Some Highlights:

§ The Cost of Waiting

to Buy is defined as the additional funds it would take to buy a home if

prices & interest rates were to increase over a period of time.

§ Freddie Mac predicts

interest rates to rise to 4.8% by next year.

§ CoreLogic predicts

home prices to appreciate by 5.3% over the next 12 months.

§ If you are ready and

willing to buy your dream home, find out if you are able to!

Looking to Buy, Sell, or Invest? Contact:David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Saturday, January 30, 2016

Should I Buy Now Or Wait Until Next Year?

Thursday, January 28, 2016

A Million+ Boomerang Buyers about to Enter Market

TransUnion recently released

the results of a new study titled “The Bubble, the Burst and Now - What

Happened to the Consumer?” The study revealed that

1.5 million homeowners that were negatively impacted by the housing crisis

could re-enter the housing market in the next three years. TransUnion defined

“negatively impacted” as…

“…those who were 60+ days past due on a mortgage loan, lost

their mortgage through foreclosure, short sale or other non-satisfactory

closure, or had a mortgage loan modification between the Bubble and Burst.”

“…those who were 60+ days past due on a mortgage loan, lost

their mortgage through foreclosure, short sale or other non-satisfactory

closure, or had a mortgage loan modification between the Bubble and Burst.”

Other interesting findings in the study:

- During the mortgage

bubble in 2006, 78 million consumers, or 43% of credit-active consumers in the

U.S., had a mortgage

- More than 8% of these

consumers were “impacted”

- 5 Million consumers

will again be eligible for a mortgage in the next four years

Bottom Line

If you are a family that experienced the impact of the last

housing crisis, now may be the right time to again buy your own home.

David Demangos

858.232.8410

Locally Known, Globally Connected

Luxury Home Marketing Specialist

Global Property Specialist

David@AwesomeSanDiegoRealEstate.com

www.AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

Saturday, January 16, 2016

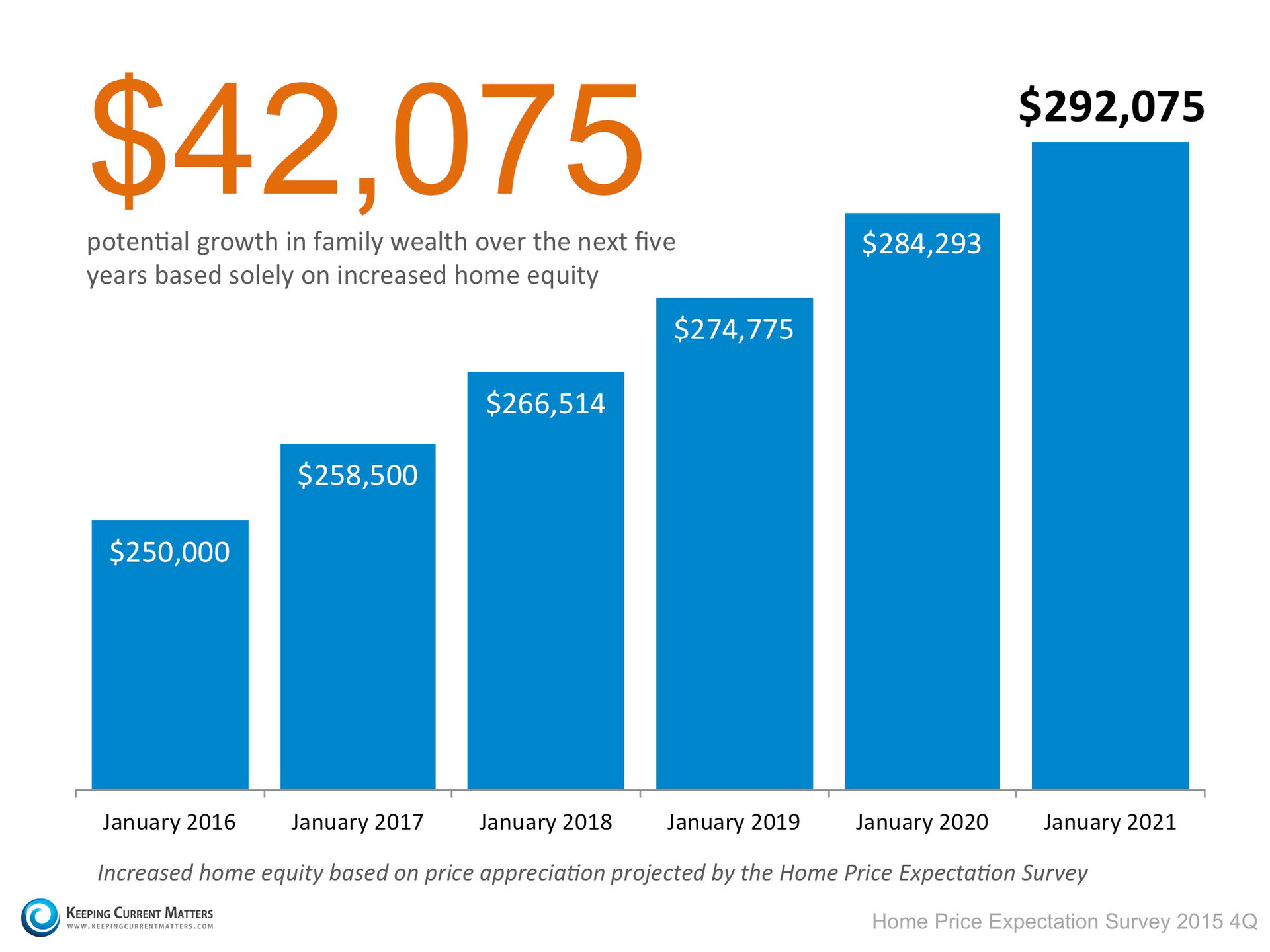

Building Family Wealth Over The Next 5 Years

As the economy continues to

improve, more and more Americans are seeing their personal financial

situations also improving. Instead of just getting by, many are now beginning

to save and find other ways to build their net worth. One way to dramatically

increase their family wealth is through the acquisition of real estate. For

example, let’s assume a young couple purchases and closes on a $250,000 home

in January. What will that home be worth five years down the road? Pulsenomics surveys a

nationwide panel of over one hundred economists, real estate experts and

investment & market strategists every quarter. They ask them to project

how residential prices will appreciate over the next five years. According to

their latest survey,

here is how much value that $250,000 house will gain in the coming years.

Over a five year period, that homeowner can build their home equity to over $40,000. And, in many cases, home equity is large portion of a family’s overall net worth.

Bottom Line

If you are looking to better your family’s

long-term financial situation, buying your dream home might be a great

option.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Friday, January 15, 2016

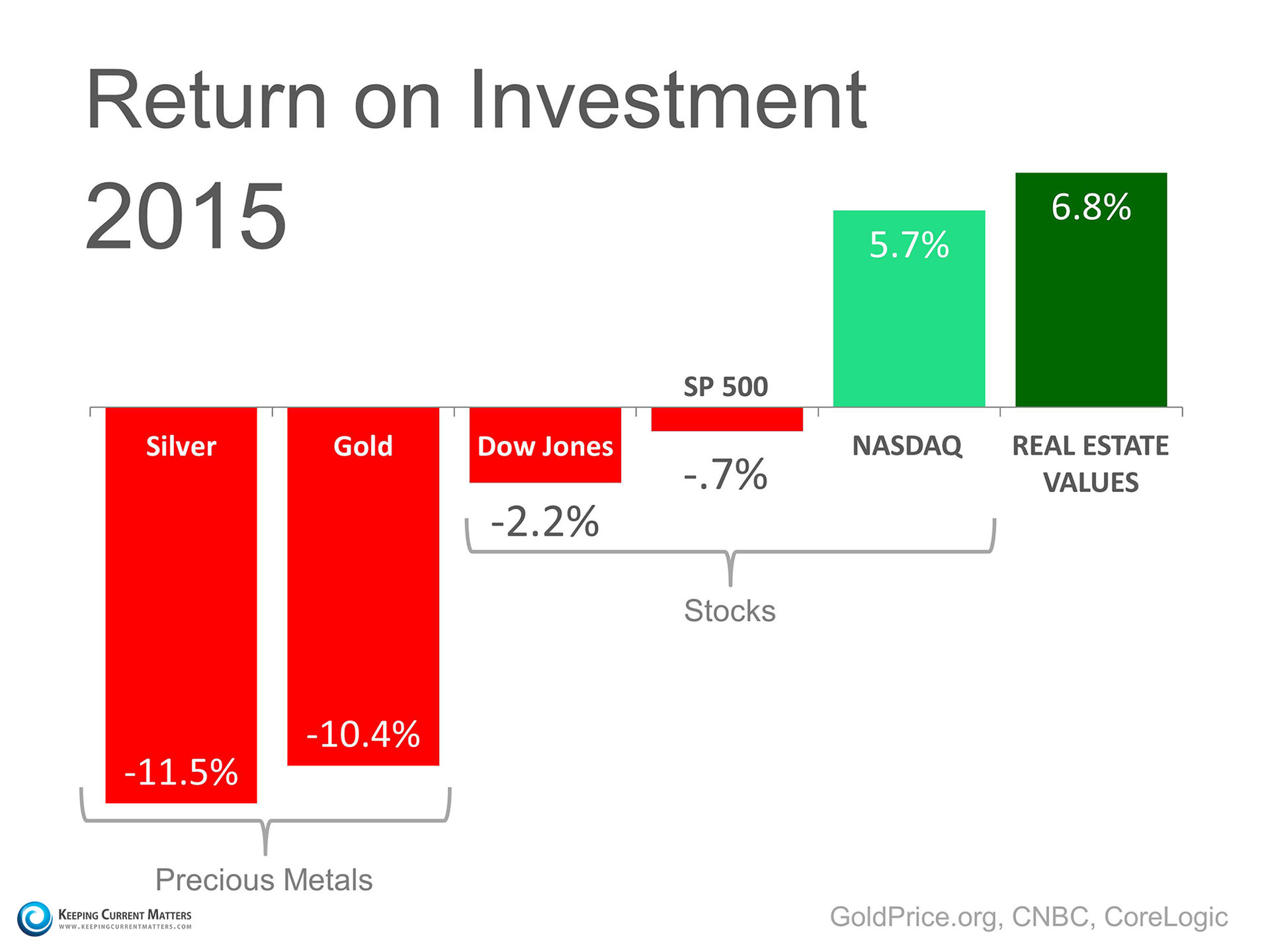

Real Estate Shines as an Investment in 2015

A survey by The Joint Center of Housing Studies

at Harvard University

reveals that when a family is buying a home they consider the financial

benefits of homeownership along with the social benefits. The survey mentions

things like:

- Paying rent does not

make sense

- Owning a home helps

you building family wealth.

- Buying a home is

investing in your retirement.

- Home equity gives

you something to borrow against.

So how did homeownership match up against

other investments in 2015? Here is a chart that compares its return on investment

against precious metals and the stock market last year.

Bottom Line

Not only did homeownership offer all its

social benefits. It also was a great investment financially.

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Saturday, January 2, 2016

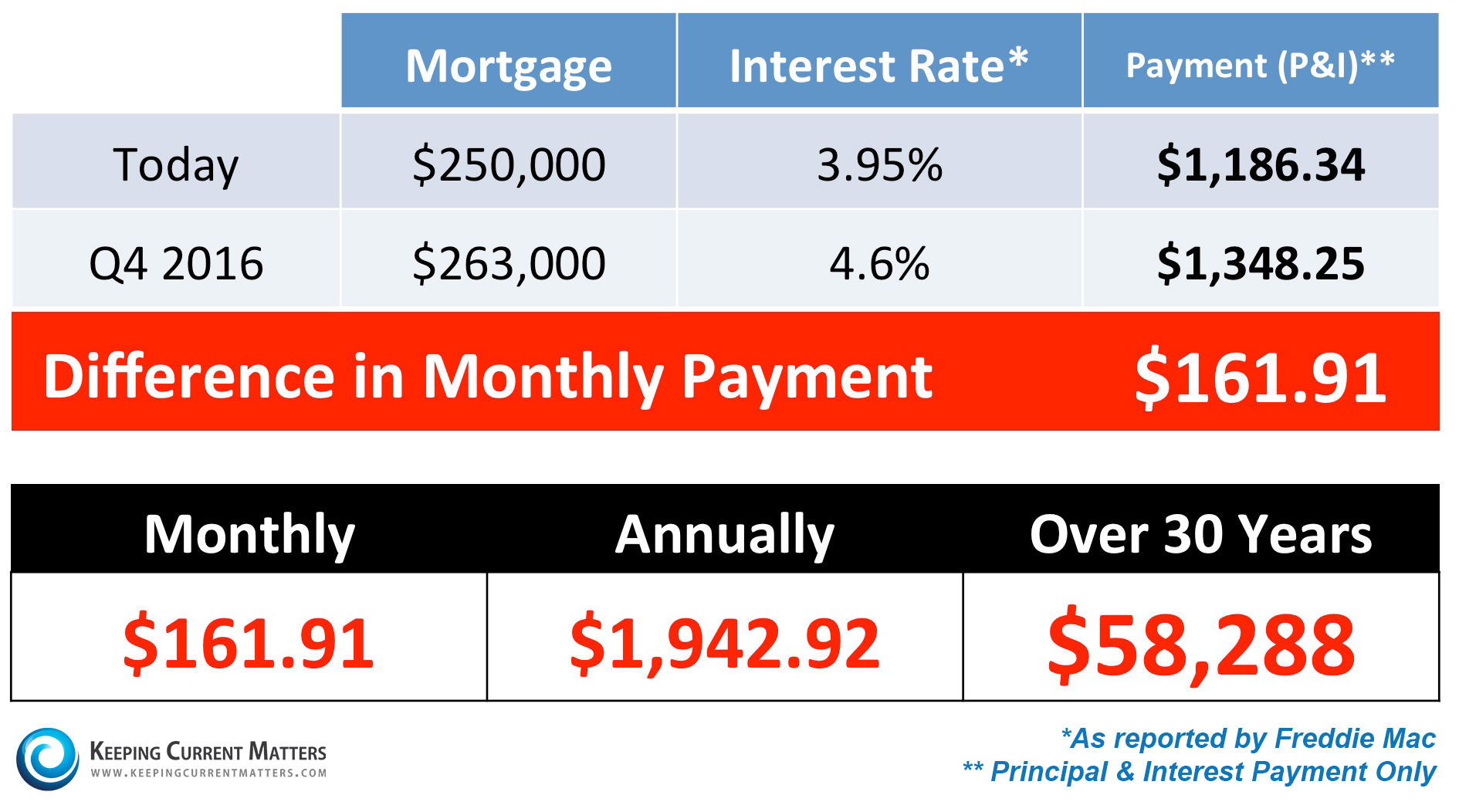

Buying A Home? Do You Know The Difference Between Cost & Price?

As a seller, you will be most

concerned about ‘short term price’ – where home values are headed over the

next six months. As a buyer, you must be concerned not about price but

instead about the ‘long term cost’ of the home. The Mortgage Bankers Association (MBA),

the National Association

of Realtors, Fannie

Mae and Freddie

Mac all projected that mortgage interest rates will increase by about three-quarters of a percentage

point over the next twelve months. According to CoreLogic’s most recent Home Price Index Report,

home prices will appreciate by 5.2% over the next 12 months. As a seller, you will be most

concerned about ‘short term price’ – where home values are headed over the

next six months. As a buyer, you must be concerned not about price but

instead about the ‘long term cost’ of the home. The Mortgage Bankers Association (MBA),

the National Association

of Realtors, Fannie

Mae and Freddie

Mac all projected that mortgage interest rates will increase by about three-quarters of a percentage

point over the next twelve months. According to CoreLogic’s most recent Home Price Index Report,

home prices will appreciate by 5.2% over the next 12 months.

What Does This Mean

as a Buyer?

Here is a simple demonstration of what

impact an interest rate increase would have on the mortgage payment of a home

selling for approximately $250,000 today if home prices appreciate by the

5.2% predicted by CoreLogic

over the next twelve

months:

David Demangos 858.232.8410 Locally Known, Globally Connected Luxury Home Marketing Specialist Global Property Specialist David@AwesomeSanDiegoRealEstate.com www.AwesomeSanDiegoRealEstate.com Our Team Goes to Extremes to Fulfill Your Real Estate Dreams! |

Subscribe to:

Posts (Atom)

![Should I Buy Now Or Wait Until Next Year? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2016/01/Cost-of-Waiting-KCM.jpg)