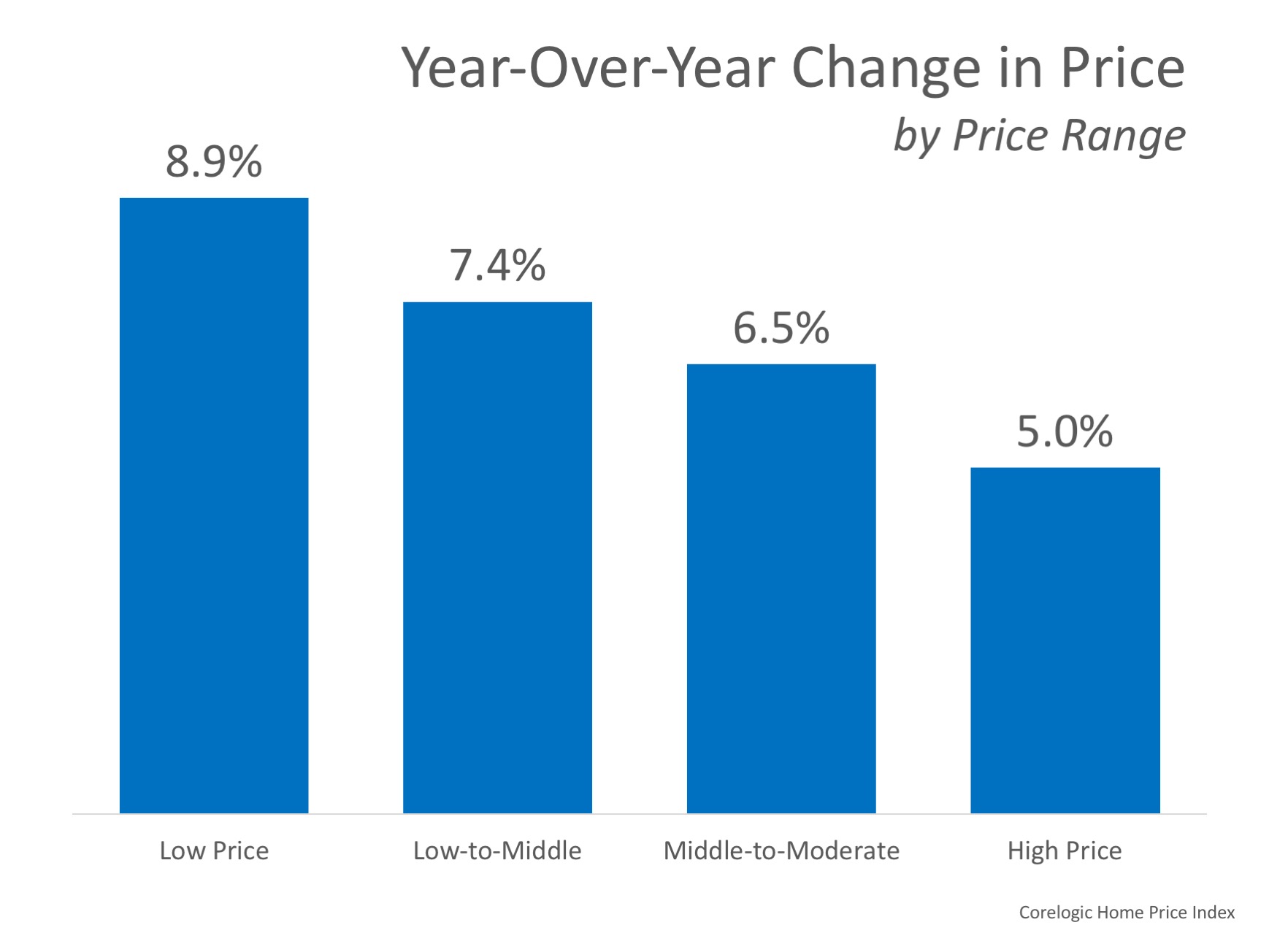

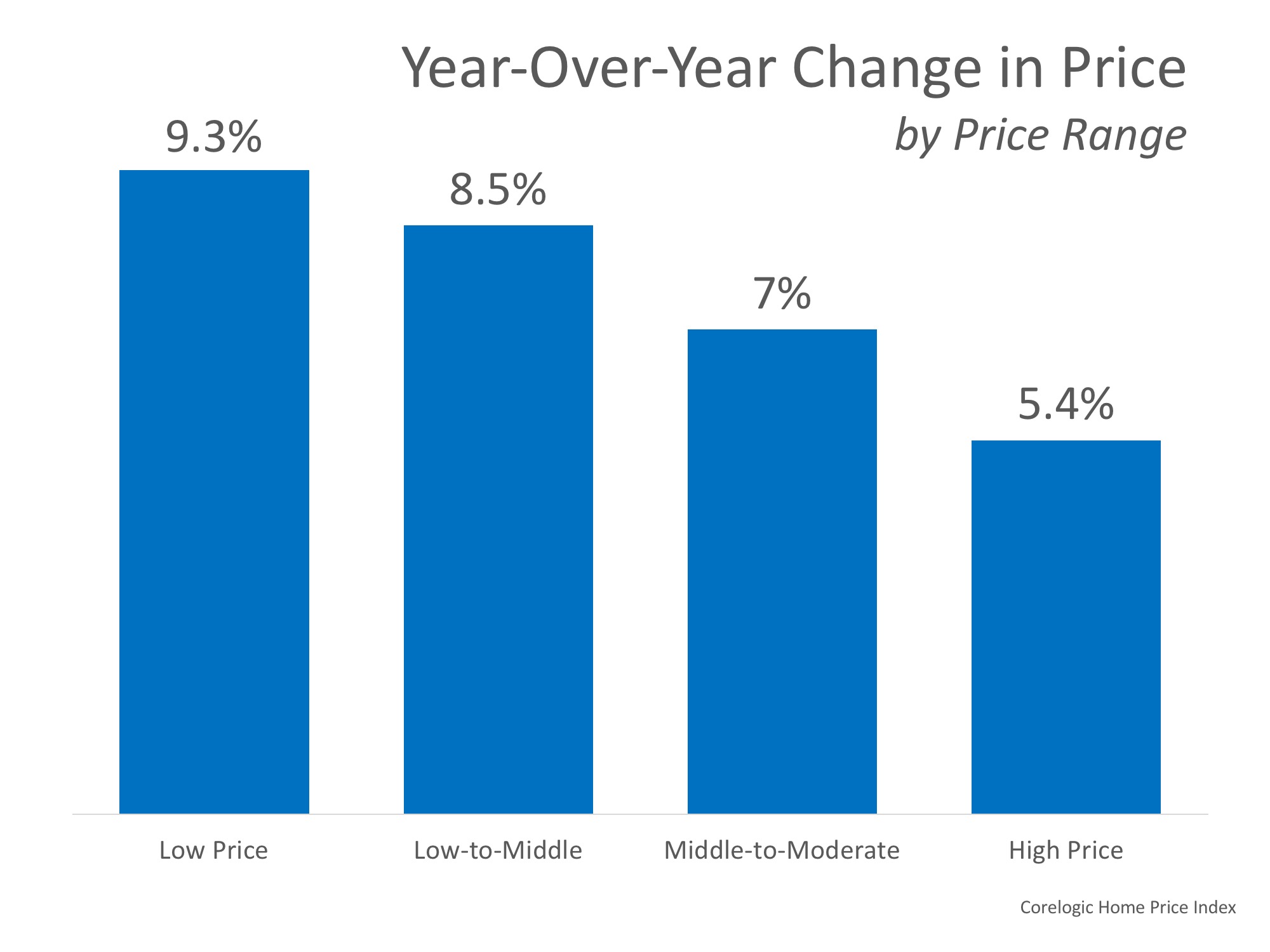

Due to the undersupply of homes on the market today, there’s upward pressure on prices. Consider simple economics: when there is high demand for an item and a low supply of it, consumers are willing to pay more for that item. That’s what’s happening in today’s real estate market. The housing supply shortage is also resulting in bidding wars, which will also drive price points higher in the home sale process.

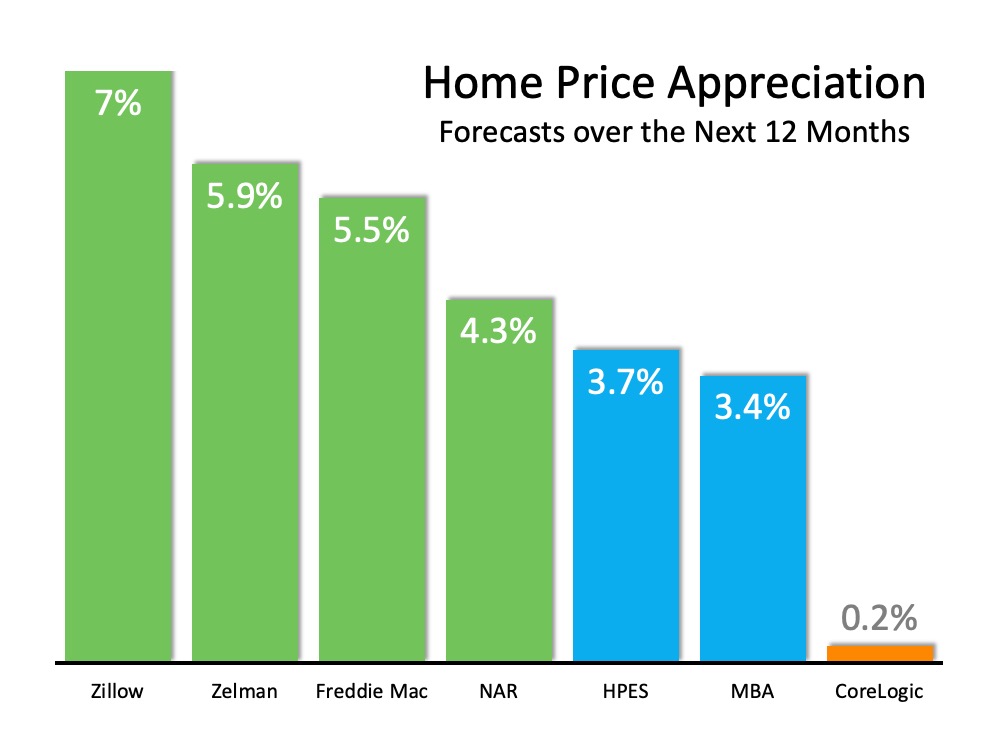

There’s no evidence that buyer demand will wane. As a result, experts project price appreciation will continue over the next twelve months. Here’s a graph of the major forecasts

released in the last 60 days

I hear many foreclosures might be coming to the market soon. Won’t that drive prices down?

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it’s clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

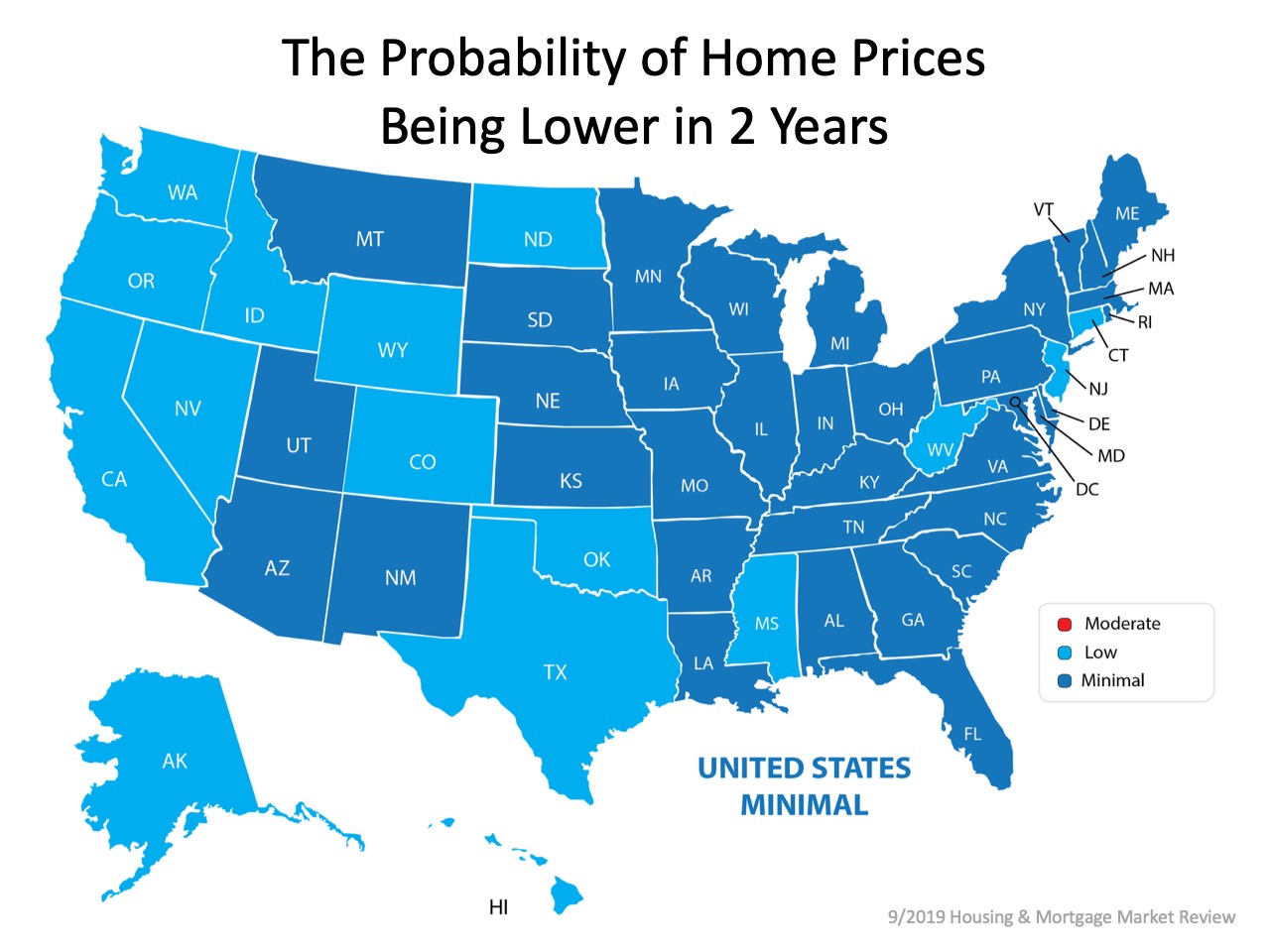

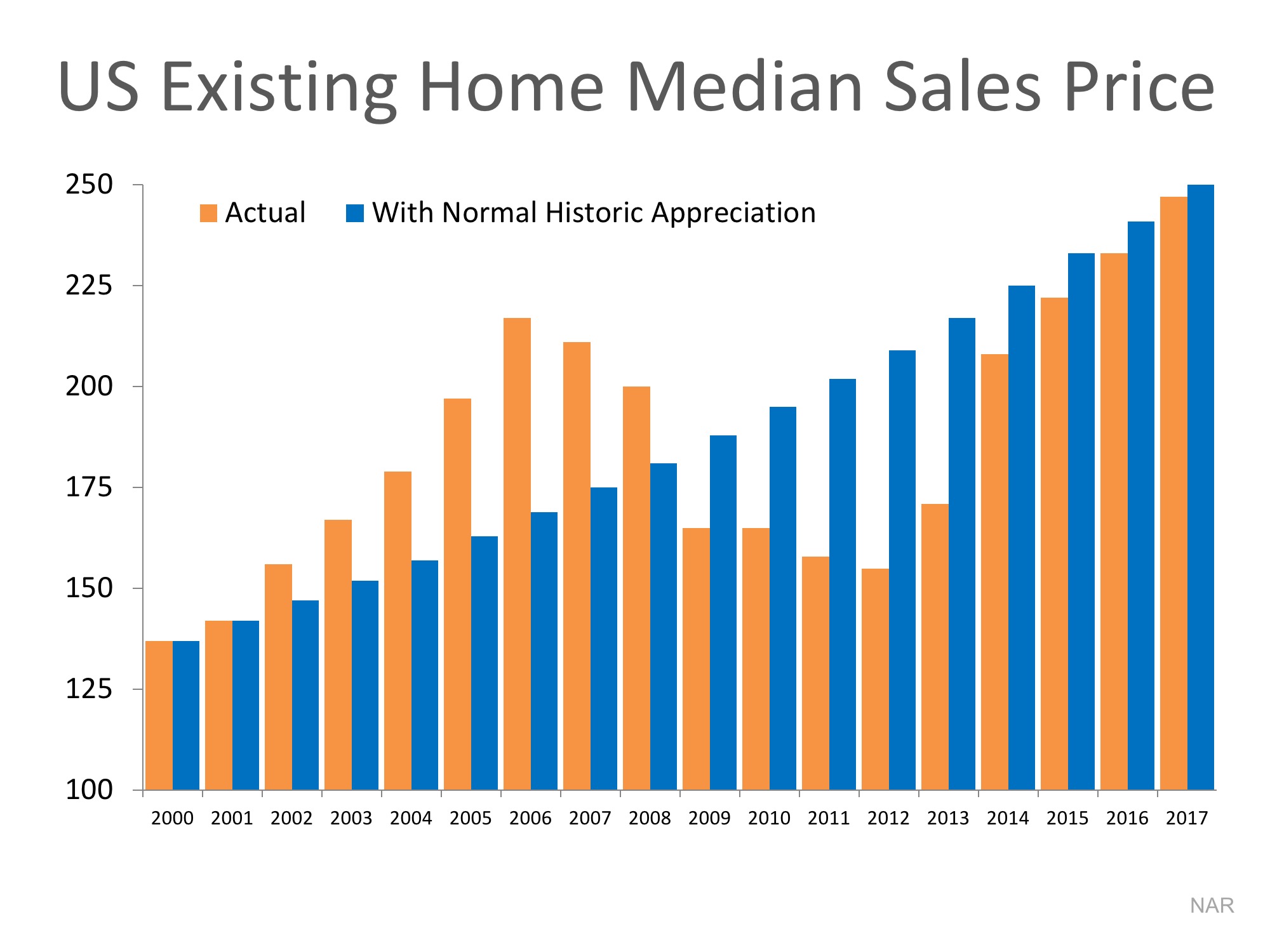

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it’s clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Bottom Line

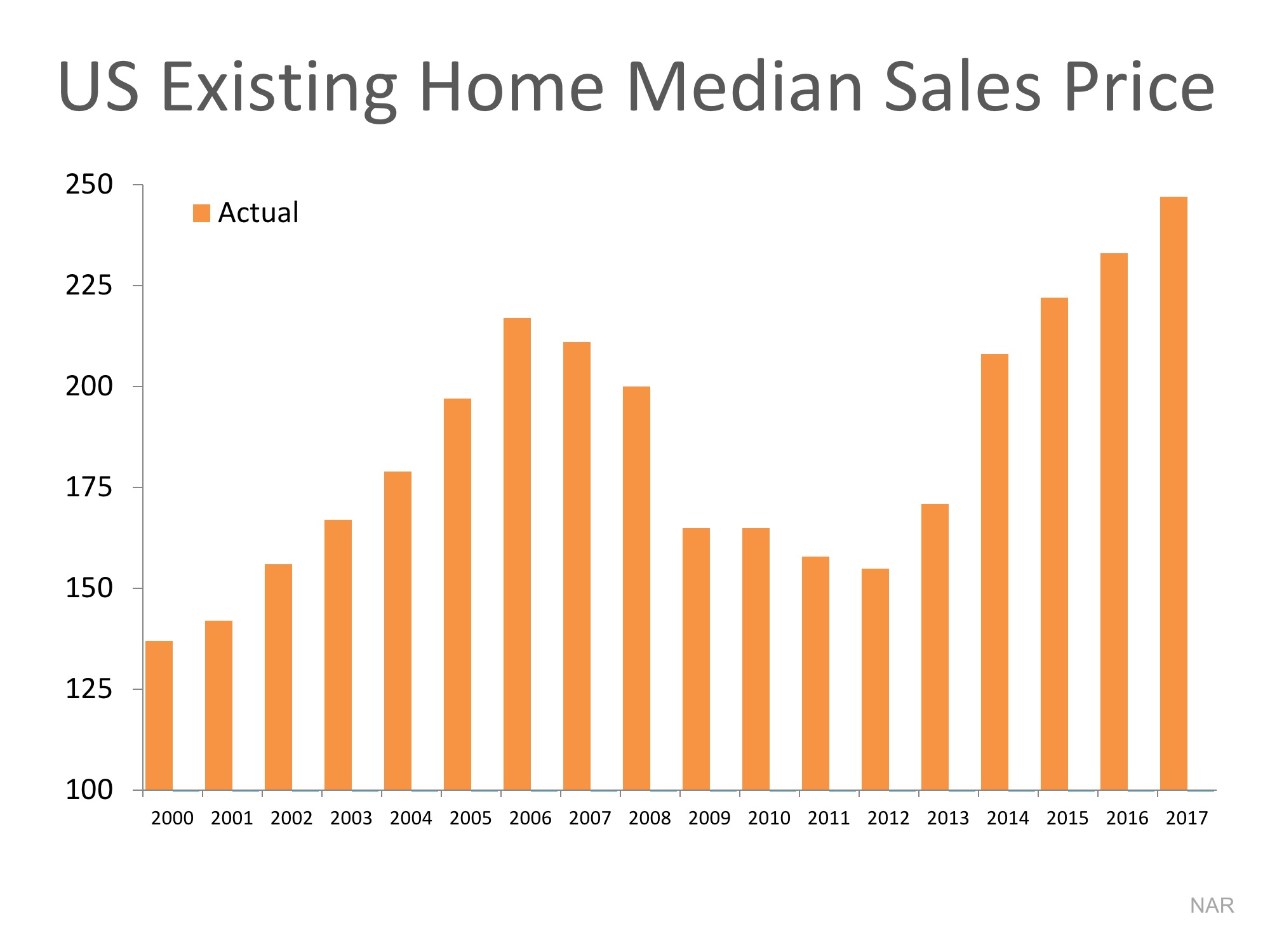

Originally, many thought home prices would depreciate in 2020 due to the economic slowdown from the coronavirus. Instead, prices appreciated substantially. Over the next year, we will likely see home values rise even higher given the continued lack of inventory of homes for sale.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,& 2019 Recognition of Excellence Award Winner SDAR