Buyers have more options than they did a few years ago. It's worth tackling repairs now to ensure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

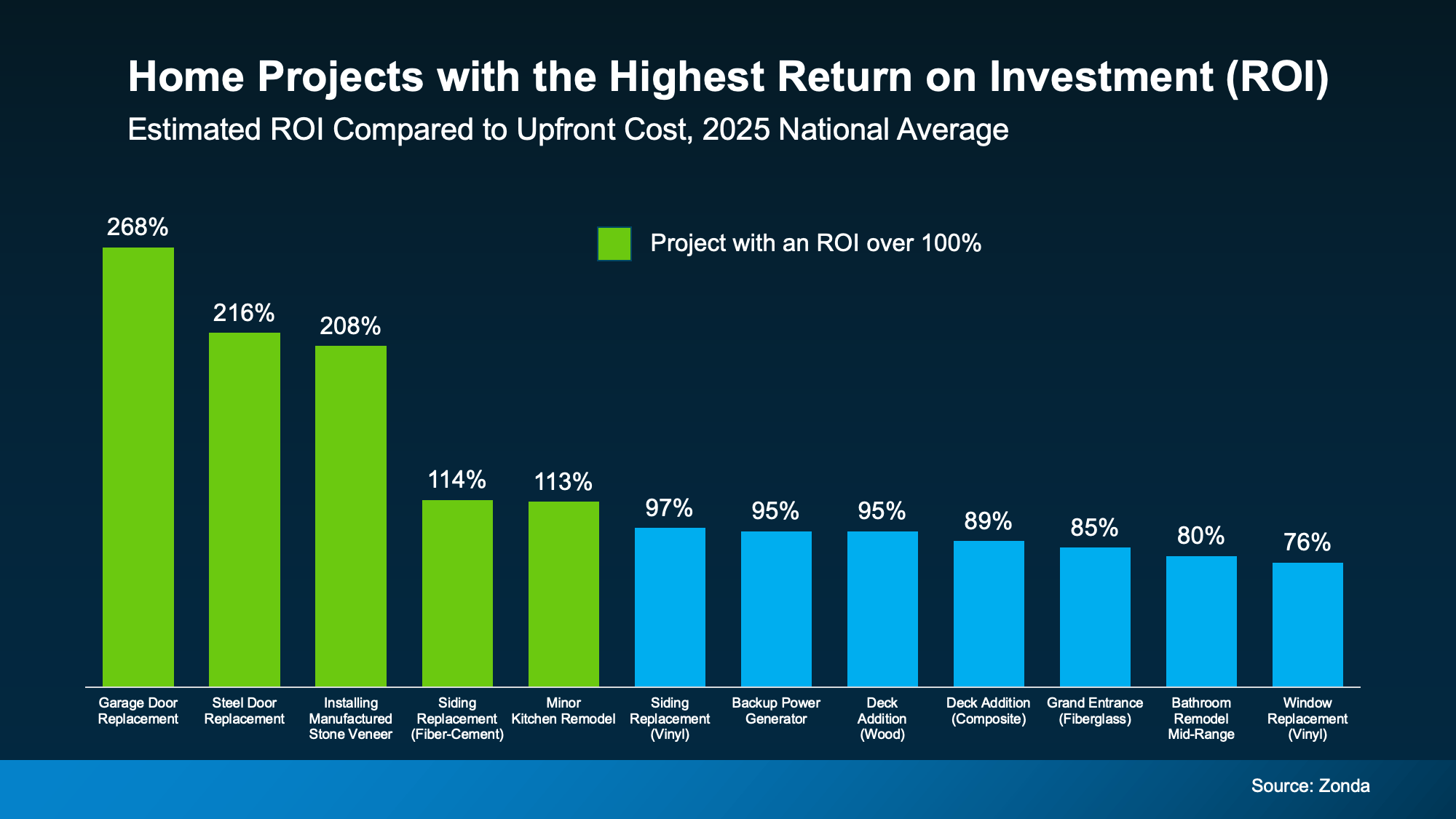

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Which Projects Tend to Pay Off?

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results are surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

Small Updates, Big Visual Impact

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to pay more for homes that are well cared for, updated, and move-in ready.

This Chart Is a Starting Point, Not a Strategy

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

What can you skip without hurting your sale?

Where will a small investment make the biggest difference?

Is it better to update, or sell as-is?

That guidance helps you avoid over-improving and under-preparing.

Bottom Line:

If you’re looking to sell your San Diego home this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, let’s talk through what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams