Some Highlights:

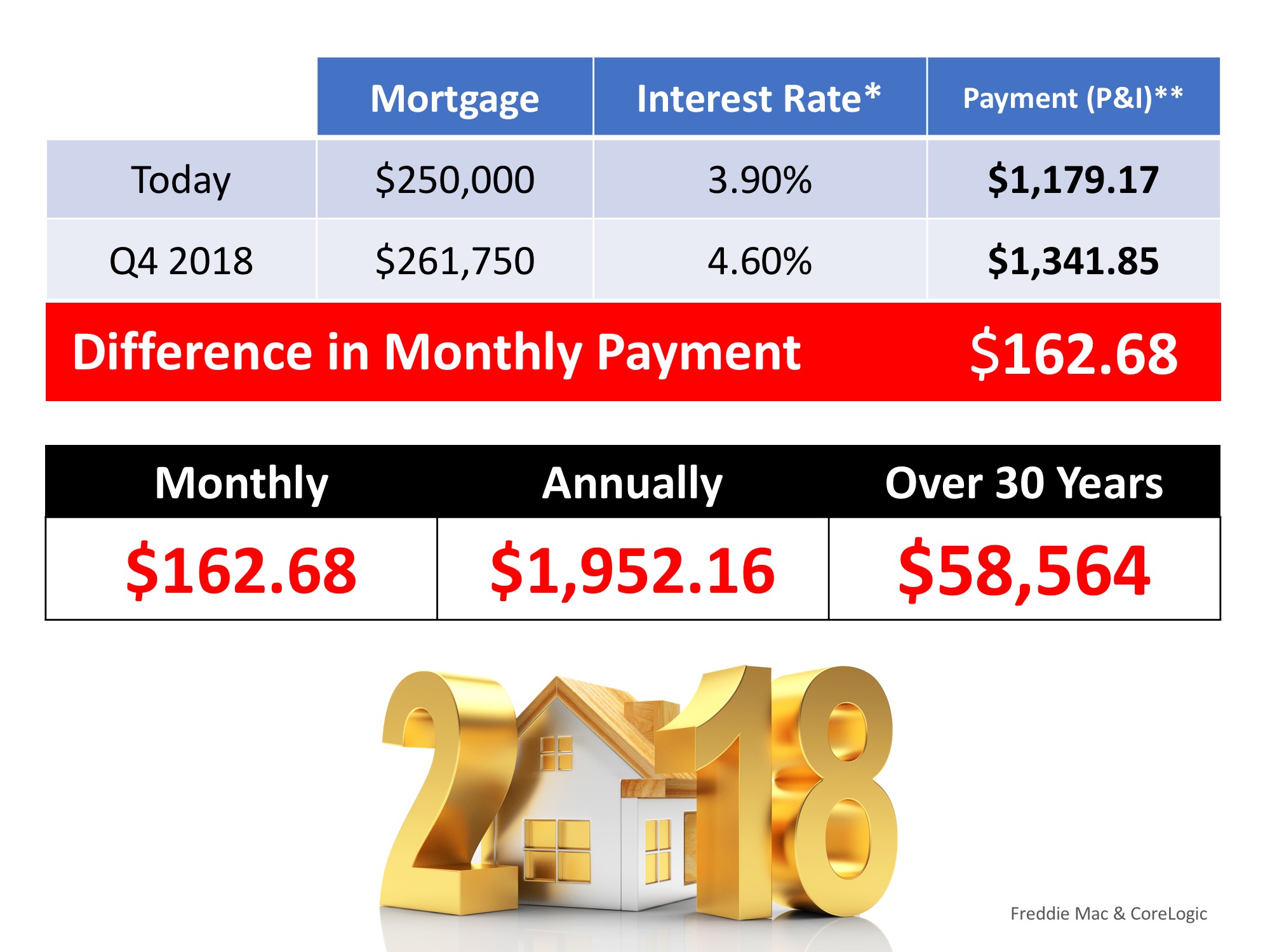

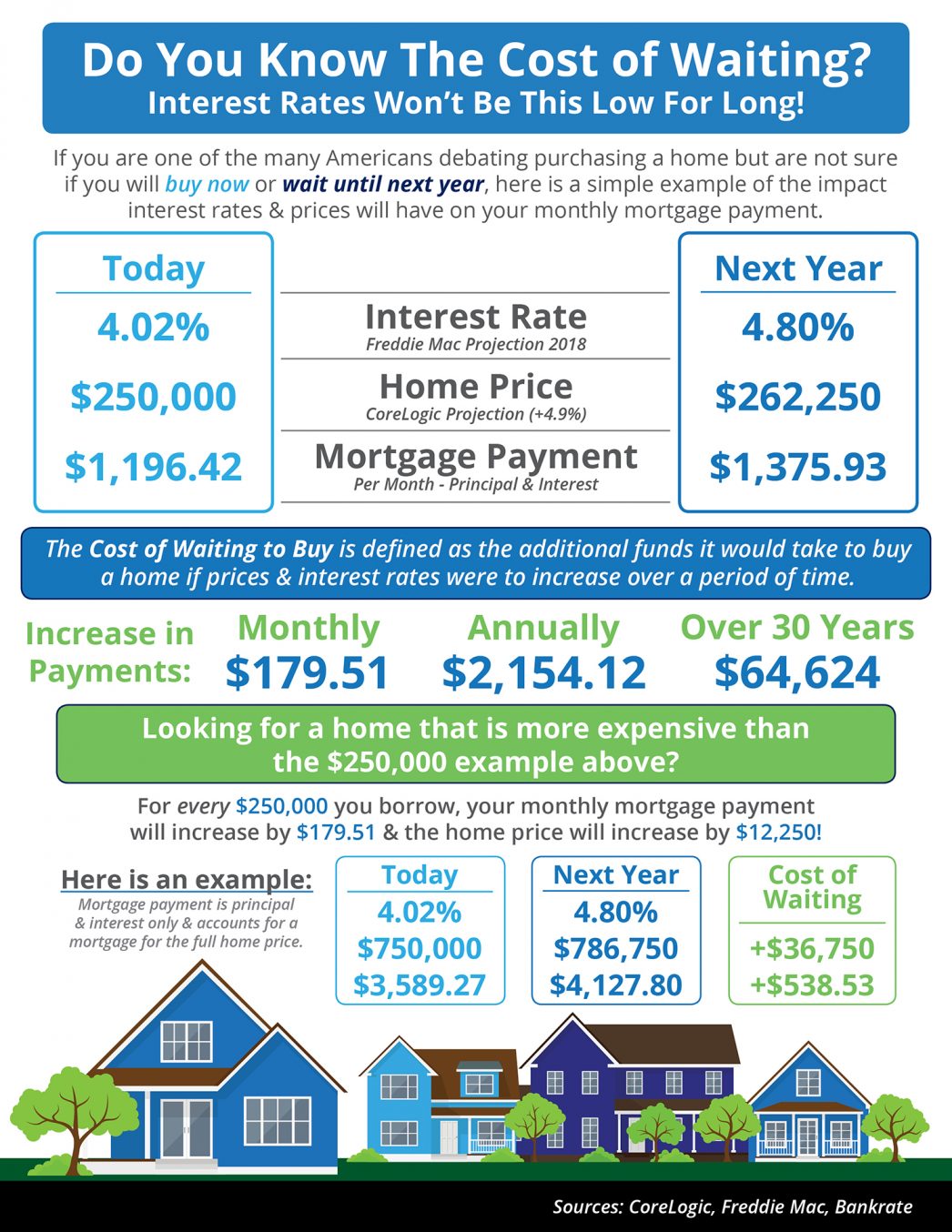

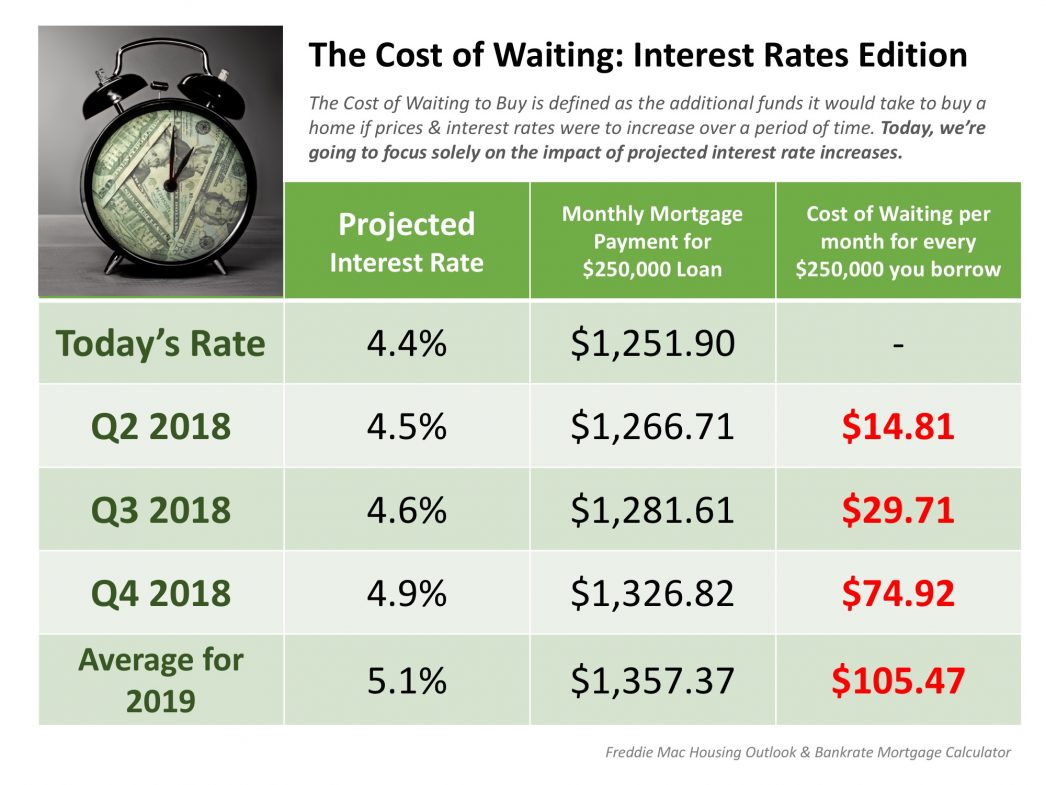

Interest rates are projected to increase steadily heading into 2019.

The higher your interest rate, the more money you end up paying for your home and the higher your monthly payment will be.

Rates are still low right now. Don’t wait until rates hit 5% to start searching for your dream home!

Looking to Buy, Sell, or Invest? Contact:

David Demangos - Keller Williams Realty

Cell: 858.232.8410 | Realtor® BRE# 01905183

www.AwesomeSanDiegoRealEstate.com

Our Team Goes to Extremes to Fulfill Your Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016 & 2017 Recognition of Excellence Award Winner SDAR