If you're thinking of buying or selling a house, it's important to know it doesn't just impact you—it helps out the local economy and your community, too.

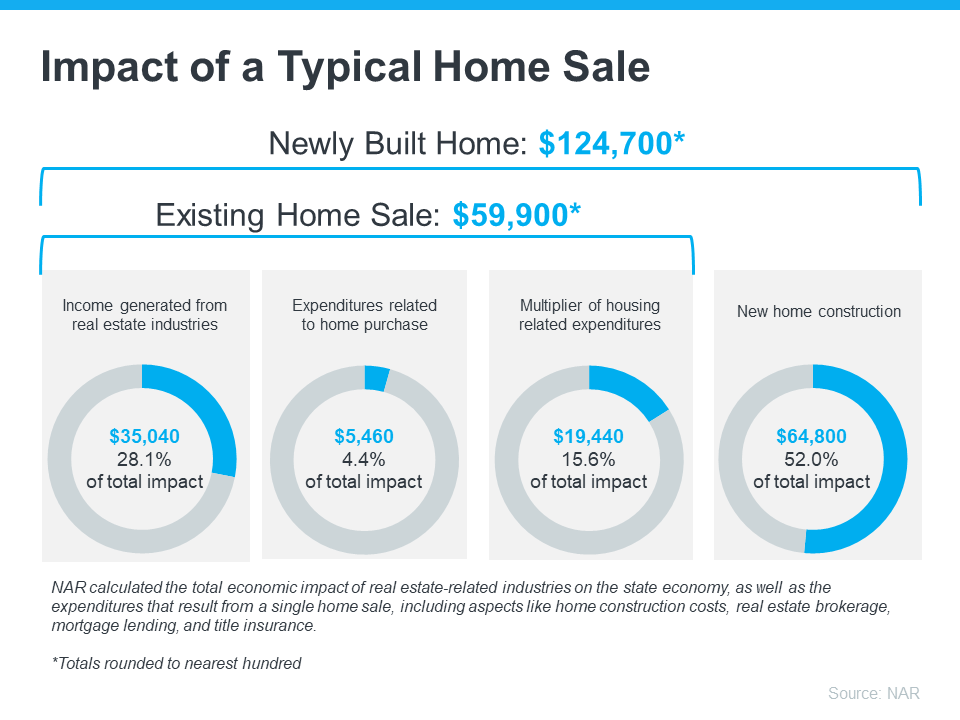

Every year, the National Association of Realtors (NAR) puts out a report that breaks down the financial impact that comes from people buying and selling homes (see visual below):

When a house is sold, it really boosts the local economy. That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

“. . . housing is a significant job creator. In fact, for every single-family home built, enough economic activity is generated to sustain three full-time jobs for a year . . .”

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

Think about all the people involved with selling a house—city officials, contractors, lawyers, real estate agents, specialists, etc. Everyone has a job to do to make your deal go through. So, each transaction is a big help to those who work and live in your community.

Put simply, when you buy or sell a home, you’re helping out your neighbors. So, when you decide to move, you're not just meeting your own needs—you're also doing something good for your community. Just knowing your move helps so many people around you can give you a sense of empowerment as you make your decision this year.

Bottom Line

Every time a home is sold, it really helps out the local economy. If you’re ready to move, let’s get in touch. It won’t just change your life—it’ll also do a lot of good for the whole community.

David Demangos - eXp Realty

Cell: 858.232.8410 | Realtor® DRE# 01905183

www.AwesomeSanDiegoRealEstate.com

We Go to Extremes to Fulfill Real Estate Dreams!