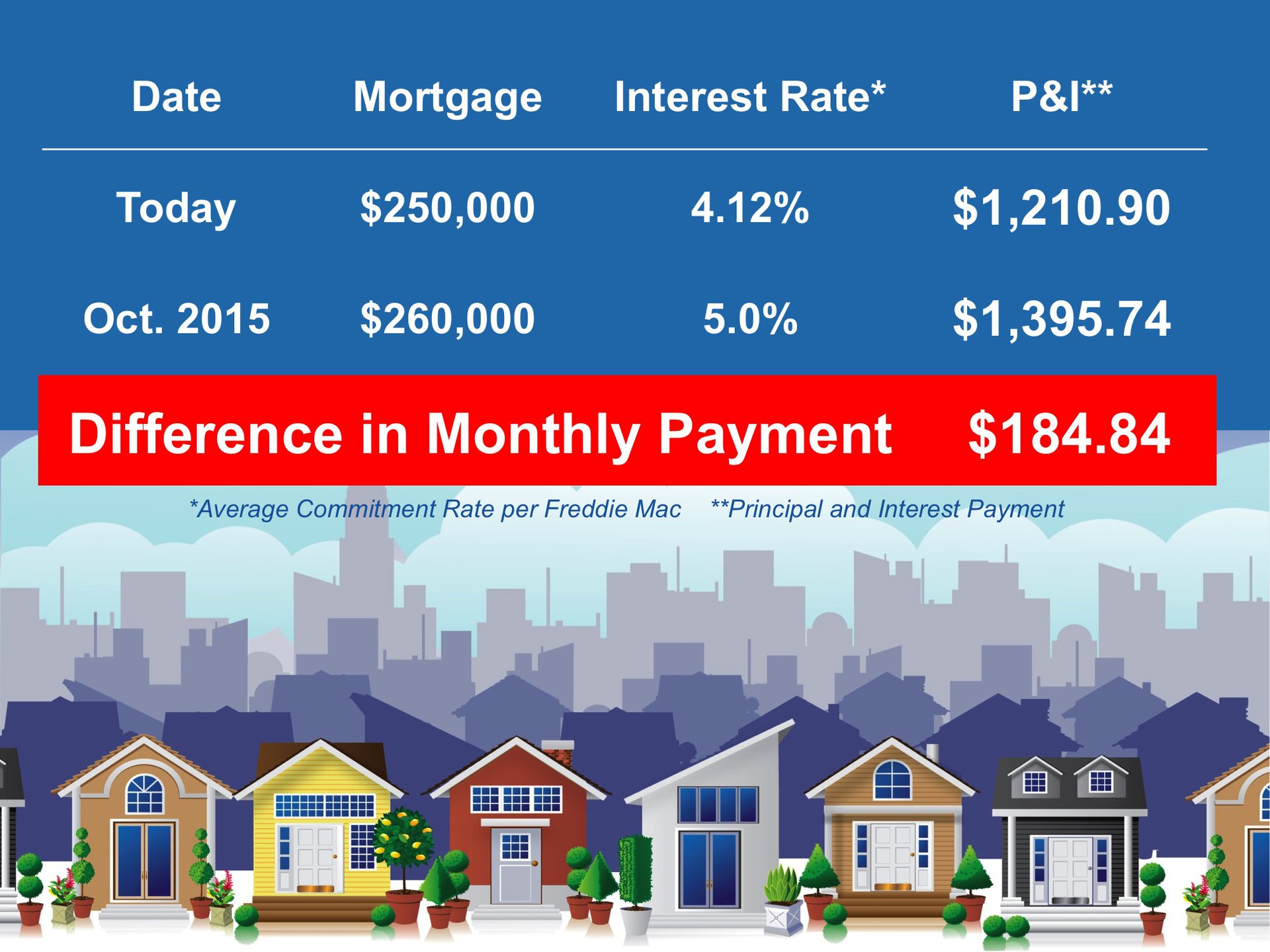

School is back in session, the holidays are right around the corner, you might not think that now is the best time to sell your house. But with inventory below historic numbers and demand still strong, you could be missing out on a great opportunity for your family.

1. Demand is Strong

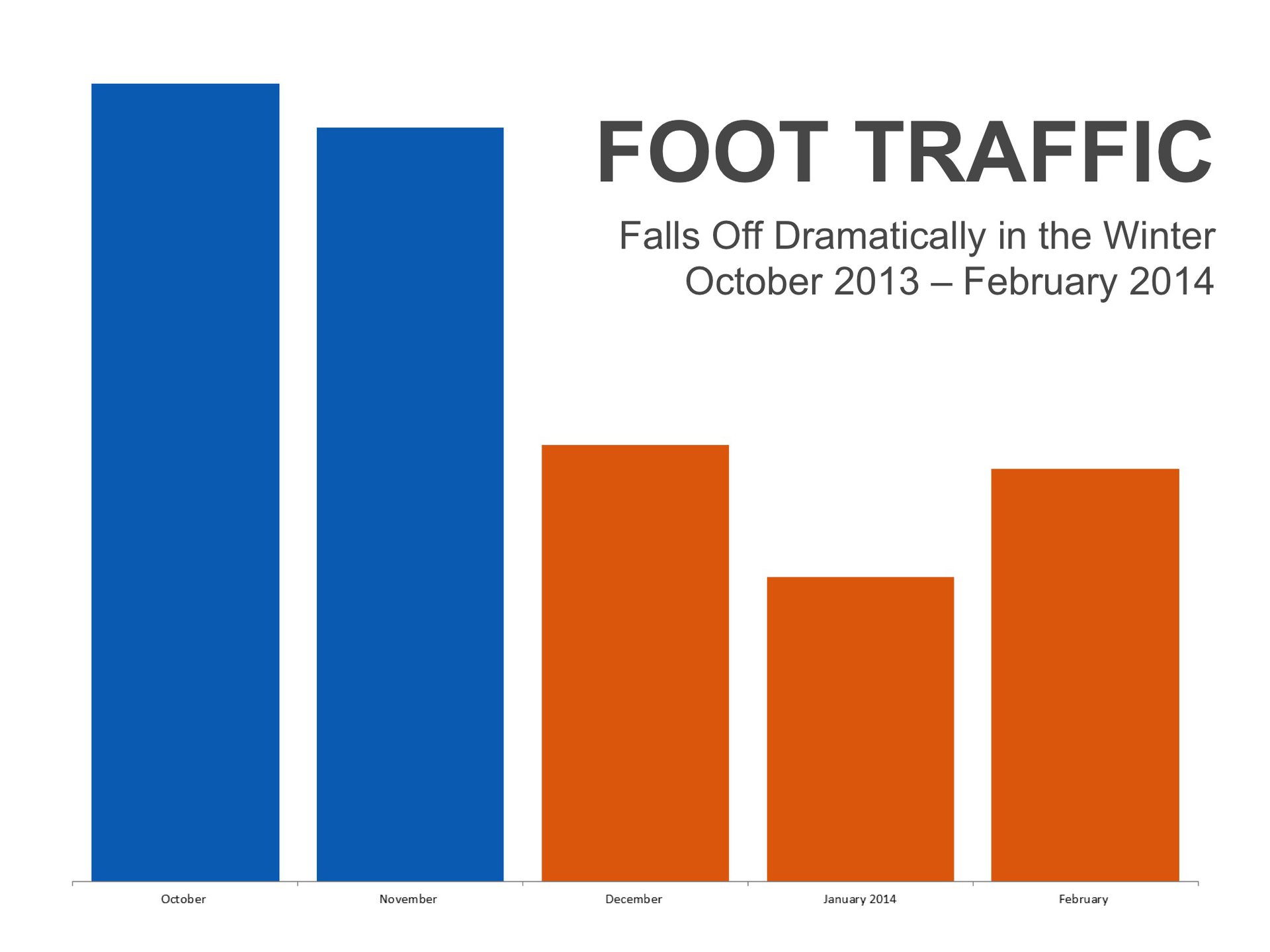

Foot traffic refers to the number of people out actually physically looking at home right now. The latest foot traffic numbers show that there are more prospective purchasers currently looking at homes than at any other time in the last twelve months which includes the latest spring buyers’ market. These buyers are ready, willing and able to buy…and are in the market right now!

2. There Is Less Competition Now

Housing supply is still under the historical number of 6 months’ supply. This means that, in many markets, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market.

There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market in the near future.

Also, new construction of single-family homes is again beginning to increase. A recent study by Harris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference).