University that addressed a

major financial benefit to owning your own home: forced savings. The report explains:

“Since many people have trouble saving and

have to make a housing payment one way or the other, owning a home can

overcome people’s tendency to defer savings to another day.”

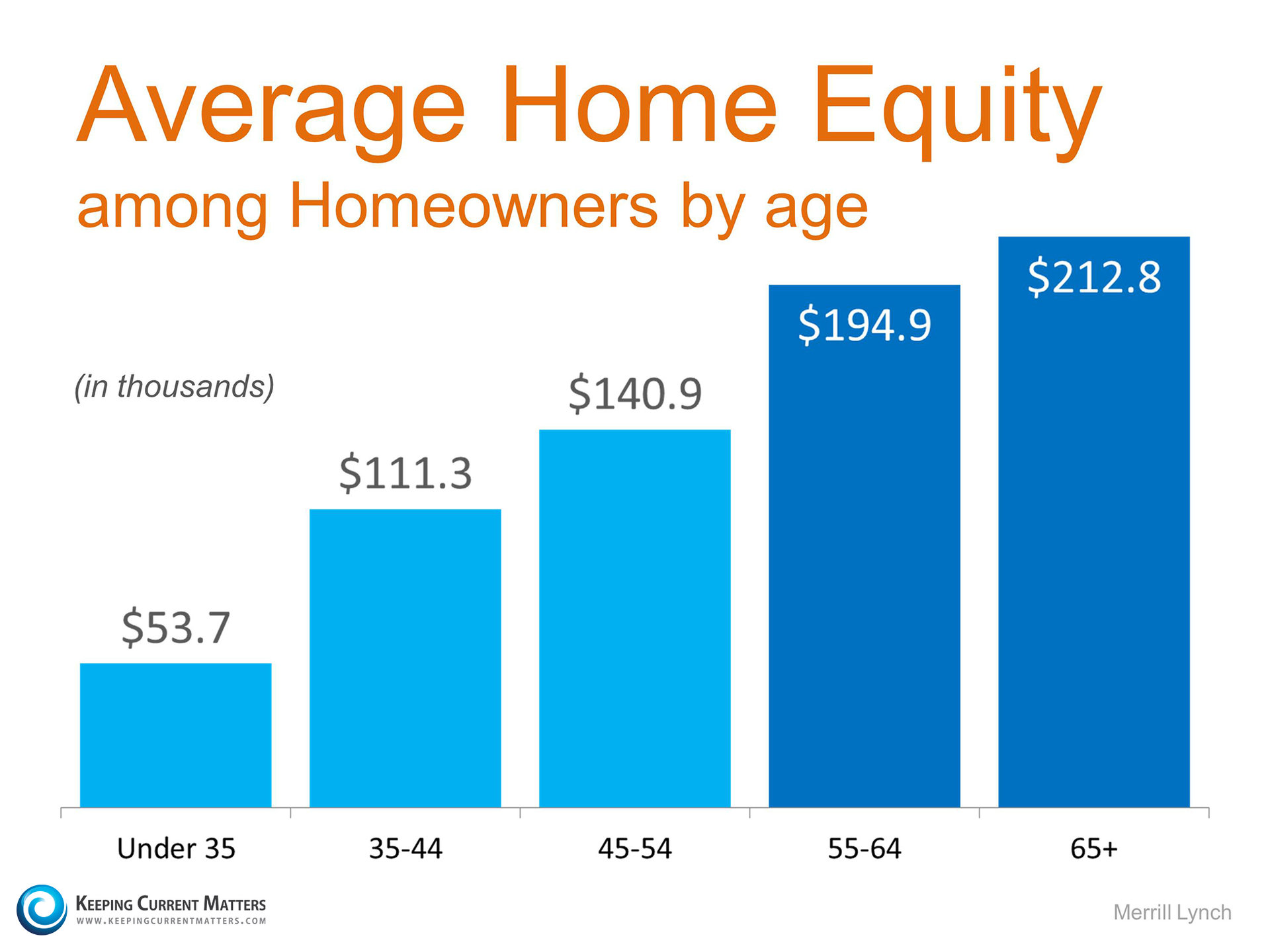

The Merrill

Lynch study proves this point with the following data on home

equity (a form of savings):

Bottom Line

There are many reasons that owning a home

makes sense. The financial reasons are powerful. As one participant in the Merrill Lynch study put

it:

“When I was younger, I always worried about

that monthly mortgage payment. Now that I am retired, I have the peace of

mind of knowing I own my home free and clear.”

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Saturday, November 14, 2015

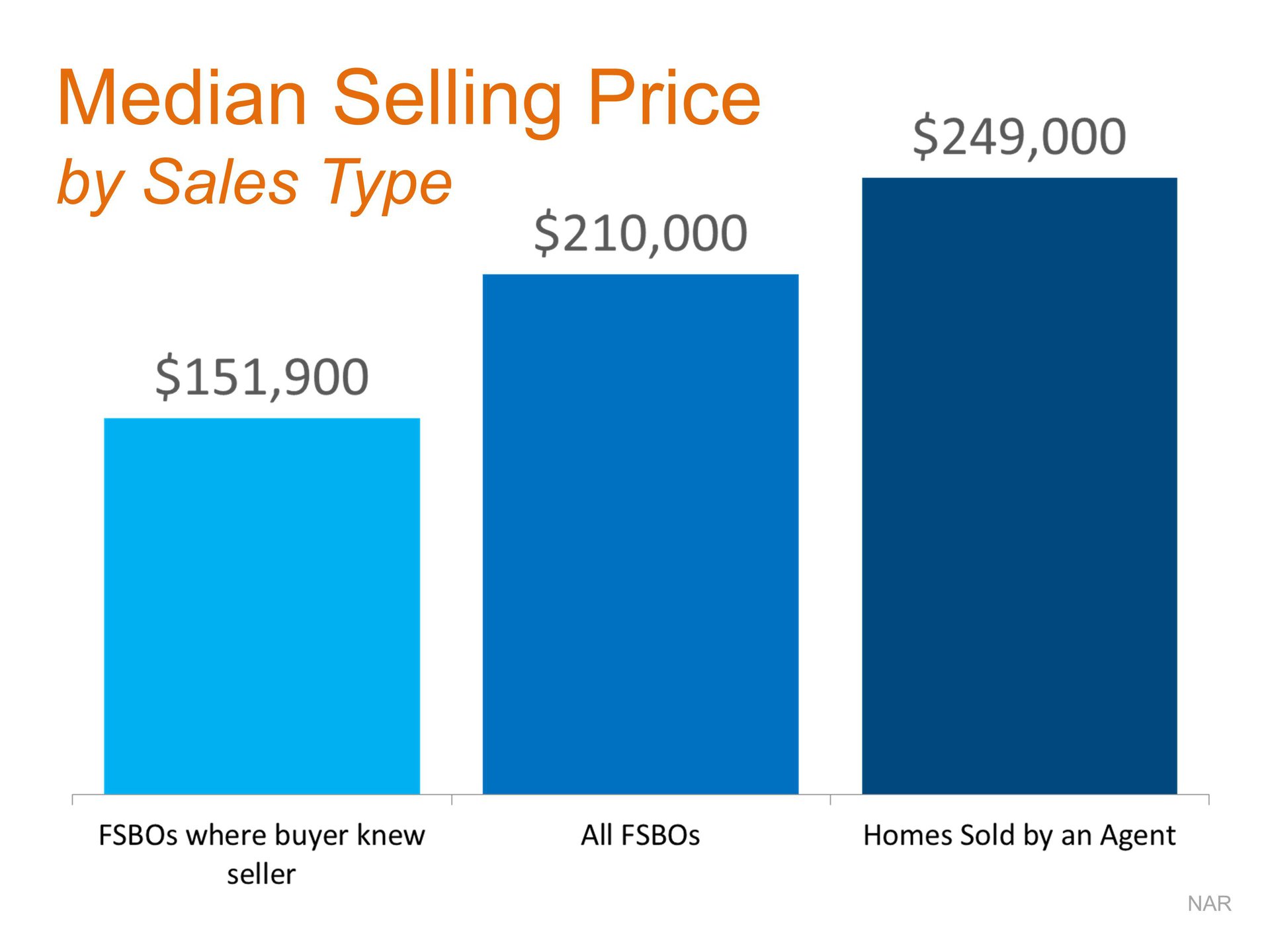

Why You Should Hire A Professional When Buying A Home!

Many people wonder whether they should hire

a real estate professional to assist them in buying their dream home or if

they should first try to go it on their own. In today’s market: you need an

experienced professional!

|

Friday, November 13, 2015

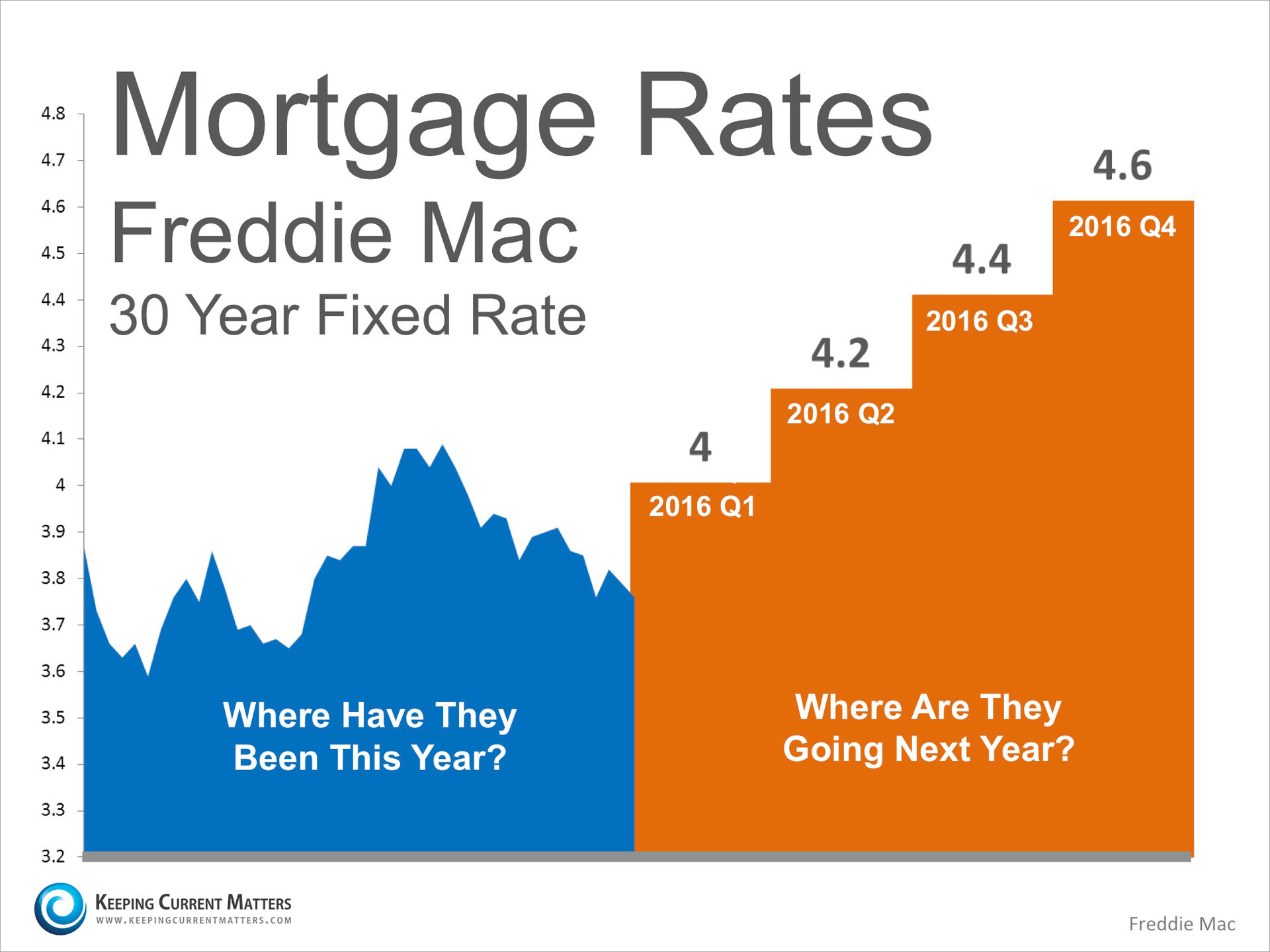

Where Are Mortgage Rates Headed? This Winter? Next Year?

The interest rate you pay on your

home mortgage has a direct impact on your monthly payment. The higher the

rate the greater the payment will be. That is why it is important to look at

where rates are headed when deciding to buy now or wait until next year.

Below is a chart created using Freddie

Mac’s October 2015 U.S.

Economic & Housing Marketing Outlook. As you

can see interest rates are projected to increase steadily over the course of

the next 12 months.

How Will This Impact

Your Mortgage Payment?

Depending on the amount of the loan that you

secure, a half of a percent (.5%) increase in interest rate can increase your

monthly mortgage payment significantly. According to CoreLogic’s latest Home Price

Index, national home prices have appreciated 6.4%

from this time last year and are predicted to be 4.7% higher next year. If

both the predictions of home price and interest rate increases become

reality, families would wind up paying considerably more for their next home.

Bottom Line

Even a small increase in interest rate can

impact your family’s wealth. Meet with a local real estate professional to

evaluate your ability to purchase your dream home.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Saturday, November 7, 2015

Waiting Until After the Holidays, Isn’t a Smart Decision

Every year at this time, many homeowners

decide to wait until after the holidays to put their home on the market for

the first time. Others who already have their home on the market decide to

take it off the market until after the holidays. Here are six great reasons

not to wait: 1.

Relocation buyers are out there. Companies are not concerned with holiday time

and if the buyers have kids, they want them to get into school after the

holidays. 2.

Purchasers that are looking for a home during the holidays are serious buyers

and are ready to buy. 3.

You can restrict the showings on your home to the times you want it shown.

You will remain in control. 4.

Homes show better when decorated for the holidays. 5. There is less

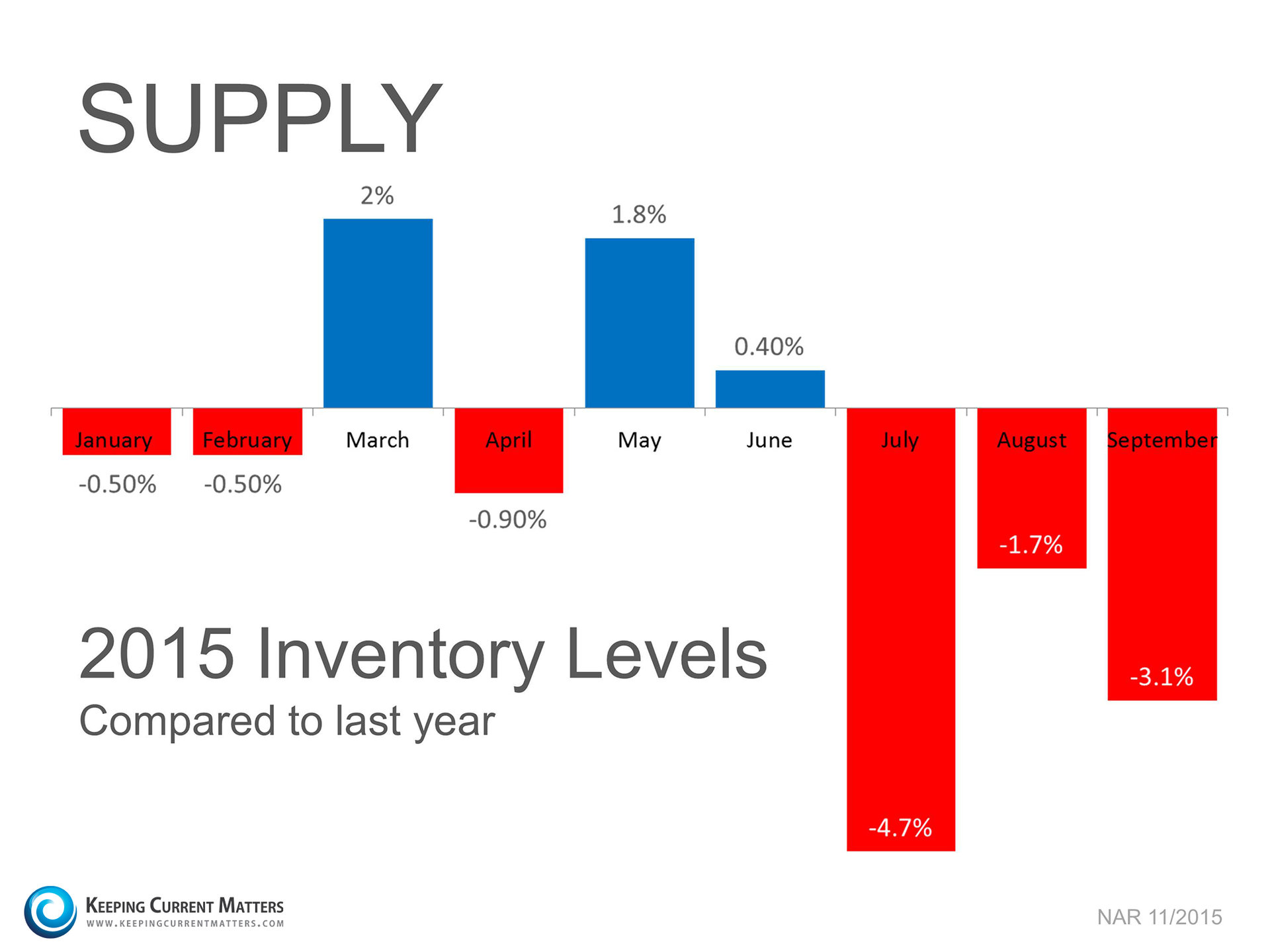

competition for you as a seller right now. Let’s take a look at listing

inventory as compared to the same time last year:

6. The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will make a comeback in 2016. This will lessen the demand for your house.

Bottom Line

Waiting until after the holidays to sell

your home probably doesn't make sense.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

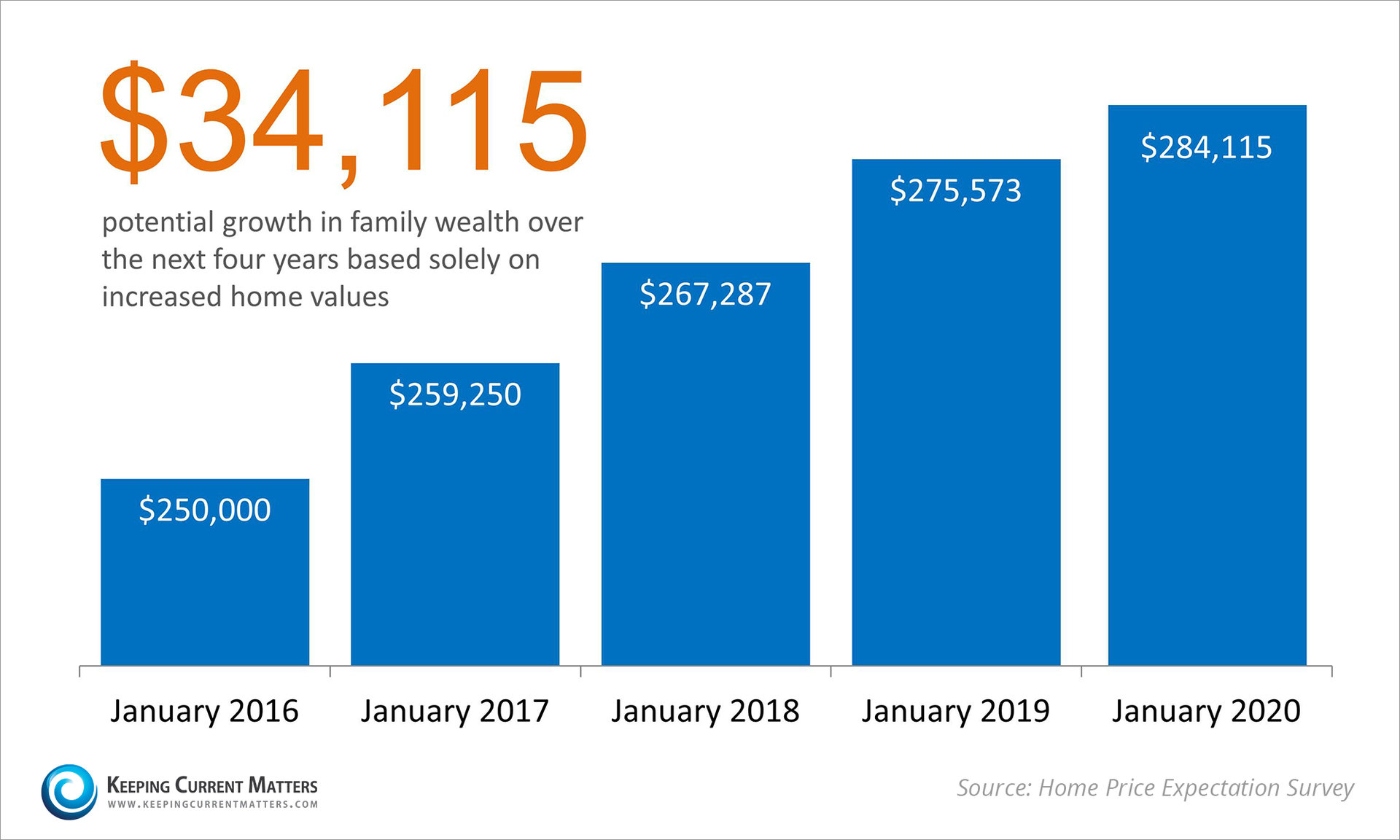

Sunday, November 1, 2015

Family Wealth Grows as Home Equity Builds

|

Subscribe to:

Posts (Atom)

![Slaying Myths About Buying A Home [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Slaying-Myths-KCm.jpg)

![Fannie Mae Housing Market [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Fannie-Mae-Housing-Market-KCM.jpg)