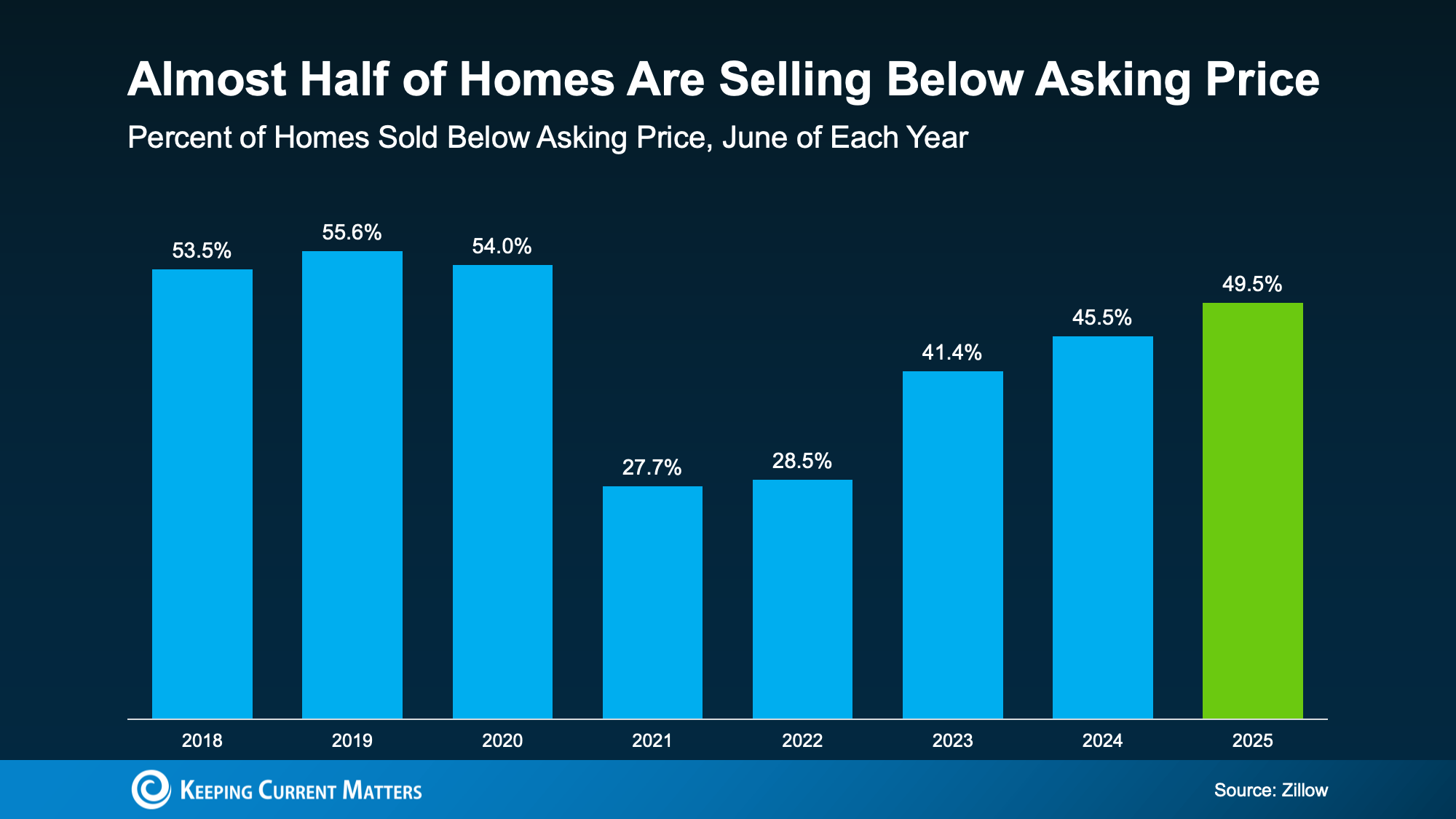

If people's selling strategy still assumes they’ll get multiple offers over asking, it’s officially time for a reset. That frenzied seller’s market is behind us. And here are the numbers to prove it.

From Frenzy to “Normal”

Right now, about 50% of homes on the market are selling for less than their asking price, according to the latest data from Cotality.

But that isn’t necessarily bad news, even if it feels like it. Here’s why. The wild run-up over the last few years was never going to be sustainable. The housing market needed a reset, and data shows that’s exactly what’s happening right now.

The graph below uses data from Zillow to show how this trend has shifted over time. Here’s what it tells us:

- 2018–2019: 50–55% of homes sold under asking. That was the norm.

- 2021–2022: Only 25% sold under asking, thanks to record-low rates and intense buyer demand.

- 2025: 50% of homes are selling below asking. That’s much closer to what’s typical in the housing market.

Why This Matters If You’re Selling Your House

Why This Matters If You’re Selling Your House

In this return to normal, your pricing strategy is more important than ever.

A few years ago, you could overprice your house and still get swarmed with offers. But now, buyers have more options, tighter budgets, and less urgency.

Today, your asking price can be make or break for your sale, especially right out of the gate. Your first two weeks on the market are the most important window because that’s when the most serious buyers are paying attention to your listing. Miss your price during that crucial period, and your sale will grind to a halt. Buyers will look right past it. And once your listing sits long enough to go stale, it’ll be hard to sell for your asking price.

The Ideal Formula

Basically, sellers who cling to outdated expectations end up dealing with price cuts, lower offers, and a longer time just sitting on the market. But homeowners who understand what’s happening are still winning, even today.

Because that stat about 50% of homes selling for under asking also means the other half are selling at or above – as long as they’re priced right from the start.

So, how do you set yourself up for success? Do these 3 things:

- Prep your house. Tackle essential repairs and touch-ups before you list. If your house looks great, you’ll have a better chance to sell at (or over) your asking price.

- Price strategically from day one. Don’t rely on what nearby homes are listed for. Lean on your agent for what they’ve actually sold for. And price your house based on that.

- Stay flexible. Be ready to negotiate. And know that it doesn’t always have to be on price. It may be on repairs, closing costs, or some other detail. But know this: today’s serious buyers expect some give-and-take.

If you want your house to be one that sells for at (or even more than) your asking price, it’s time to plan for the market you’re in today – not the one we saw a few years ago. And that’s exactly why you need a stand-out local agent.

Bottom Line

You don’t want to fall behind in this market.

So, talk to an agent about what buyers in your area are paying right now. With their expertise and a strategy that gets your house noticed in those crucial first two weeks, anything is possible.

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams