According to new data released from ApartmentList.com, 49.5 million renters in the United States were cost-burdened in 2017, meaning they spent more than 30% of their monthly incomes on rent. This accounts for nearly half of all renter households in the country and is up 3.1 million from 2007.

When a household is cost-burdened by their monthly housing expense, they are not as easily able to save money for the future. This is a big factor for many renters who dream of owning their own homes someday.

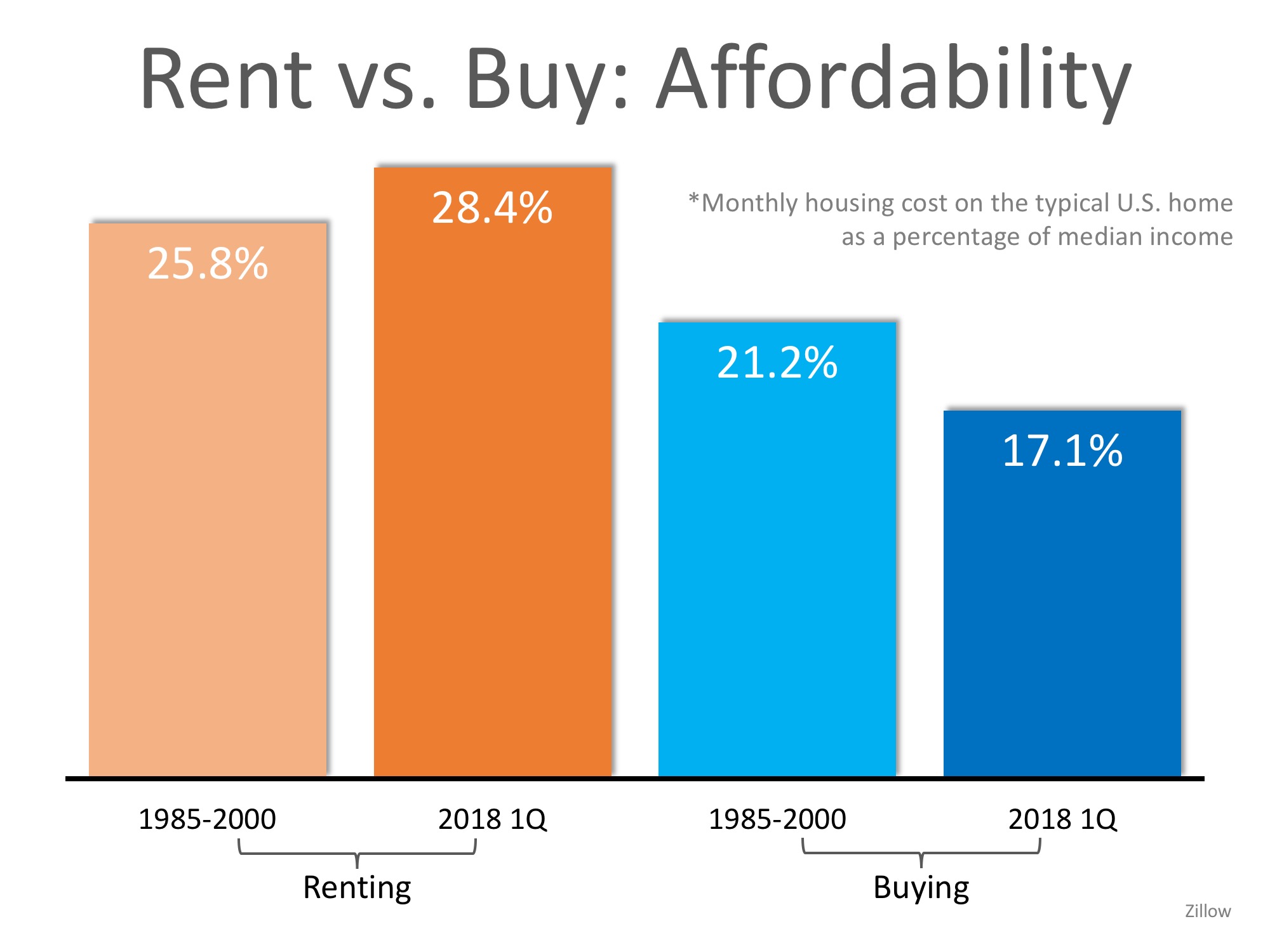

But there is hope for those who are able to save at least a 3% down payment! The percentage of income needed in the US to buy a home is significantly less than renting at 17.1%!

The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

Bottom Line

If you are one of the many renters who is spending too much of their monthly income on rent, consider saving money by getting a roommate, moving into a less expensive apartment, or even moving in with family. These are all ways to save for a down payment so that you can put your housing costs to work for you!

Looking to Buy, Sell, or Invest? Contact:

David Demangos - Keller Williams Realty

Cell: 858.232.8410 | Realtor® BRE# 01905183

www.AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016 & 2017 Recognition of Excellence Award Winner SDAR