While the pandemic continues, Americans are re-evaluating their homes, floorplans, locations, needs, and more. Some need more space, while others need less. Whether you’re renting or own your home, if remote work is part of your future, you may be thinking about moving, especially while today’s mortgage rates are so low.

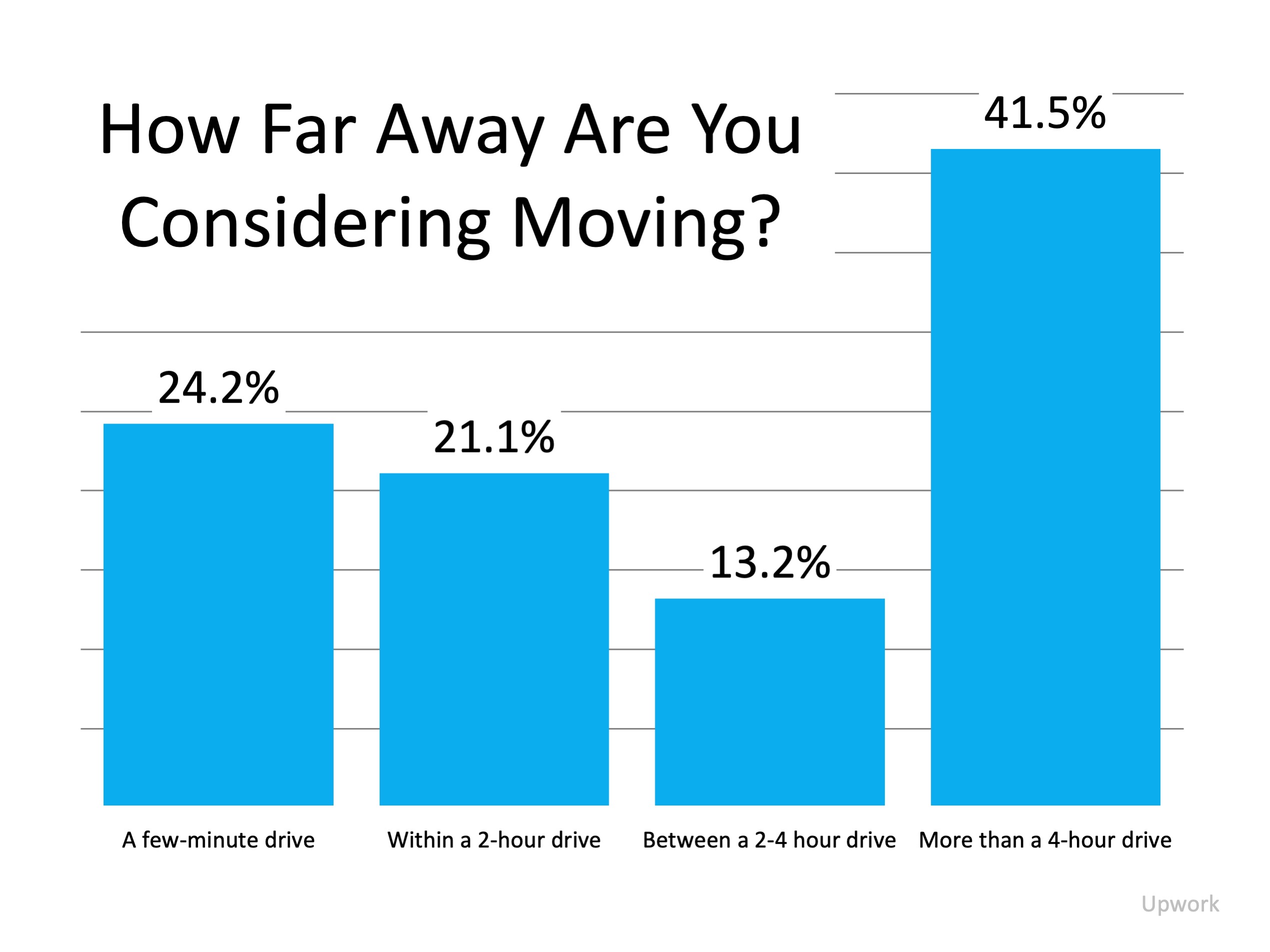

A recent study from Upwork notes:

“Anywhere from 14 to 23 million Americans are planning to move as a result of remote work.”

To put this into perspective, last year, 6 million homes were sold in the U.S. This means roughly 2 – 4X as many people are considering moving now, and there’s a direct connection to their ability to work from home.

The same study also notes while 45.3% of people are planning to stay within a 2-hour drive from their current location, 41.5% of the people who are citing working from home as their primary reason for making a move are willing to look for a home more than 4 hours away from where they live now (See graph below):

“People are seeking less expensive housing: Altogether, more than half (52.5%) are planning to move to a house that is significantly more affordable than their current home.”

Whether you can eliminate your daily commute to the office, or you simply need more space to work from home, your plans may be changing. If that’s the case, it’s time to connect with a local real estate professional to assess your evolving needs and determine your path together.

Bottom Line

This has been a year of change, and what you need in a home is no exception. Let’s connect today to make sure you have expert guidance on your side to help you find a home that fits your remote work needs.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,& 2019 Recognition of Excellence Award Winner SDAR