Some Highlights:

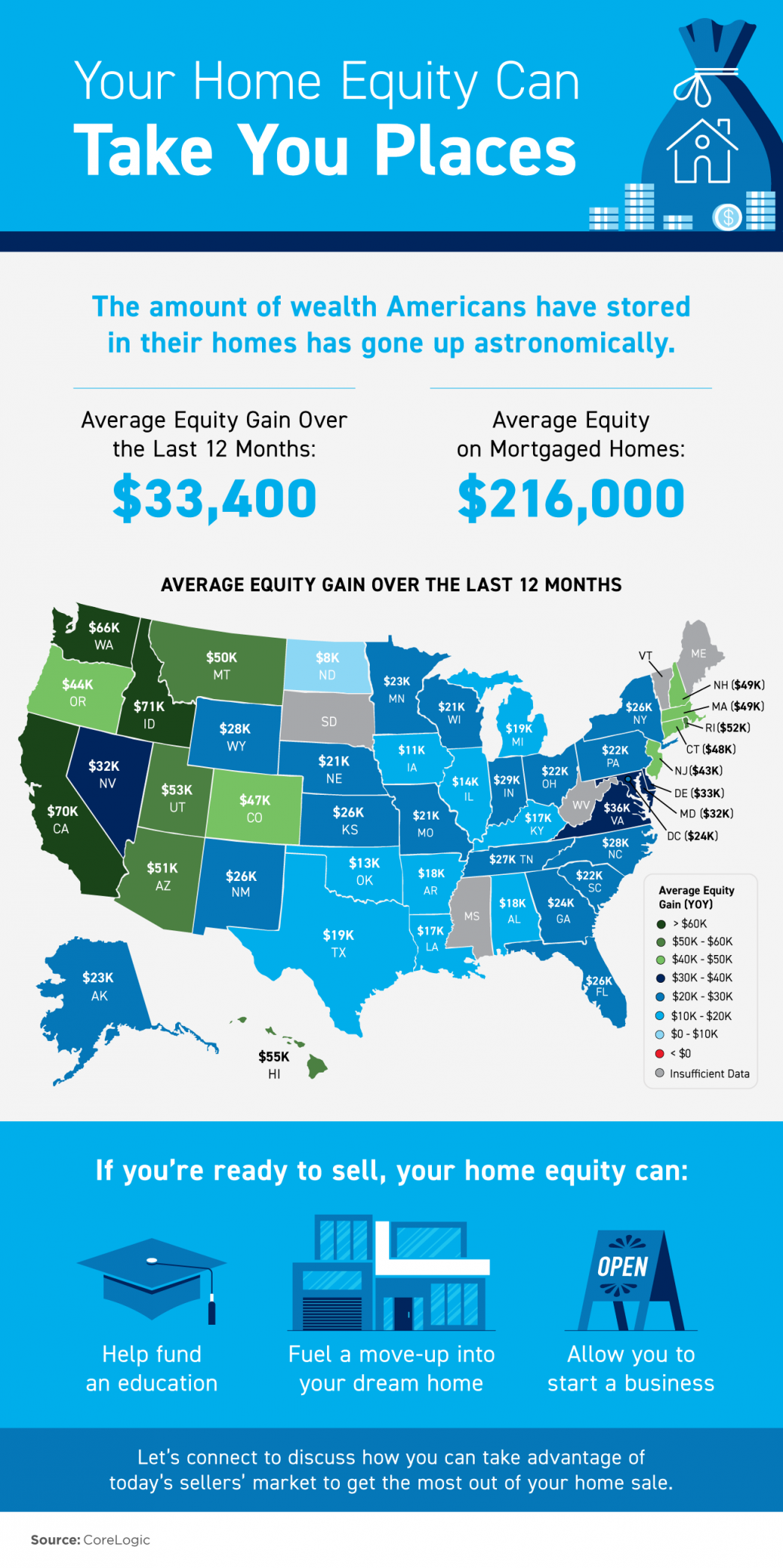

The amount of wealth Americans have stored in their homes has increased astronomically.

On average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000.

When it’s time to sell, your home equity can help accomplish your goals. Let’s connect to discuss how you can take advantage of today’s sellers’ market to get the most out of your home sale.

Looking to Buy, Sell, or Invest? Contact:

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!

San Diego Real Estate Expert | Global Property Specialist

Certified Luxury Marketing Specialist | CLHMS Million Dollar Guild Agent

Green Specialist | Certified International Property Specialist

2016, 2017, 2018,& 2019 Recognition of Excellence Award Winner SDAR