In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment myth could open the path to homeownership for many more.”

Myth #1: “I Need a 20% Down Payment”

“Americans still overestimate the qualifications needed to get a mortgage, resulting in qualified potential buyers not even considering homeownership. Indeed, the Urban Institute report revealed that 16 percent of consumers believed that the minimum down payment required by lenders is 20 percent or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

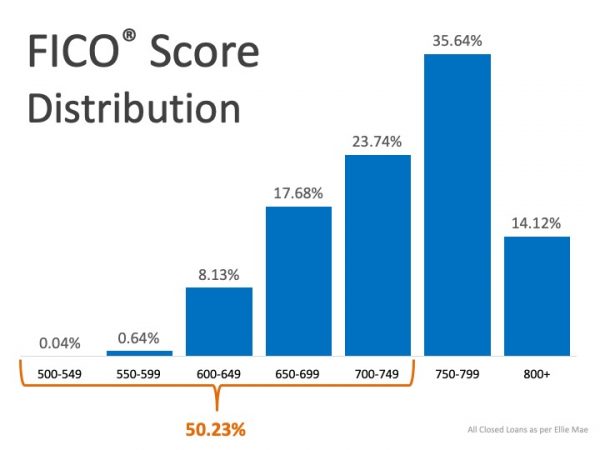

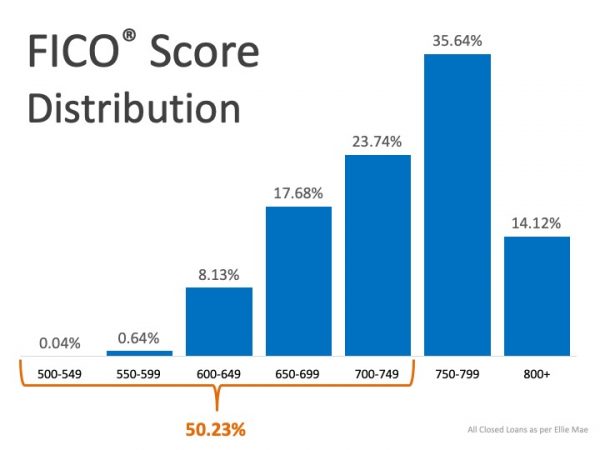

Myth #2: “I Need a 780 FICO® Score or Higher”

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Looking to Buy, Sell, or Invest? Contact:

David Demangos - Keller Williams Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017 & 2018 Recognition of Excellence Award Winner SDAR