Some Highlights

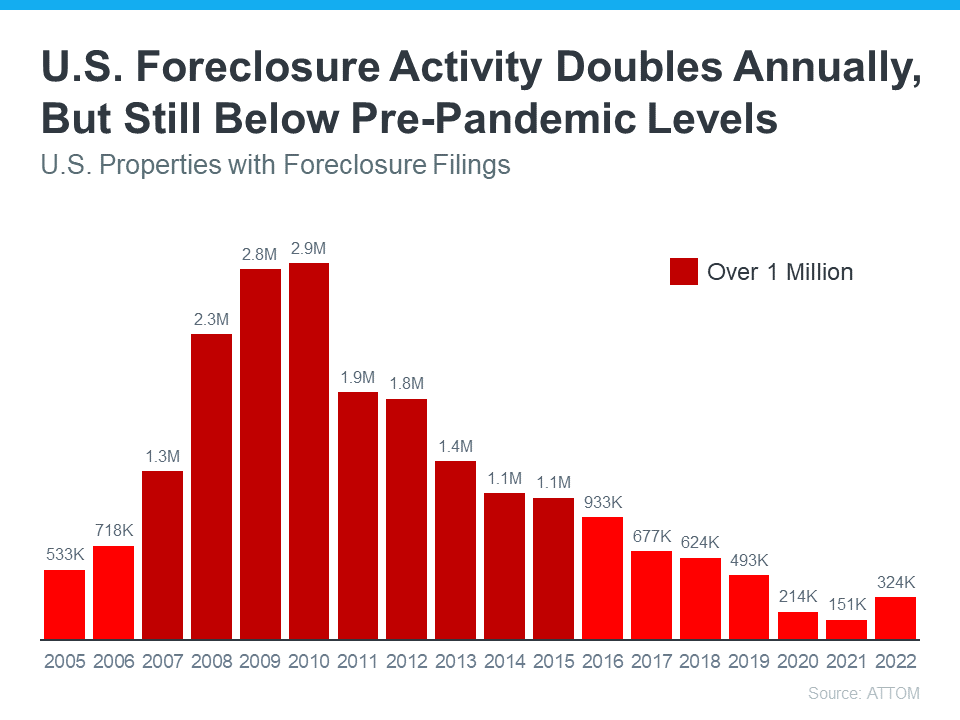

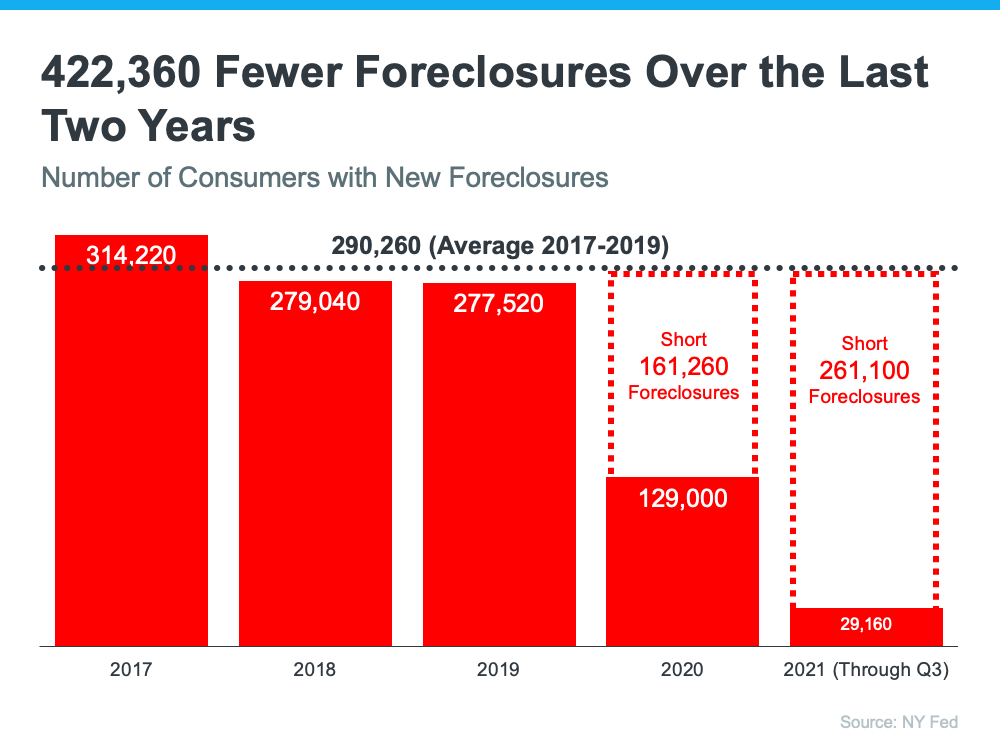

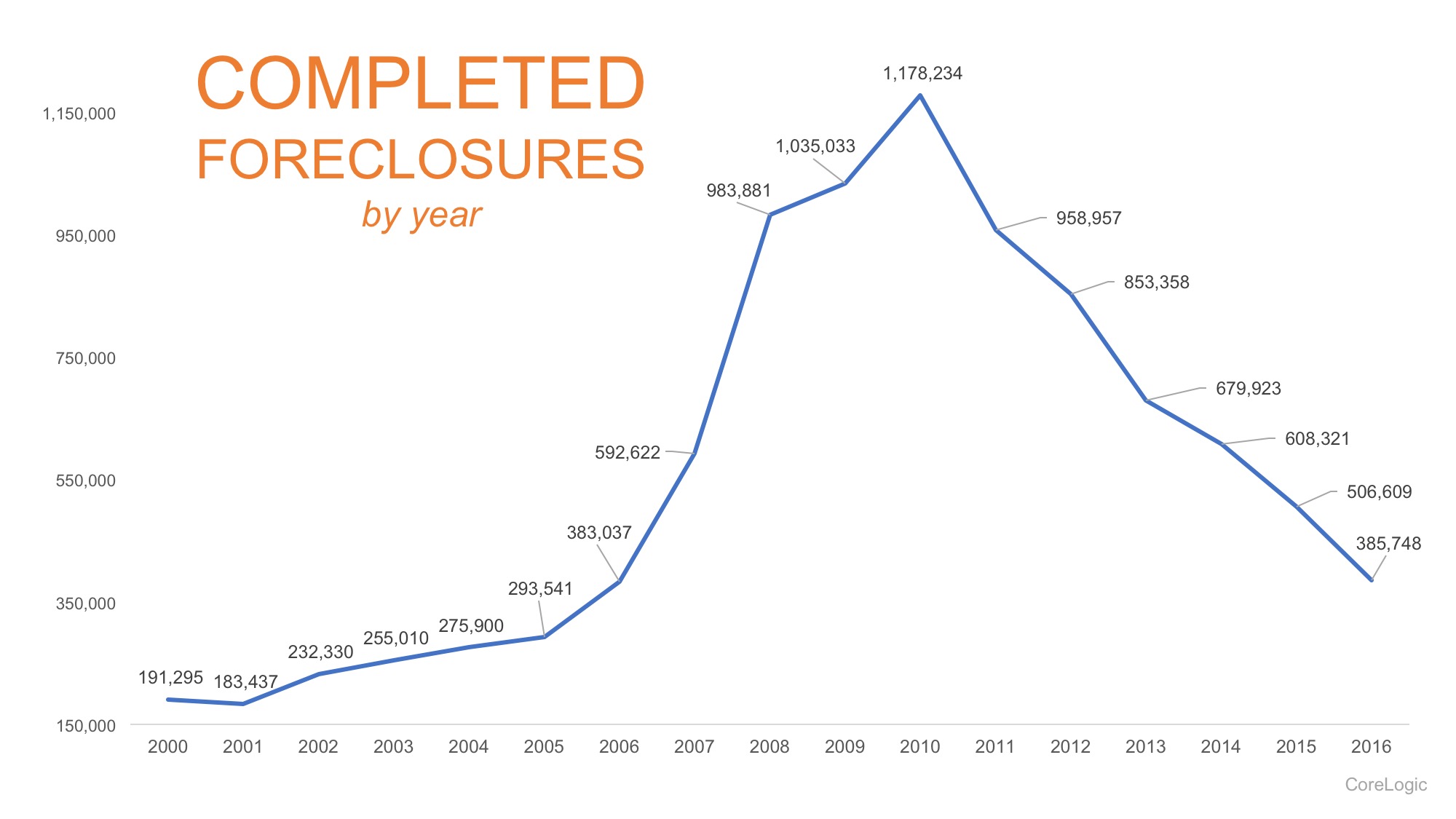

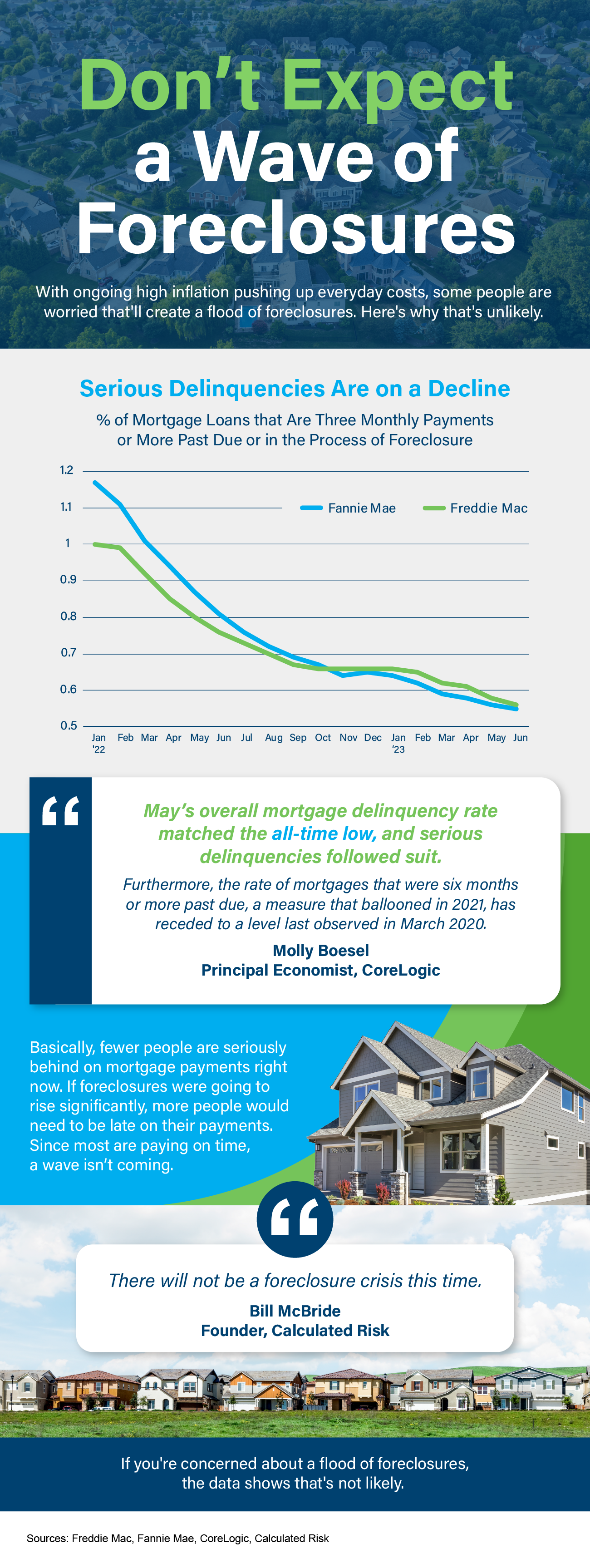

With ongoing high inflation pushing up everyday costs, some people are worried that'll create a flood of foreclosures. Here's why that's unlikely.

Fewer people are seriously behind on mortgage payments right now. If foreclosures were going to rise a lot, more people would need to be late on their payments.

Since most are paying on time, a wave isn’t coming. If you're concerned about a flood of foreclosures, the data shows that's not likely.

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,2019,2020,& 2021 Recognition of Excellence Award Winner SDAR